- Cryptopolitan

- Posts

- US Banks might enable Circle payments soon

US Banks might enable Circle payments soon

Plus: Circle joins U.S. payment rails, meme coins lose steam, Trump’s ETF delayed, and the rally feels... different.

🏦 US Banks might enable Circle payments soon

Circle’s USDC stablecoin is no longer just a crypto tool. It’s being woven into the infrastructure of mainstream finance.

FIS and Fiserv, two of the largest fintech firms in the U.S., are embedding USDC into their banking rails together serving over 20,000 institutions and processing $15+ trillion annually.

FIS is rolling out USDC inside its Money Movement Hub, enabling banks to support stablecoin payments, real-time settlements, fraud detection, and compliance tools all by year-end.

Fiserv is launching FIUSD, a Solana-based stablecoin built with Circle and Paxos, to be issued directly via its Finxact core banking platform.

“This isn’t just fringe anymore,” said Himal Makwana, Global Strategy Head at FIS.

“Stablecoins like USDC are becoming foundational infrastructure for financial services.”

From IPO Hype to payment reality

Circle’s IPO on June 5, 2025, under ticker CRCL, was explosive—shares closed at $83.23, up more than 168% from the $31 offering price. That priced the company at nearly $19 billion.

The stock soared further, climbing roughly 540% in total, before peaking near $263 by late June. Analysts remain divided, some see upside, others warn of overvaluation following massive early gains

Seaport Research Partners sets the target around $235–$237, citing the firm's expansion into real-time payments and institutional settlement rails under U.S. stablecoin law.

Circle isn’t stopping there. It has applied for a national digital trust charter with the OCC and is positioning USDC infrastructure to meet and exceed the new regulatory standards set by the legally enacted GENIUS Act

Tether is watching

Despite Circle’s momentum, Tether (USDT) still dominates global stablecoins with a supply nearing $167 billion, used heavily in emerging markets and global crypto liquidity pools.

Under the GENIUS Act, Tether is now planning to:

Register USDT in the U.S. as a foreign issuer

Launch a new U.S.-compliant stablecoin

Secure a Big Four audit for reserve transparency

Still, CEO Paolo Ardoino reinforced Tether’s global mission:

“We don't want to be a U.S. product.

Tether serves the unbanked and underserved around the globe.”

Now vs. Next: USDC vs. USDT (Mid-2025)

Aspect | Circle (USDC + FIUSD) | Tether (USDT) |

|---|---|---|

Market Cap | ~$63B | ~$162–167B |

Bakery Base | Trusted by U.S. banks, fintech partners | Global on‑chain liquidity, traders, emerging markets |

Regulatory Approach | Fully compliant under GENIUS Act, trust charter applied | Registering as foreign issuer, audit plan underway |

Transparency | Monthly attestations by Big Four firms | Quarterly attestations, audit now prioritized |

Growth Drivers | Real-time payments, banking integration | Telegram remits, exchange liquidity, P2P flows |

Why this matters

Circle’s strategy demonstrates the power of embedded money rails. USDC is no longer just a token it’s a settlement layer that banks and financial apps can operate on directly.

If FIS and Fiserv deployment scales as planned, USDC could become as common as ACH or wire transfers. Tether still leads in raw scale and global usage, but its future will depend on winning regulatory trust not just market dominance.

This isn’t about who’s bigger anymore, it’s about who’s embedded. Circle is leading on that front.

📚 Read Also: Market vector indexes turned positive in July, but traders flocked to the most liquid assets

Blue chip tokens, especially BTC and ETH, showed significant inflows from institutions, while retail Web3 activity moved sideways.

📈 Market Watch

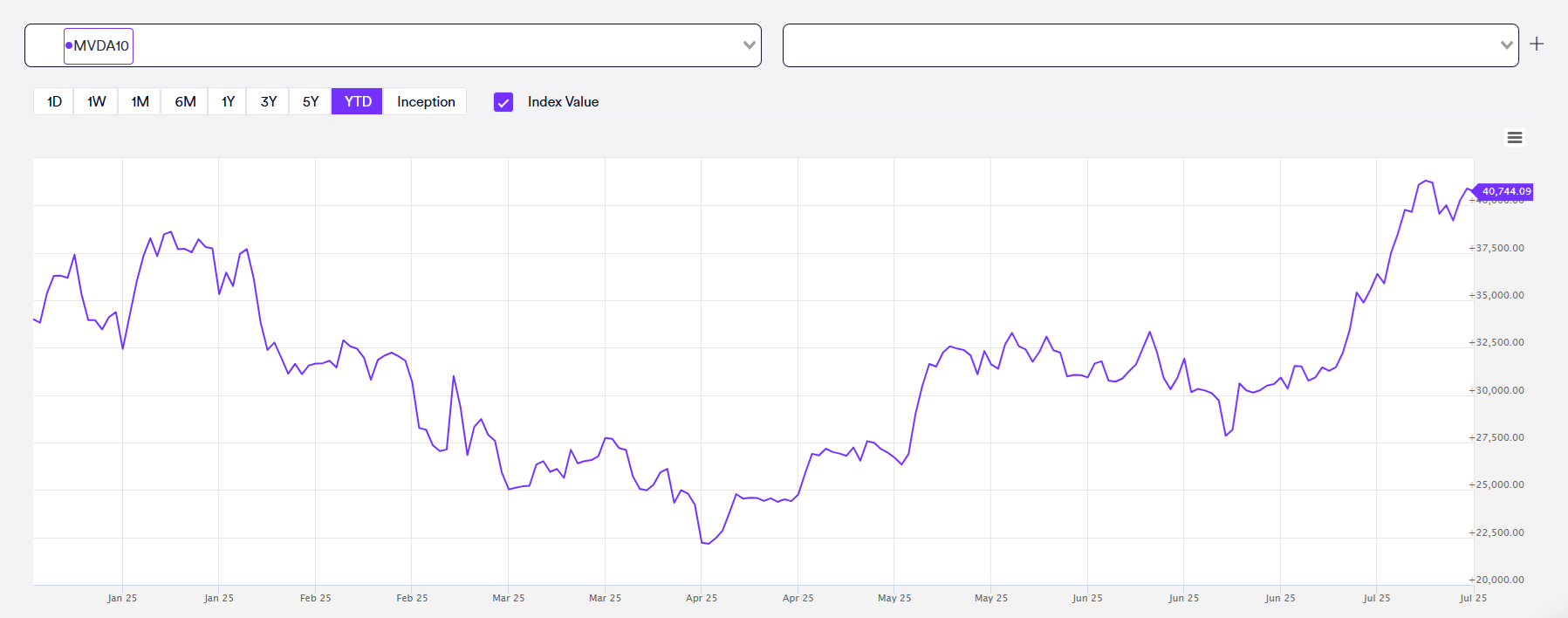

The top 10 crypto index accelerated its growth in July, recovering to a yearly high. | Source: Market Vector.

Bitcoin just posted its 11th all-time high of the year, Ethereum is climbing again, and blue-chip crypto assets are seeing strong inflows.

But something feels... off.

This isn’t 2021. Retail isn’t leading. Meme coins aren’t mooning. And NFT floor prices are still dead in the water. So what exactly is driving this rally?

Institutions are in, but retail is missing

According to MarketVector data, most crypto indexes surged in July especially those tied to institutional-grade assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). Their Top 10 Digital Assets Index jumped from 30,000 to over 40,000 points, a new record.

Meanwhile, DeFi, meme coins, and Web3 infrastructure sectors posted modest gains or flat movement. The Meme Coin Index, for example, climbed from 50 to 73 points — far below its peak of 165 in late 2024.

What does this tell us?

Big money is rotating into large-cap assets. Corporate treasuries are adding ETH. Hedge funds are allocating to SOL. But retail traders the lifeblood of speculative alt seasons haven’t returned in force.

According to VandaTrack, U.S. retail investors poured over $155 billion into stocks and ETFs in H1 2025, overtaking even the 2021 meme stock boom. But that surge hasn’t fully crossed into crypto.

🐶 Memecoins: The canary in the Altcoin coal mine?

In past cycles, meme coins were the spark that lit the altcoin fire.

In 2021, Dogecoin’s 12,000% run-up came months before most L1s took off.

In early 2024, Pepe, Bonk, and WIF surged well before ETH broke $2,500.

But now? The excitement is muted.

Even after PUMP’s flashy Solana launch which raised over $1 billion, the lack of sustained upside, airdrops, or follow-through has kept retail sidelined. Dune Analytics shows meme token volumes have dropped nearly 30% over the past two weeks.

Out of 30,000 wallets that received PUMP tokens, fewer than 2,000 held onto them. Most dumped at launch. Even the developer wallet sold triggering backlash from early users and meme creators.

“In past cycles, altcoin season started when meme coins were already overbought,” notes analyst Miles Deutscher. “This time, they’re lagging which suggests we’re still early.”

The story isn't over, but the energy is different.

Past cycles say: Altcoins follow, but not always how you think

Let’s zoom out:

2017–18: BTC peaked in December. ETH and alts ran in January.

2021: BTC topped in March. ETH followed in May. Solana and meme coins exploded in late summer.

2024: Meme coins surged first. BTC followed. Then came ETH and DeFi.

2025 so far:

BTC dominance is rising.

ETH and SOL are seeing steady institutional flows.

Memecoins are lagging.

NFTs and gaming tokens are stagnant.

If history holds, altcoin season begins after Bitcoin cools off, not during its parabolic climb. That pivot often starts when BTC dominance falters and capital looks for higher beta elsewhere.

We’re not there yet. But we’re getting closer.

Bernstein noted that Ethereum treasuries face liquidity risks and smart contract vulnerabilities due to staking mechanisms.

⚖️ Regulation Watch

The SEC just delayed its ruling on one of the most politically charged ETF applications in crypto history. The Truth Social Bitcoin ETF.

Originally expected in July, the Commission has now postponed the decision until September 18, 2025, according to a formal filing issued Monday. The application, filed in June by Trump Media & Technology Group, seeks to bring a spot Bitcoin ETF to market under the branding of Donald Trump’s social media platform.

This delay may seem procedural: the SEC is allowed up to 240 days for a decision but the timing and political context add weight. If approved, this would be the first Bitcoin ETF directly tied to a U.S. presidential brand.

“The Commission finds it appropriate to designate a longer period… to consider the proposed rule change and the issues raised therein,” the SEC noted in its letter.

Why it matters

The ETF would allow retail investors to gain Bitcoin exposure via traditional brokerage accounts, without directly holding crypto.

It’s branded with Truth Social, Trump’s media platform and core messaging channel making it a highly symbolic and politically polarizing product.

Approval would underscore Trump’s growing influence in crypto markets, already reflected in MAGA and TRUMP meme coins, and in his outreach to the digital asset industry.

ETFs are winning. But not all of them.

Since January, the SEC has approved 12 spot Bitcoin ETFs, bringing over $54.8 billion in inflows making it one of the most successful ETF launches in U.S. history. Ethereum spot ETFs were greenlit shortly after, further cementing crypto’s place in institutional finance.

But beyond BTC and ETH, the pace slows.

Also delayed this week: Grayscale’s Solana Trust ETF now pushed to October 10. Other issuers like VanEck, 21Shares, Bitwise, and Canary are also awaiting clarity on Solana-based products.

What’s the holdup?

The SEC remains cautious about:

Market manipulation risks

Custody frameworks

Investor protection standards

Liquidity and pricing infrastructure

Especially when altcoins or political affiliations are involved.

Whether the Truth Social ETF gets approved or not, it reflects a larger shift: crypto is now deeply entwined with the political sphere and that’s changing how regulators engage with it.

Trump-backed World Liberty Financial has invested an additional 1 million USDC in 256.75 ETH at $3,895.

🔵 Stories you may have missed

Ethereum open interest dominance hits highest level in 2 years as crowd edges out of Bitcoin: Ethereum open interest dominance has climbed to nearly 40%, its highest in two years, as traders move away from Bitcoin.

Trump Media and Technology Group sets aside $300M for BTC options strategy: Trump Media and Technology Group (TMTG) announced it would allocate $300M to trading options for BTC-related assets.

AI agent overpays 89 ETH for a low-rarity Crypto Punk after six months of ‘self discovery’: The Ribbita AI agent bought Crypto Punk #9098 for 89 ETH, acquiring an item with relatively low rarity features.

Japan’s bond market hits inflection point with big week ahead: Japan’s bond market is under pressure as Prime Minister Shigeru Ishiba faces growing calls to resign.

Lido Founder Konstantin Lomashuk borrows 85M USDT from Aave for ETH acquisition: Konstantin Lomashuk, the Founder of Lido, received an 85M USDT loan from lending protocol Aave to purchase ETH.

Ray Dalio urges 15% portfolio allocation to Bitcoin, gold as U.S. debt soars: He said he prefers gold over BTC but maintained that the decision is up to the investor to decide which is best.

Japan says $550 billion from Trump trade deal could fund Taiwan chip plants in U.S.: Japan’s top trade official said Saturday that $550 billion in investments secured through a U.S. tariff deal might be used to support Taiwanese semiconductor factories inside the United States.

29th July

🗓️ Senate Turns Up the Heat on Crypto – July 29, 2021

In a key U.S. Senate hearing, lawmakers raised alarms about crypto being used to evade sanctions and finance crime. Senator Elizabeth Warren called for tighter oversight, warning that digital assets could undermine the U.S. dollar and national security.

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter: @CPOfficialtx

Telegram Channel: @CryptopolitanOfficial

Beehiiv: https://cryptopolitan.beehiiv.com/

Facebook: https://www.facebook.com/cryptopolitan