- Cryptopolitan

- Posts

- 🧠 Your 2025 Crypto wrap-up

🧠 Your 2025 Crypto wrap-up

What mattered in 2025.

Hey there!

We pulled together the moments that made 2025 what it was.

Here’s your crypto year, wrapped. The way only Cryptopolitan can.

Talk about starting the year with a bang, that’s exactly what happened in 2025.

President Donald Trump revealed the launch of his new crypto token, $TRUMP which broke through $15 Billion in market cap in a few hours.

$MELANIA followed soon after.

And then there was $LIBRA, introduced as an economic experiment by Argentina’s president, Javier Milei, before some $4.4 billion evaporated in less than five hours when insiders took their leave.

Followed by congressional hearings, court cases and a lot of backlash, it looked like a wrap-up for politicians launching tokens.

2025: Year of the institutions

Retail wasn’t the only one “winning” in 2025. Institution adoption gained a tremendous pace and so did innovative strategies to acquire digital assets.

One of the most talked of strategies was Digital Asset Treasury (DAT) as over 200 companies tried it and invested $42.7B in crypto.

Spot ETFs blew by $115B AUM: with Bitcoin receiving $57B, ETH getting $13B and new Solana/XRP ETFs launched due to strong demand.

This was the year we can say that institutions “officially” entered crypto.

2025 was the year crypto got a seat at the table

President Trump signed the GENIUS Act, the House passed the Anti-CBDC Act, banning the Fed from issuing a retail CBDC and CLARITY Act passed the House with strong bipartisan backing and advanced toward Senate consideration.

Trump also signed two executive orders: one promoting ,U.S. digital finance leadership another establishing a Strategic Bitcoin Reserve.

With new SEC and CFTC leadership, regulators paused lawsuits and launched collaborative initiatives like the Crypto Sprint and Task Force.

And how can we forget the roundtable.

From Whitepapers to The White House. We came a long way 👏

Hack and recovery of the year

On May 14, Bybit suffered the largest exploit of 2025.

Roughly 400,000 ETH (over $1.1 billion) was drained in a highly coordinated attack, later attributed to the Lazarus Group.

But what looked like the end was just the beginning of one of the greatest recovery the industry has seen.

Exchanges, CEOs, White hats and even retail stepped in and supported ByBit and helped recover 38% of the stolen funds in a few weeks.

2025 reminded us that crypto still breaks.

But it also proved that when it does, the entire industry can show up to fix it.

Stablecoins hit $300 Billion and went global

Total stablecoin market cap surpassed $300 Billion, but it became more than a numbers story as the leaders were USDT and USDC: both dollar backed.

That set-off a wave.

From Europe to Asia: Central Banks rolled out pilots for Stablecoins, fearing the influence of dollar in the Stablecoin market.

Even the IMF stepped in and labeled stablecoins a macro-financial concern.

We know that it’s getting serious when the IMF has to step-in.

Let’s talk On-chain

On-chain trading hit new highs. The DEX-to-CEX spot ratio peaked at 37.4% in June, and held strong at 21% by November.

RWAs surged to $23B, led by $14B in tokenized private credit and $8.2B in Treasuries, while global tokenized assets hit $1.47T, including $309.9B in stablecoins.

Prediction markets matured into a $27.9B industry, peaking at $2.3B weekly volume during Q4’s election and sports cycle.

Major protocols advanced too with Ethereum’s Fusaka upgrade and Solana’s Firedancer. Bitcoin kicked off formal BIP‑360 talks to prepare for post-quantum threats.

Our favourite: ALL TIME HIGHS 🎉

The record breakers of 2025:

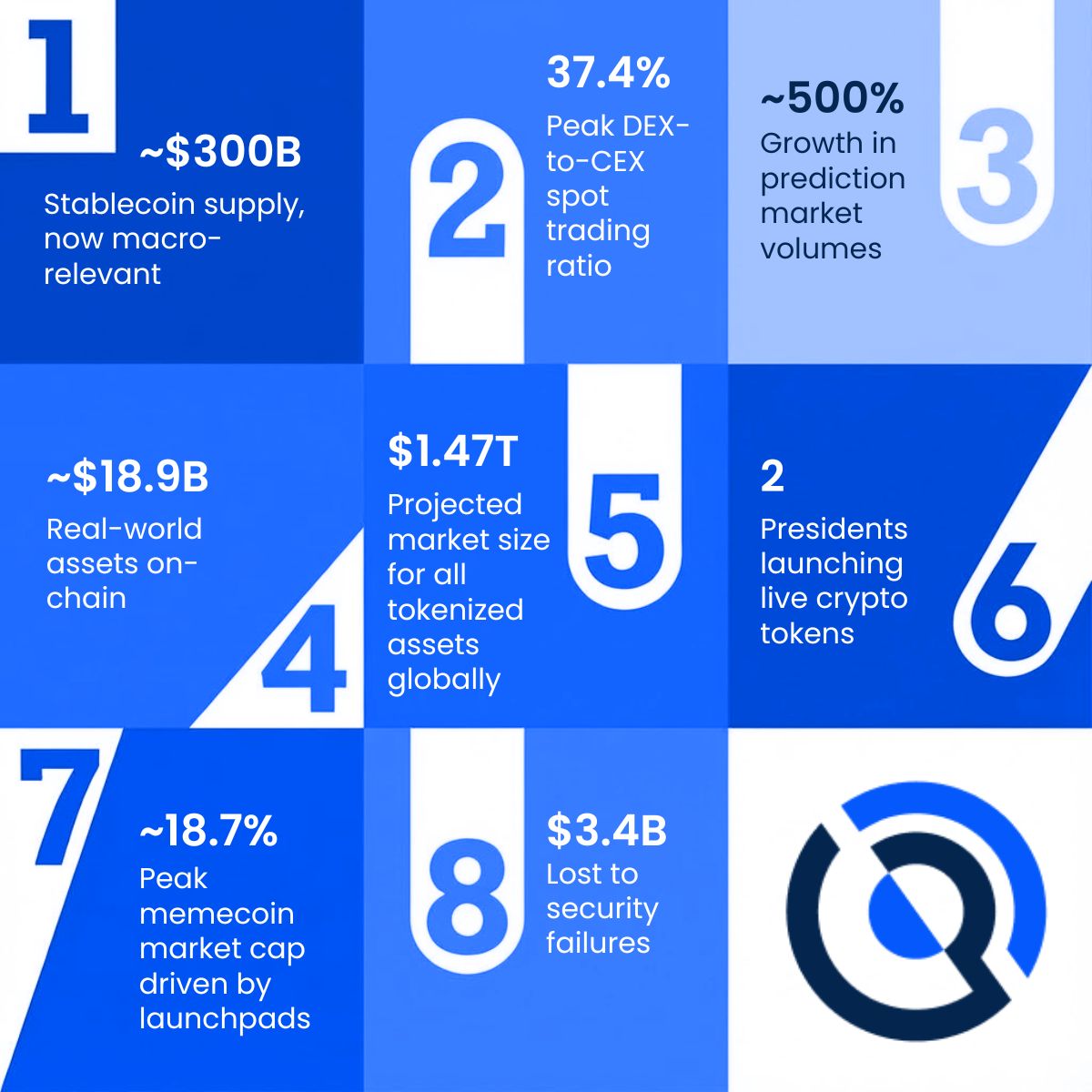

2025 in numbers

🧠 What didn’t exist before 2025

The IMF called stablecoins a macro-financial risk

Crypto CEOs sat at the White House for policy roundtables

The U.S. launched a Crypto Task Force with regulatory backing

Bitcoin ETFs created sustained buy pressure from TradFi flows

Solana and XRP ETFs were approved

Prediction markets generated over $27.9 billion in trading volume till October, on track to surpass $40 billion by year-end.

DEXs rivalling CEXs in volume

Presidential tokens hit billions in market cap

Quantum threat proposals (BIP‑360) entered Bitcoin core dev discussions

Autonomous agents executed trades without human input

Thank you for being here

Sometimes it’s easy to miss the progress when the noise is loud and the headlines lean negative. But as we wrapped 2025, we at Cryptopolitan took a step back and realized just how far the industry had come.

Beyond the hacks and FUD, this year delivered breakthroughs in policy, infrastructure, adoption, and real-world utility.

It’s been an incredible ride bringing the freshest scoops, sharpest insights, and no-nonsense reporting to your inbox and we’re just getting started. 2026 is shaping up to be even bigger, and we can’t wait to continue the journey with you.

Thank you for reading.

Here’s to staying ahead of the curve, together.

-Team Cryptopolitan

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook