- Cryptopolitan

- Posts

- Trump revives crypto bills after House chaos

Trump revives crypto bills after House chaos

PLUS: Markets bounce back as Bitcoin recovers, PUMP starts buybacks, Ripple’s tokenization push heats up in Dubai real estate and a special gift for you 🎁

🇺🇸 Trump revives crypto bills after house chaos

Trump’s “Crypto Week” hits a wall in Congress. Here’s what happened:

• Trump’s push for new crypto rules stalled in the House

• 13 Republicans joined Democrats to block key bills

• GENIUS, CLARITY, and anti-CBDC bills failed to advance

• The vote was expected to pass, but

— Cryptopolitan (@CPOfficialtx)

9:15 PM • Jul 15, 2025

Just hours after U.S. crypto legislation appeared dead in the water, Donald Trump staged a dramatic save.

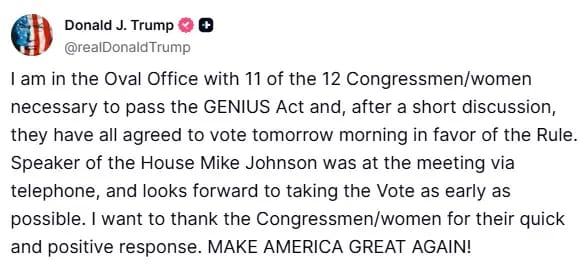

In a late-night Truth Social post, Trump revealed he had met with the GOP rebels who had earlier sunk a key procedural vote on crypto regulation. After a "short discussion" in the Oval Office, the lawmakers agreed to reverse their position, reviving three stalled bills.

Here’s what happened:

Earlier in the day, 13 hardline Republicans joined Democrats to block the vote that would’ve moved crypto bills to the floor.

The rebellion centered on the stablecoin bill, with some lawmakers objecting to the lack of amendments.

Two vocal opponents demanded a ban on a Federal Reserve-issued CBDC be added, a growing concern among crypto advocates.

The vote failed 196–223, catching the market off guard and triggering a sharp correction.

Bitcoin plunged over 5% after the failed vote, dropping to $116K from $120K.

Crypto-linked stocks like Coinbase, Robinhood, and Riot Platforms all traded lower in after-hours.

Then Trump stepped in.

In his post, Trump thanked Congress and Speaker Mike Johnson (who joined remotely) and said the rule would now be re-voted on today, opening the door for full debate on all three bills.

These include:

A bipartisan stablecoin regulation framework

A market structure bill defining the roles of SEC and CFTC

Protections for DeFi and self-custody rights

Markets recovered quickly.

By Wednesday morning, the crypto market had gained nearly 3%.

BTC bounced to $118,727

ETH surged 6% to $3,170, up 22% for the week

The Fear & Greed Index remains in “Greed” territory, signaling traders see this as a dip, not a reversal

This last-minute deal highlights Trump’s deepening alignment with crypto interests — just weeks after he promised to be a “crypto president.”

With a re-vote now imminent, and all three major bills back on track, this could mark a defining moment in U.S. crypto regulation.

📚 Read Also: Trump says Scott Bessent won’t become Fed chair moments after he said ‘I’m happy to do it!’

Scott claimed the search for a Powell replacement had started and he was involved. Trump blasted Powell again over renovation costs and high interest rates.

📈 Market Watch

Pump.fun has kicked off a series of buybacks to protect its newly launched PUMP token from collapsing, a bold move that’s already begun to pay off.

Just a day after the token went live, the team spent 118,350 SOL (worth millions) to repurchase 2.99 billion PUMP tokens, helping the price recover to $0.006, up 22% on the day.

Why the buybacks matter:

In the past 8 hours, PumpFun has spent 118,350 $SOL to buy 2.99B $PUMP and has moved it to another wallet.

It has received 187,770 $SOL ($30.59M) (from fee wallets) and still holds 69,420 $SOL worth $11.48M and is likely to buy further $PUMP.

Addresses:

-

— Onchain Lens (@OnchainLens)

1:33 AM • Jul 16, 2025

PUMP suffered a 56% drop after launch, as whales sold and shorted the token immediately

Liquidity on Raydium and Meteora was initially thin, adding to volatility

Buybacks helped restore confidence and grew liquidity to $27.5M on Raydium

70% of whale trades on Hyperliquid are now long, indicating bullish sentiment returning

The token is still in price discovery mode, but sentiment is shifting.

PUMP remains low-float and controversial

Despite a $2.35B market cap (FDV: $6.65B), PUMP has limited circulating supply, keeping price action wild.

Insider activity rumors and short-term hype have led some to compare it to HYPE tokens, which also promised revenue sharing via meme protocols.

So far, Pump.fun hasn’t announced a token burn or formal utility. The only known lever: buybacks funded by SOL reserves and fees.

But there’s a bigger concern: revenue is down

At its peak, Pump.fun generated $13M daily in fees. That number now sits around $1.3M, with some days dipping below $1M. Meanwhile, rival meme platform LetsBonk is pulling ahead in activity.

If PUMP is to survive long-term, it needs more than buybacks. It needs to justify its market cap and show it can outgrow its meme roots.

Through this rollout, clients can trade cryptocurrency futures directly on CME Group’s platform via Kraken Pro.

⛓️ Protocol Watch

Ripple has secured a major foothold in the Middle East, partnering with Ctrl Alt to provide custody infrastructure for Dubai Land Department’s tokenized real estate project.

The project, running on the Prypco Mint platform, is built on the XRP Ledger (XRPL), marking the first time a government land registry in the region is using a public blockchain to issue title deeds.

What Ripple brings to the table:

Secure, scalable custody for tokenized property records

First UAE custody partner via Ctrl Alt

Infrastructure already supporting clients in Europe, Africa, APAC, and LatAm

Reinforces XRPL’s use case beyond remittances — into institutional-grade tokenization

Ripple’s Middle East MD, Reece Merrick, called this a “perfect example” of Dubai’s positioning as a digital asset hub.

The demand is already real

In just over a month, three properties were successfully tokenized and sold via Prypco Mint:

A Business Bay apartment attracted 224 investors from 40+ countries

A $653K property in Kensington Waters sold out in under 2 minutes

The third listing, Dubai’s first tokenized villa, was fully funded in 5 minutes

Each listing offered fractional ownership starting at just $544 (2,000 AED).

Today, two new properties dropped in Dubai Marina and MBR City.

Ctrl Alt is the engine, Ripple is the vault

Ctrl Alt, now licensed by VARA as a VASP issuer, chose Ripple to handle asset custody, citing the company’s proven security and operational standards.

CEO Matt Ong said the choice was straightforward: “We needed tech that institutions trust.”

Ripple’s UAE expansion is accelerating

Licensed by the DFSA as a blockchain payments provider

Partnered with Zand Bank and Mamo for cross-border payments

Its stablecoin, RLUSD, was approved for use inside DIFC — a first

Now, with property deeds being minted on XRPL, Ripple is embedding itself into Dubai’s tokenized future.

📚 Read Also: PayPal to expand its PYUSD stablecoin to Arbitrum

The integration will provide users with multiple choices of blockchains, allowing for increased flexibility and control.

🎉 Giveaway alert

🎟 GIVEAWAY ALERT: Win 3 FREE Pro Passes to Bitcoin Asia 2025!

Hong Kong | Aug 28–29

🔉 Hear Eric Trump LIVE at @BitcoinConfAsia!

How to Enter:

✔️ Follow @CPOfficialtx

✔️ Comment: Why do you need to be at #BitcoinAsia2025?

✔️ Tag 3 friendsDeadline: July 31, 2025

— Cryptopolitan (@CPOfficialtx)

12:30 PM • Jul 16, 2025

🔵 Stories you may have missed

Goldman Sachs, BofA, and Morgan Stanley break multiple records with Q2 earnings: Goldman Sachs, Bank of America, and Morgan Stanley just dropped their Q2 earnings numbers, and let’s be honest, Wall Street analysts got smoked.

Tariff payments up to $50B as America’s trade partners ‘chicken out’ from retaliation: Only China and Canada have shot back against the U.S. so far. The EU and Mexico have opted for negotiation

Grok 4 will no longer rely on Elon Musk’s tweets, xAI says: Elon Musk’s X, formerly Twitter, revealed that its chatbot Grok will no longer base its responses on Musk’s ideology.

BigOne exchange suffers $27M exploit: The BigOne exchange suffered a $27M attack affecting its hot wallets on Ethereum, Solana, Bitcoin, and TRON.

Bitcoin devs propose quantum-safe upgrade to protect 25% of BTC: Jameson Lopp, CTO and co-founder of the self-custody platform Casa, along with five other developers, has proposed new strategies to counter the potential threat of quantum computing

Fidelity’s subsidiary exposure to Metaplanet signals rising TradFi interest in Bitcoin treasuries: Popular investment firm Fidelity has become the largest shareholder of Japan-based Bitcoin treasury company Metaplanet.

Polymarket may be priming for U.S. return after DOJ, CFTC drop investigation: The U.S. Department of Justice and Commodity Futures Trading Commission (CFTC) have quietly ended their investigations into the crypto-based prediction market, Polymarket.

16th July

On this day in 2014, Mt. Gox—the infamous Bitcoin exchange—filed for Chapter 15 bankruptcy protection in the United States, months after losing over 850,000 BTC due to a long-undetected hack.

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter: @CPOfficialtx

Telegram Channel: @CryptopolitanOfficial

Beehiiv: https://cryptopolitan.beehiiv.com/

Facebook: https://www.facebook.com/cryptopolitan