- Cryptopolitan

- Posts

- 💸 The Dollar isn’t as untouchable as it used to be

💸 The Dollar isn’t as untouchable as it used to be

Carry trades roar back. PLUS: EM currencies surge, Brazil’s real leads, gold hits records, stablecoins shrink, and crypto waits its turn.

If you shifted some of your cash into emerging-market currencies at the end of last year, congratulations, you’re probably enjoying some sturdy gains about now.

The Dollar’s sliding and emerging markets are loving it

2026 has gotten off to a quiet start with one of finance’s oldest strategies making people money: the carry trade.

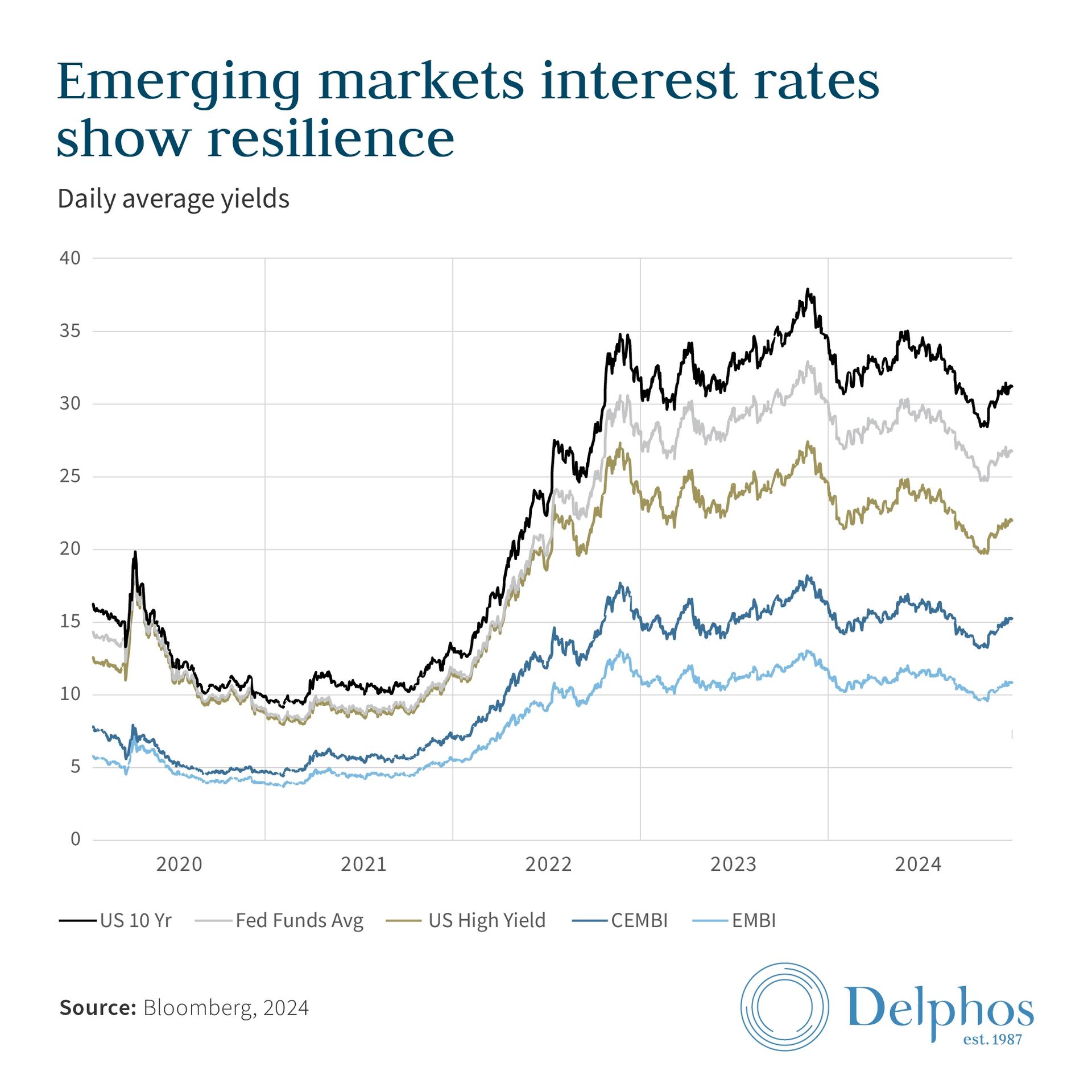

Investors are borrowing in dollars and betting heavily on currencies such as Brazil’s real, Turkey’s lira and Colombia’s peso, markets where central banks have maintained high interest rates even as inflation has cooled.

The result? A 1.3 percent surge in Bloomberg’s own carry trade index this month alone, on top of last year’s 18 percent return, the steepest gains in more than a decade. (For those keeping score at home: That’s ahead of the S&P 500, gold and yes, even Bitcoin, for now.)

💡 Quick explainer: What’s a carry trade?

In theory, it’s a no-brainer: borrow in a currency with low interest rates (think the US dollar), and invest in one with high rates (say Brazil’s real). You pocket the difference, but only if the exchange rate doesn’t go against you.

Throw in global political noise including Trump’s threats of tariffs on South Korea and Europe and suddenly the world’s “safe haven” currency doesn’t feel so safe.

Brazil’s real is the currency star

The Brazilian real has been the world’s best-performing currency, using its pandemic-era decline to give itself a shot in the arm just as global investors begin going shopping.

Brazil’s real is up more than 4% this year so far. That’s on top of a 23.5% gain last year. Wall Street also has a thing for Turkey and the Czech Republic. Morgan Stanley and Citi both identified them as 2026 favorites.

On the other side? India’s rupee and Indonesia’s rupiah have fallen. But not every EM currency is cut out for this.

So why is the dollar weakened?

It’s no longer just about rates. Brutish trade threats by Trump revive fears of another tariff war. Markets are just beginning to price in more volatility, and with $8 trillion worth of European holdings linked to US assets, the dollar’s reserve currency status is not as unassailable as it once was.

Even BlackRock cautioned in a recent report that were political risks to mount foreign governments might hasten their downsizing of dollar exposure.

And how about crypto?

To crypto people, it’s old hat. Weak dollar? Investors seek other potential stores of value. That’s helped gold rally to all-time highs. Tokenized gold is surging too.

And as much as Bitcoin is down this week, its “digital gold” sales pitch gets louder every time the greenback stumbles.

There’s a larger macro story at play here: the old guard (dollar hegemony) is under attack, and emerging markets, gold, even crypto could benefit from the cracks in the foundation.

🤔 Quick Poll: What’s your best hedge if the dollar keeps falling? |

👉 Reply to this email with your answer and you might get featured in next week’s issue.

📊 Market Watch

🟡 Highest points goes to Tether gold

Tether Gold (XAU₮) now dominates the tokenized gold market, crossing $4B in value. Spot gold breaking $5,000/oz with central banks surreptitiously adding to reserves has driven demand for real-world asset (RWA) tokens through the roof.

Tether’s 27-ton Q4 gold purchase even equalled some sovereigns, and yes, it’s all on-chain.

💵 Shrinking stablecoins indicate flight to safety

$2.2B has been withdrawn from the leading stablecoins over the past 10 days.

On-chain data reveals that money is not just going from crypto to the sidelines, it’s streaming into gold and silver.

The decline in the supply of stablecoins indicates poor buying strength for altcoins to come. Risk on: Until there’s new money coming in, expect less ammo and slower risk-on recoveries.

⚒️ BlackRock’s Bitcoin earnings ETF is on the way

Say hello to the new wave of Bitcoin ETFs: BlackRock has just filed the S-1 for its iShares Bitcoin Premium Income ETF. Unlike the current IBIT, this version has an income layer where call options are sold, targeting yields of 8-12% annually.

Think: covered calls for crypto. With IBIT already managing $69B in AUM, this would enable the floodgates to be pried open for Bitcoin-as-yield plays on TradFi balance sheets.

🤯 This blew our mind

Silver just did something we normally only see in crypto.

In the course of 14 hours, the silver market moved by close to $2 trillion in long positions.

It began the day with a $500 billion jump in market cap…

Then plummeted on by almost $950 billion…

And somehow recovered another $500 billion..

That is almost Bitcoin’s entire market value, up and down, and then back up again, in a single day of trading.

The most pithy tweet doing the rounds:

Silver is quite literally tossing around Bitcoin’s entire market cap in a couple of hours.

For a metal often mocked as “boring,” silver just flipped the script. Some traders are scrambling to put any sense at all on it, blame now includes algotraders, then flight-to-safety demand gone haywire and there’s the odd muffled “manipulation.”

All we know is: someday, this will be in textbooks.

🐥 Top tweets

Here are Cryptopolitan’s top picks:

📡 Signal vs Noise

NOISE:

“Crypto is too volatile for mainstream adoption.”

“It’s all speculation.”

“No one uses it in real life.”

SIGNAL:

Brian Armstrong won’t consider crypto an erratic asset class.

He thinks of it as ghost infrastructure, insinuating itself into payments, identity, and daily digital life.

Wait, isn’t this making you think about TCP/IP when you email someone? You really don’t. So too will we not explicitly be thinking “blockchain” when we get our passports verified, pay for coffee or own assets online.

The actual conversation is not if crypto will be used.

It is how deeply it will be baked in, so much that even its loudest detractors depend on it without realizing.

From MiCA and U.S. regulations to Layer-2s and ZKPs, the groundwork is being laid.

Headline picks by our Head of H.R

Australia warns crypto regulation gaps threaten consumer safety

Meta trials new paid subscriptions across Instagram, Facebook and WhatsApp

Metaplanet shrugs off $680M Bitcoin hit, raises 2026 outlook

Coinbase Commerce hacker wakes up, funnels $5.4M into Tornado Cash

Japan’s $7 trillion JGB crash pushes yields higher and spooks global markets

Meme of the day

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook