- Cryptopolitan

- Posts

- 🏠 Trump orders $200B in mortgage bond buys. Markets think 2008.

🏠 Trump orders $200B in mortgage bond buys. Markets think 2008.

$200B in MBS demand injected by decree. PLUS: Coinbase leans into TradFi, Morgan Stanley plans a crypto wallet, Bitcoin volatility stays muted, and CNBC crowns XRP the trade of 2026.

Trump orders $200B in mortgage bond buys. Markets think 2008.

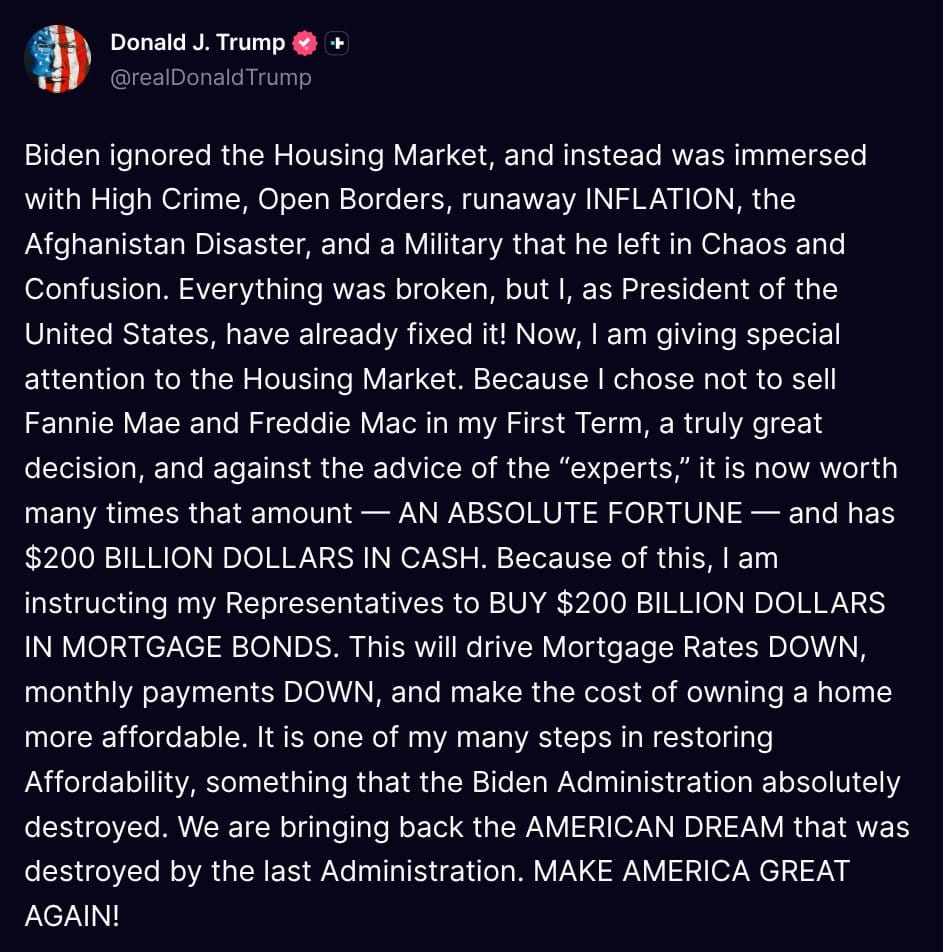

U.S. President Donald Trump has directed $200 billion in mortgage-backed bonds to be bought up through Fannie Mae and Freddie Mac, resurrecting an old role: not seen since the time of the global financial crisis, where central planning was used to fuel housing markets.

Trump cast the move as a reset for American homebuyers.

First, what did Trump order?

Mortgage-backed securities (MBS), are bundles of home loans made to investors.

Prices of bonds climb and rates on mortgages fall when a big buyer enters the market and scoops them up aggressively.

That’s the theory.

Trump ordered Fannie Mae and Freddie Mac, the two government-backed mortgage giants, to purchase $200 billion of these bonds, essentially inserting demand into the housing finance system.

This is akin to tools employed by the Federal Reserve during crises except that, for once, the order isn’t coming from the White House.

Where is this $200B coming from?

That’s where questions start.

Technically, Fannie and Freddie don't have $200B in money. That’s not at all reflected in their most recent filings.

But the head of the Federal Housing Finance Agency, Bill Pulte, clarified that the administration is counting broader liquidity, not just cash balances.

That includes:

Restricted cash

Short-term securities

Repurchase agreements

In the aggregate, these resources total approximately $190B and the administration believes represents “ample liquidity” to move forward.

It’s close but it’s also financial engineering, not just a pile of idle money.

Why markets are uneasy

Mortgage bonds were at the heart of the 2008 collapse. What was wrong back then was not just housing, but the degree to which the financial system had been intertwined with mortgage risk.

This time, the quality of the loans themselves is better. It’s the size and the political timing of the intervention that’s making investors jittery.

Rather than naturally correcting markets, the government is imposing lower rates by decree.

That raises questions:

How long will this support continue?

What occurs when it gets pulled back?

Who would be on the hook for any losses if housing does not respond?

There are no answers to those questions yet.

And what is Bitcoin doing?

Not a lot, but that’s the point.

At the time of writing Bitcoin dipped below $90,000, but volatility remained subdued.

Open interest barely moved

Liquidations dropped sharply

Momentum indicators are flat

🧠 Cryptopolitan’s Take

This isn’t about housing alone.

It’s about how much governments are willing to go to manage outcomes, and how comfortable markets are with that. Trump is gambling cheaper mortgages will drive faster.

And markets are wondering what the long-term cost comes to.

POLL: How do you see this playing out? |

📊 Market Watch

🔵 Coinbase goes full TradFi

Coinbase is adding copper and platinum futures to its commodities arm, which already covers gold, silver, oil and other metals, in a scramble to become the “everything exchange.”

The move is similar to those made by TradFi rivals Bitget and Binance, which are both introducing metal markets.

Bank of America and Goldman Sachs raised their rating on Coinbase stock, citing its expanding access to tokenization, Base and institutional finance.

🪙 Morgan Stanley’s digital ambitions expand

Morgan Stanley to roll out its own crypto wallet in late 2026, after E*Trade’s implementation of BTC, ETH and SOL trading through Zerohash.

The bank is diving deep into pre-IPO investing through EquityZen, and employee wealth planning through Carta.

Its long-term plan? Blend TradFi + DeFi and tokenize ownership, from private stock to client portfolios.

👑 Bitcoin forecasts diverge sharply

BTC has $80K level in sight and is hovering around that mark after the fall from above $126K back in 2025.

Calls for prices in 2026 are all over the map, but it will be somewhere between $75K and $225K, depending on what the Fed does and ETF flows and institutional lending. ETFs will push demand as digital asset treasuries (DATs) recede.

Volatility, however, is guaranteed.

👀 Are you watching?

CNBC has just declared XRP the best trade of 2026.

Ripple-funded token soared 20% this week, took back the #3 position (by market cap) and managed to stand out amid Q4 wreckages.

Why?

Regulatory clarity (SEC fight over)

Steady fund inflows

Real utility in cross-border payments

CNBC had also mentioned Solana as an altcoin-to-watch, citing their opinion that tokenization, speed and cheaper transfer would be major drivers in 2026.

Poll: Which altcoin will outperform in 2026? |

🐥 Top tweets

Here are Cryptopolitan’s top picks:

Friday headline picks

Former Zcash developers launch ‘cashZ’ wallet after exiting the project

Truebit’s native token TRU crashes 99.9% following $26M exploit

Vitalik Buterin says increasing bandwidth is safer than reducing latency for blockchain scalability

SharpLink Gaming deploys $170M in Ethereum to layer-2 network Linea

Meme of the day

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook