- Cryptopolitan

- Posts

- Trump’s WLFI Token Tanks on Day One

Trump’s WLFI Token Tanks on Day One

PLUS: Ethereum gas spikes, Coinbase & OKX chase Australia’s $2.8T pensions, $453M in token unlocks loom, top AI accounts to follow, and influencer leak drama.

🏦 Trump’s WLFI token tanks on day one

The Trump family’s foray into crypto hit the market this week and it was anything but quiet.

World Liberty Financial (WLFI), a token co-founded by Donald Trump’s sons and backed by the former president himself, tumbled 16% on its first day of trading. WLFI opened at $0.28 across Binance, OKX, and Kraken, spiked to $0.33, then sank to $0.23 by New York midday.

Despite the rocky debut, WLFI immediately became one of the most traded tokens, with a combined notional value of $6.4B on launch day. For the Trump family, it marks their most significant financial play since the White House. Trump personally holds 15.7B WLFI tokens, worth about $3.6B at launch prices making the token potentially their most valuable asset, even above real estate.

🚨 Ethereum feels the activity momentum

The launch didn’t just rattle traders, it rattled Ethereum. WLFI briefly became the busiest smart contract on the network, pushing gas fees to 100 gWei. The highest in months.

Swaps spiked to $145 per transaction at peak congestion.

Ethereum daily transactions jumped to 1.58M, with over 550K active addresses.

More than 129 ETH was burned in WLFI-related gas fees within hours.

💡 Quick Explainer: Why gas matters

Gas fees = the price you pay to use Ethereum. High fees signal demand, but they also expose scalability limits. WLFI showed how one hyped token launch can clog the entire chain.

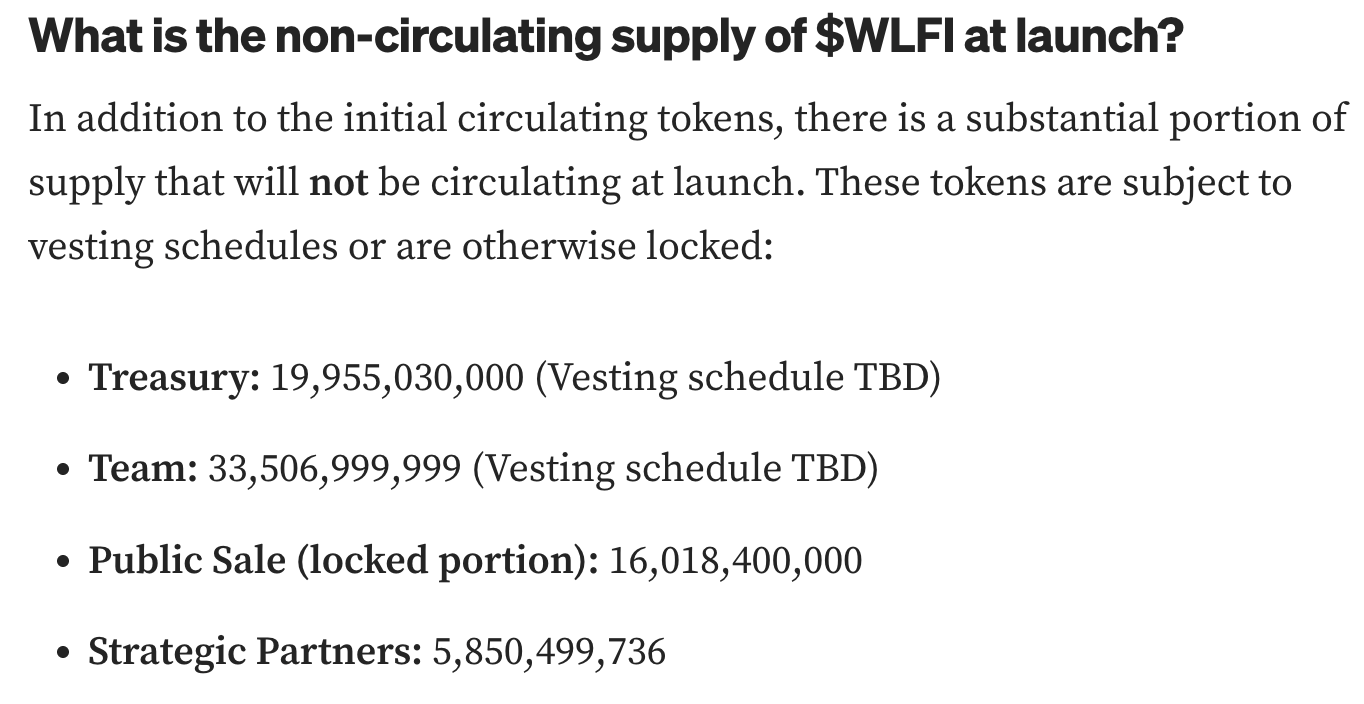

📊 Tokenomics and restrictions

World Liberty Fi structured the launch to control supply but also raised eyebrows:

Only 24.7B tokens (of 100B total) unlocked for trading.

Early investors allowed to sell just 20% of holdings, but founders face no such restriction.

A Nasdaq-listed partner, Alt5 Sigma, received $1.5B split between WLFI tokens and cash to support a WLFI treasury strategy.

The result? A thin free float with $7M DEX liquidity, fueling volatility and fears of early profit-taking.

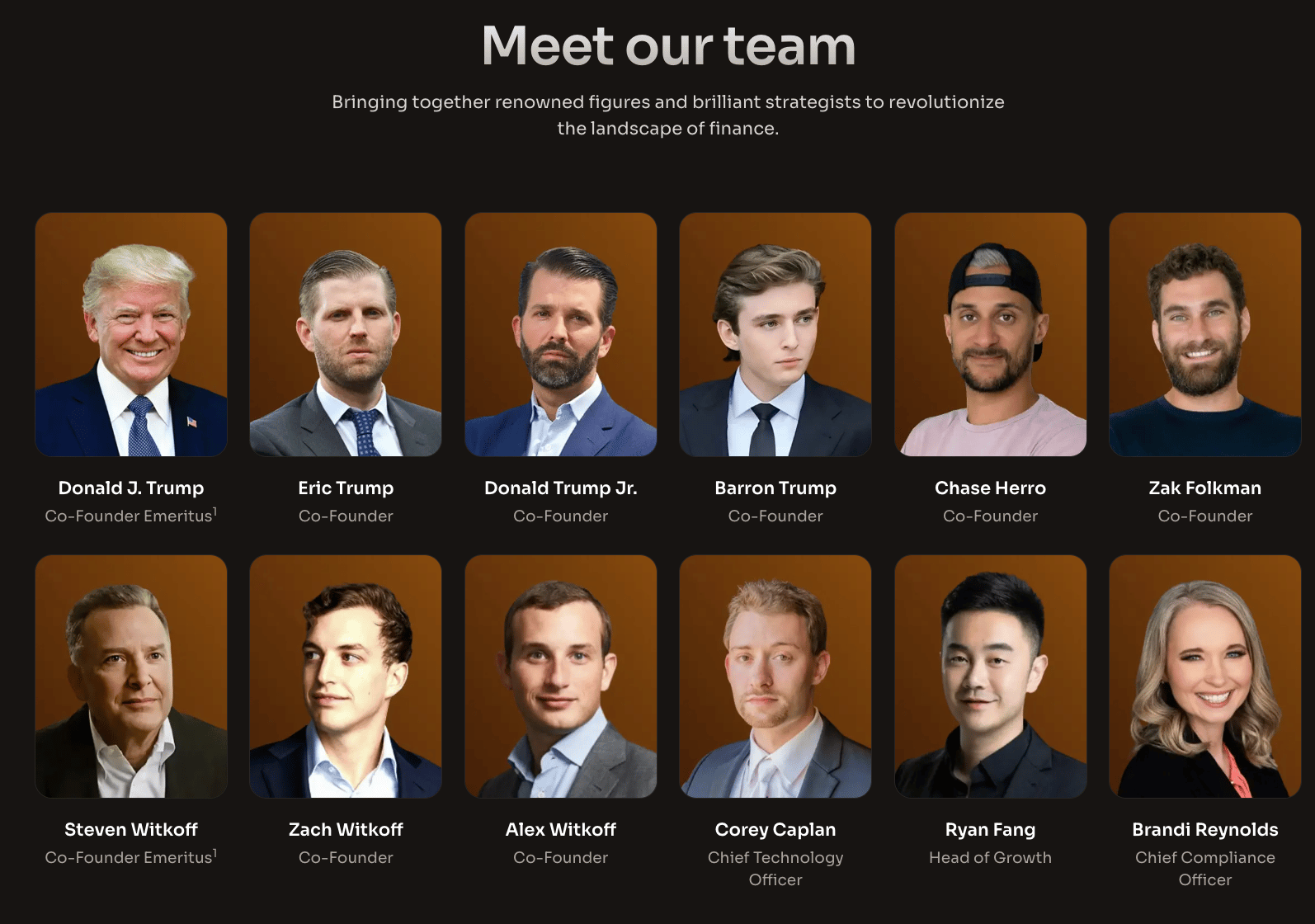

⚖️ Politics and scrutiny

WLFI is as much politics as it is crypto.

Trump’s sons are listed as co-founders, with Trump himself as “Co-Founder Emeritus.”

Investors include Justin Sun ($75M), DWF Markets ($250M into WLFI’s stablecoin USD1), and entrepreneurs from Ghana to Abu Dhabi.

Critics like Senators Elizabeth Warren and Maxine Waters warn of conflicts of interest, saying the family’s holdings create “an obvious incentive” to push regulators toward crypto-friendly rules.

💡 Quick Explainer: Why WLFI is controversial

Unlike most meme tokens, WLFI isn’t just hype, it’s tied to the sitting U.S. president, creating direct overlap between political power and personal financial gain.

💳 Market Watch

Two of crypto’s biggest names, Coinbase and OKX are eyeing one of the world’s richest retirement systems: Australia’s $2.8 trillion superannuation pool.

Their entry point? Self-Managed Super Funds (SMSFs), which let individuals pick their own investments. SMSFs make up about 25% of Australia’s retirement money and are far more flexible than traditional pension funds.

Coinbase is rolling out a dedicated SMSF service, already boasting 500 investors on the waitlist. Most plan to allocate up to A$100K (~$65K USD) into crypto.

OKX launched its SMSF offering in June, also seeing strong demand.

Pension money is some of the stickiest capital in finance. Even a small shift into crypto could reshape flows though regulators remain cautious, warning against overexposure.

Currently, SMSFs hold just $1.1B in crypto, a sliver of the system. But with younger Australians opening funds earlier and allocating more to digital assets, the pipeline looks primed for growth.

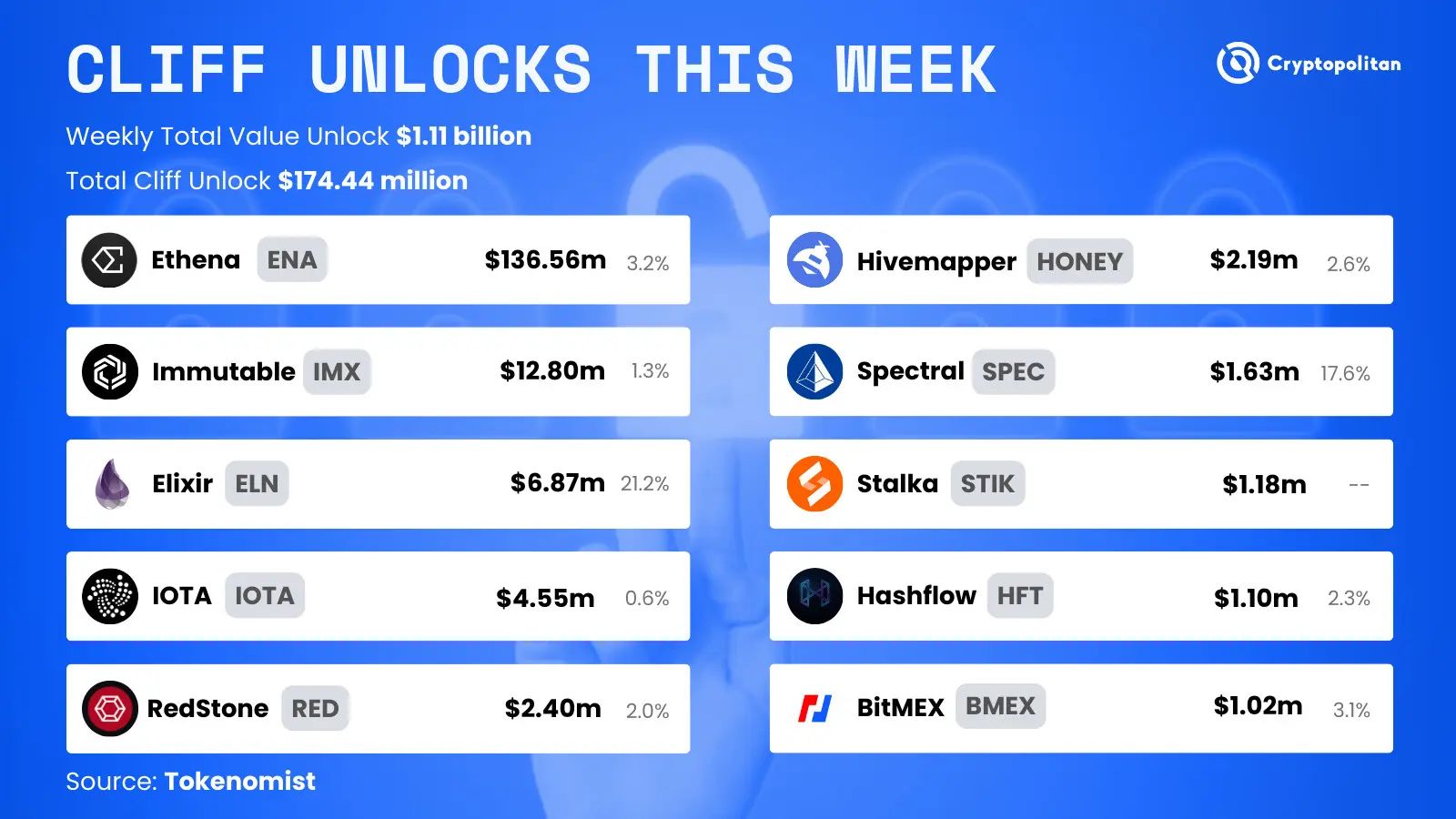

📊 Token unlocks our analyst is watching

Over $453M in tokens are set to unlock this week. The biggest ones on our radar:

Ethena (ENA): $135.5M cliff unlock (3.35% of supply).

Immutable (IMX): $12.3M cliff unlock (1.27% of supply).

Solana (SOL): $100M linear release (0.09% of supply).

TRUMP: $41.2M linear release (1.52% of supply).

💡 Quick explainer: Cliff vs Linear

Cliff unlocks = large chunks released at once → often create sharp volatility.

Linear unlocks = slow daily drips → steady supply pressure over time.

👉 Want the full list of unlocks this week?

Top AI builders to follow on X

Here are the top picks:

@emostaque – Emad Mostaque

Founder of Stability AI. Candid on open-source AI, regulation battles, and decentralization.@karpathy – Andrej Karpathy

Ex-Tesla AI lead, OpenAI co-founder. Breaks down complex AI topics in plain language.@soumithchintala – Soumith Chintala

Co-creator of PyTorch. Shares deep research and updates from inside the AI trenches.@levelsio – Pieter Levels

Indie hacker behind viral AI tools. Great for scrappy product hacks and real-world AI use cases.@sullyomarr – Sully Omar

Founder of Loveable.ai. Posts daily demos and reviews of AI products that actually work.@hardmaru – David Ha

Ex-Google Brain researcher. Blends cutting-edge AI insights with an artistic lens.

Intern picks: Your Tuesday headlines

🎭 Culture corner:

Crypto detective ZachXBT dropped a bomb this week, leaking a price sheet of 200+ influencers charging for undisclosed promotions.

The doc listed X handles, wallet addresses, and rates per post, exposing what shilling really costs:

Tier 1 names like Atity charged up to $60,000 for a single post.

Others offered “bulk tweet packs”, 4 promos for $8K, 6 tweets for $12K.

Most posts? No ad disclosure. Zach counted <5 out of 160+ deals marked as paid.

👉 Wallets tied to the influencers made transactions traceable, confirming the deals.

Quick explainer:

Paid promos without disclosure = market manipulation risk. Regulators are watching, and leaks like this show how deeply “influencer marketing” is baked into crypto trading culture.

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook