- Cryptopolitan

- Posts

- You don’t need cash to buy Bitcoin ETFs anymore

You don’t need cash to buy Bitcoin ETFs anymore

PLUS: In-kind creations approved, whales are staking ETH, $818M in tokens unlock, and ETH turns 10..

The SEC quietly changed the game for crypto ETFs 🤫

While most people were watching charts…

The SEC just handed Bitcoin and Ethereum ETFs a major upgrade. One that could blow the door open for Solana, Cardano — maybe even DOGE.

📜 Here’s what happened:

The SEC approved in-kind creations and redemptions for Bitcoin and Ether ETFs.

That means institutions can now swap real Bitcoin and ETH for ETF shares just like they already do with gold and oil funds.

Sounds boring? It’s not.

It’s a behind-the-scenes change that:

Makes ETFs cheaper and faster to operate

Attracts more liquidity and arbitrage from big players

Sets the blueprint for future altcoin ETFs

This is huge… and will create an explosion of option-based Bitcoin ETFs.

The SEC also approved:

FLEX options for crypto ETFs

Raised position limits (from 25K to 250K contracts)

Customizable derivatives for institutions to go big

🧓 TL;DR (Explain like I’m a boomer):

Now you can buy a Bitcoin ETF using your actual Bitcoin.

Not just grandma’s favorite: cold, hard cash.

🐳 ETH and BTC are getting scarce — and smart money knows it

Remember when Wintermute ran out of OTC ETH? That wasn’t noise, it was a warning. And today, we’re seeing similar signs of something brewing below the surface.

🔎 Here’s what we’re watching:

Whales, institutions, and corporate treasuries aren’t just dipping their toes into Ethereum anymore. They’re loading up, locking it up, and staking it aggressively.

Since July 9, nine new wallets have accumulated over 640K ETH (~$2.4B). Anchorage Digital just picked up 10K+ BTC. BitMine and SharpLink now hold nearly 1M ETH combined.

But more importantly: they're not trading it.

They're staking it.

This isn’t idle capital waiting to flip.

This is ETH being taken off the market, turned into a productive treasury asset — and that changes the game

ETH treasuries have more firepower than BTC ones — they can earn yield, tap DeFi, and self-reinforce holdings.

Why this matters:

Institutions aren’t just buying ETH because it’s up.

They’re buying it because it can work, it earns 3–4% staking yield, unlocks DeFi leverage, and strengthens their own balance sheets.

BTC, by contrast, just sits. Price-dependent. Narrative-driven. No yield.

That’s exactly what critics highlight about Michael Saylor’s model. It relies entirely on appreciation, not utility.

But honestly? He doesn’t care.

🔥BULLISH: Strategy raises $2.5B to buy 21,000 Bitcoins in major crypto IPO.

— Cryptopolitan (@CPOfficialtx)

9:44 PM • Jul 29, 2025

And if this buying continues? We’re staring down a supply squeeze.

Most people won’t notice it until liquidity vanishes on-chain.

But by then, the big players will already be in.

🧓 TL;DR (Explain like I’m a boomer):

ETH isn’t just mooning. It might face a supply crunch.

The whales aren’t flipping. They’re staking. And when supply dries up, price tends to surprise people.

🧠 Signal vs Noise

“Bitcoin will go up if more people buy it — and won’t if they don’t.”

Yes, that’s a real Citi quote. Not satire. Not a meme.

🧾 They published a full report explaining why Bitcoin’s price depends mostly on:

→ ETF inflows

→ More users adopting it

→ Macro vibes (stocks up, dollar down)

💬 TL;DR from Citi:

People buying → ETF issuers buy BTC → Price goes up → More people buy → Repeat.

So, what’s missing?

Corporate hoarding

They ignore treasury buyers like Strategy (21K BTC this month), who lock supply forever.Retail speculation

Most retail action happens on exchanges — not wallets. Citi’s adoption model misses that entirely.No Plan B if flows reverse

What happens if ETF inflows stop? With so much BTC held tight, the exit door could get real small, real fast.

🎯 Signal: ETF flows are real.

🫥 Noise: Reducing Bitcoin to just "more buyers = more pump" misses the full picture.

Yes, Citi. We get it. Number go up... but maybe tell us something we don’t know next time?

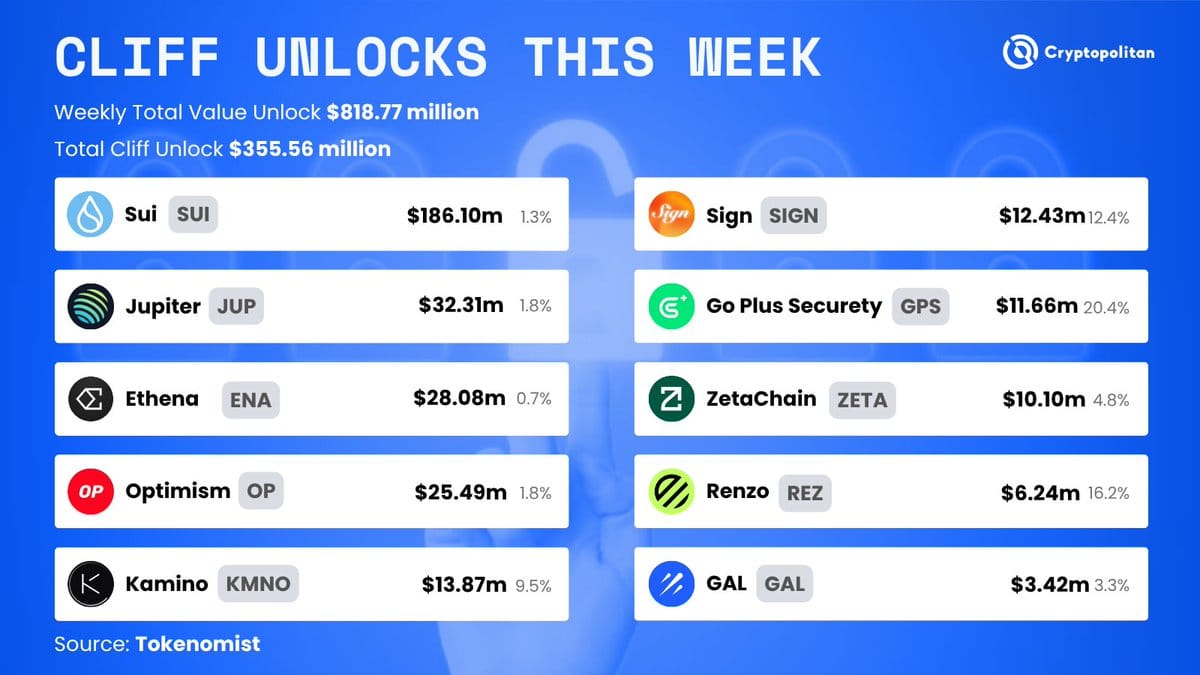

🔓 What are Cliff Unlocks and why should you care?

This week alone, over $818M in crypto tokens will hit the open market.

The biggest cliff unlocks:

SUI ($186M) — Largest unlock of the week

JUP ($32M) — Solana ecosystem pressure rising

OP ($25M) — Adds friction to L2 flows

Cliff unlocks = large, one-shot releases of previously locked tokens. They can trigger price dumps, volatility, or… nothing. Depends on how the market digests them.

But this isn’t the full picture. Another $400M+ in tokens are leaking into markets via linear unlocks from SOL, WLD, DOGE, and others.

We track major unlocks every week on our X — so you don’t have to. Follow us for weekly alpha before the dumps hit.

Top X follows for crypto regulations

Here are Cryptopolitan’s top picks:

@EleanorTerrett – If the SEC sneezes, she tweets it.

@MetaLawMan – Fights legal FUD with sharp threads.

@JakeChervinsky – Writes policy letters and tweets spicy.

@nic__carter – Big brain takes on stablecoins and state power.

@JasonYanowitz – Regulatory cliffs, token falls, and where it’s all headed.

Intern picks: Read these so he doesn’t get fired

Massive 80,000 BTC movement linked to the collapsed MyBitcoin exchange from 2011

Algeria bans all crypto operations under threat of fines and prison

Trader James Wynn lost almost all his $1.28M July deposit to Hyperliquid to liquidations

Trump-backed World Liberty Financial ETH portfolio nears $300M with latest purchase

🎂 Ethereum turns 10 — and we made a birthday video

A decade ago, Ethereum launched with a simple promise: decentralize everything.

Ten years later, it’s reaching $500 billion in market cap, running governments, funding memecoins, and turning ETH into a yield machine. We made a video for this crypto legend. Give it a watch.

Happy 10th birthday @ethereum 🥳

@VitalikButerin built the chain and we found a revolution.

Here’s to the network that’s seen it all.

— Cryptopolitan (@CPOfficialtx)

2:23 PM • Jul 30, 2025

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.