- Cryptopolitan

- Posts

- USDe’s 75% growth just made it a stablecoin giant

USDe’s 75% growth just made it a stablecoin giant

PLUS: Ethena dominates July, jobs data shocks Wall Street, and ETFs bleed billions.

Welcome back, friends —

Ethena’s synthetic dollar just flipped into beast mode. USDe surged 75% in July, staking its claim as crypto’s third-largest stablecoin — and it’s not even backed by cash.

Meanwhile, weak U.S. jobs data shook markets, Bitcoin ETFs bled nearly $1B, and Trump fired the stats chief mid-chaos. Oh, and Cathie’s buying the dip like it’s 2021.

Let’s break it down.

🧠 The synthetic dollar that’s defying gravity

Ethena’s USDe just surged 75% in July and with a $9.69B supply, it’s now the third-largest stablecoin on the planet.

Just months ago, this Ethereum-native “synthetic dollar” was treated like a science experiment. Today, it’s flipping major players and riding the momentum of the 2025 bull run. But what makes USDe different and why is it growing so fast?

📌 First: What is USDe?

Unlike USDC or USDT, USDe isn’t backed by cash reserves.

It’s a synthetic stablecoin, created through a delta-neutral strategy.

Ethena takes ETH and stakes it to earn rewards. Simultaneously, it opens short positions on ETH via perpetual futures. The two positions cancel out ETH’s volatility, leaving behind the “yield spread” that’s the foundation of Ethena’s returns. These returns power sUSDe, the yield-bearing version of USDe, earning nearly 9% APY. (this rate fluctuates)

So USDe is stable. sUSDe earns. And unlike algorithmic coins of past cycles, Ethena has weathered storms and corrected safely without contagion.

Why is it surging now?

July was a turning point.

When ETH crossed $3,800 in July, Ethena’s model became significantly more profitable. Minting resumed aggressively, more than 4 billion USDe were issued in just 30 days. And the APY for sUSDe jumped from 3.5% to nearly 9%, attracting even more capital.

Exchanges took notice. Bybit now handles over 30% of USDe’s volume, with Uniswap V3 close behind at 20%. Curve pools are deepening, and even skeptical DeFi users are embracing it.

The result? A nearly vertical expansion in supply and a real shot at challenging the stablecoin duopoly.

The bigger picture

Ethena’s rise isn’t just about numbers. It signals a shift in what the market wants. A yield-bearing stablecoin that doesn’t rely on banks or cash. A DeFi-native asset with liquidity, legitimacy, and, for now, momentum.

But risks remain. If ETH dumps or funding rates flip negative, the entire model could stress. sUSDe also has unstaking delays, and some DeFi veterans still view synthetic dollars with caution.

Still, in a world searching for “stablecoins with upside,” USDe is winning that narrative.

✍️ TL;DR: What’s up with USDe?

USDe isn’t your regular stablecoin. It’s synthetic, meaning it’s backed by ETH derivatives, not dollars in a bank.

Ethena mints USDe when ETH rallies, using delta-neutral strategies to maintain price stability while generating yield.

Why the boom? ETH’s price surge made Ethena’s model hyper-efficient, unlocking juicy 8.85% APYs and triggering a 75% supply growth in July alone.

Now the third-largest stablecoin, USDe passed SkyProtocol’s USDS and is closing in on the big two — USDT and USDC.

Where’s the risk? If ETH crashes or liquidity dries up, USDe can shrink fast. But for now, DeFi loves the momentum.

Tired of a 3-4% return from your savings account? This course might be for you.

📉 Why did Bitcoin price fall? What weak jobs data just revealed about the market

The first week of August reminded crypto investors that macro still rules the game.

After a record-breaking rally, Bitcoin saw a sharp pullback to $114,000 — and it wasn’t just a technical correction.

It was a response to a deeper macro storm involving bad jobs data, political chaos, ETF outflows, and rising rate cut odds.

Here’s what really happened and how it all connects.

1/ The U.S. jobs report shocked the system

The U.S. added just 73,000 jobs in July far below the 110,000 expected.

Even worse, the Labor Department revised down May and June figures by 258,000, the biggest downward revision since the COVID crash.

That kind of weak data signals a slowing economy, which spooked investors.

What followed? Total chaos:

Donald Trump abruptly fired BLS commissioner Erika McEntarfer

Accused her of rigging the jobs data to damage Republicans

Replaced her within hours amid widespread backlash

This sudden political move raised serious questions about data credibility and markets responded swiftly.

2/ Markets went into macro panic mode

Bond yields tumbled.

2-year Treasury yield hit a 3-month low at 3.659%

10-year yield fell to 4.24%, signaling bets on a Fed pivot

The dollar dropped hard on Friday, falling 2% against the yen and 1.5% vs the euro.

But it tried to recover Monday as the news flow stabilized.

Gold surged to $3,357 and is now coiling for a breakout.

Citi revised its forecast to $3,500, citing “tariff-led inflation risks” and slowing growth.

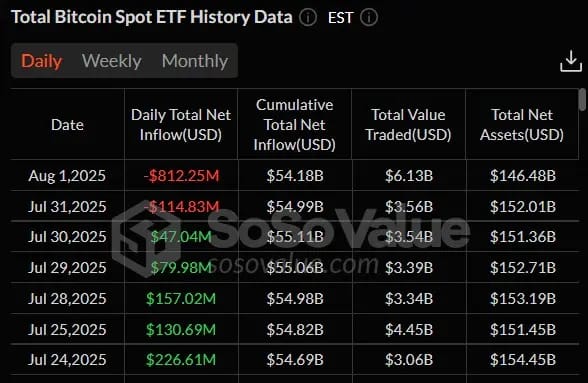

3/ Bitcoin got hit by nearly $1B in ETF outflows

With markets in flux, Bitcoin ETFs bled over $800 million on August 1 alone, the worst single-day outflow since launch.

Total net weekly outflows: $643M

7-week inflow streak? Broken.

BTC plunged to $114K before recovering slightly, still down 4% on the week.

Ethereum fared better with $154M in net ETF inflows, holding near $3.5K.

Even Arthur Hayes warned over the weekend that a correction was overdue:

No major economy is creating enough credit fast enough to boost nominal GDP.

He expects BTC to test $100K and ETH $3K before any sustainable rally resumes.

🧠 TL;DR — Explain it to your friend

Weak U.S. jobs data = panic = market meltdown

Trump fired the stats chief = chaos + credibility crisis

Fed rate cut odds jump to 70% = bond yields collapse

Bitcoin ETF outflows near $1B = BTC tanks to $114K

Ethereum holds stronger with continued inflows

Gold and stocks bounce — but volatility is back

🧠 Signal vs Noise

Britain’s missing the Crypto boom and it’s not just a regulatory problem.

Former UK Chancellor George Osborne is sounding the alarm:

We’re falling behind. Fast.

The U.S., Asia, UAE are shaping crypto’s future. The UK? Still debating stablecoins.

Osborne, now on Coinbase’s advisory council, says the real issue isn’t regulation — it’s risk aversion. Britain once led global finance by embracing change. Now it’s playing it safe, and that could cost it the next wave of innovation.

Bank of England chief Andrew Bailey isn’t convinced stablecoins even deserve a seat at the table.

His solution? Let banks issue “tokenized deposits” instead. (So... web2 in web3 clothes?)

The Chancellor promises crypto-friendliness, but the country’s policy remains stuck in molasses.

💭 Noise: “We’re doing quite a lot.”

📢 Signal: The world isn’t waiting. And the UK’s indecision might just make it irrelevant.

Top on-chain alpha seekers to follow on X

Here are Cryptopolitan’s top picks:

@cobie – Meme king and market savant. Now posting more sparingly, but still gold.

@Rewkang – Narratives, momentum shifts, and early rotations.

@MartyBent – Bitcoin-first, but macro-aware and always signal-heavy.

@cryptomanran - High-signal alerts and smart money moves, especially around market sentiment shifts.

@thedefiedge – DeFi strategies, emerging protocols, and tokenomics in a thread format.

Stocks Cathie Woods is watching

Ark just dropped $47M into crypto plays and it wasn’t random.

1/ $29.8M into Coinbase, even after the stock tanked 20

2/ $17M into BitMine now the largest public ETH treasury with 625K ETH (and aiming to stake 5% of all ETH).

Meanwhile, treasury ETH holdings just passed 1.26M almost matching ETFs. Why? Treasuries earn yield, use DeFi, and skip ETF limits.

Oh, and Ark just made SOL Strategies its Solana staking partner. She’s not chasing hype. She’s building infrastructure exposure.

Read that again: Coinbase. ETH treasuries. Solana validators.

Is this a “buy them when they dip move” or positioning Ark Invest for the future?

We will be keeping a close eye 👁️

Monday headline picks: Let’s kickstart your week

Join the Conversation!

Our X is always active. You’ll love it. Go follow.

Solana launchpad revenue hit $66.8M in July.

Letsbonkfun leads with $37.3M

2× Pumpfun’s $15.3M.Bonk is winning on revenue and volume.

— Cryptopolitan (@CPOfficialtx)

8:03 AM • Aug 3, 2025

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook