- Cryptopolitan

- Posts

- Tether wants Gold

Tether wants Gold

PLUS: Tether eyes gold mining, meme ETFs push forward, Solana’s August data stuns, Justin Sun clashes with WLFI, and the top AI projects to follow.

🏦 Tether wants Gold

Tether is already the heavyweight of stablecoins. Now it wants to dig into the ground, literally.

According to the Financial Times, the company behind USDT is in talks to invest directly in gold mining, from financing ventures to buying stakes in royalty firms that skim profits off future production. Insiders say the conversations are serious, and a move is likely. Let’s unpack this play.

Why gold, why now?

The CEO’s obsession: Paolo Ardoino has called gold “the natural Bitcoin” and a stronger hedge than fiat. Tether already holds $8.7 billion worth of the metal in its reserves.

XAUt success: Tether issues a gold-backed token (XAUt) with nearly $900 million in circulation. It’s up 35% this year, riding the surge in spot gold past $3,600.

Existing bets: Earlier this year, Tether put $105 million into Elemental Altus, a royalty company, and doubled down with another $100 million after its merger into Elemental Royalty Corp.

A diversification sprint

Tether pulled in $13B in profit last year and another $5.7B in the first half of 2025. Instead of parking cash, it has been splashing out:

Lending to commodity traders

Building AI ventures and brain-computer interfaces

Funding Bitcoin mining and agro projects

Even buying a stake in Juventus Football Club

Gold mining looks like the next piece of its empire playbook: convert stablecoin profits into hard assets that keep Tether relevant even if USDT loses ground.

The competitive pressure

USDT still dominates the $288B stablecoin market with ~59% share, but the moat is shrinking:

The U.S. GENIUS Act has opened the door for banks and fintech giants like Stripe to issue their own stablecoins.

Circle’s USDC and Ripple’s RLUSD are pushing regulatory compliance as their main edge. Ripple, for instance, is targeting African payments, one of Tether’s strongholds.

The open question

Gold gives Tether a safety net, but critics inside the mining industry doubt the company has a real strategy. For them, Tether is a finance player dabbling in a sector where long-term planning and operational know-how decide who wins.

💳 Market Watch

The REX-Osprey™ DOGE ETF, $DOJE, is coming soon!

$DOJE will be the first ETF to deliver investors exposure to the performance of the iconic memecoin, Dogecoin $DOGE.

From REX-Osprey™, the team behind $SSK, the first SOL + Staking ETF.

@OspreyFunds

Investing involves risk.

— REX Shares (@REXShares)

7:29 PM • Sep 3, 2025

Wall Street may be about to get its first taste of Dogecoin in ETF form.

Rex Shares and Osprey Funds have filed for a Dogecoin ETF under the ticker $DOJE, and Bloomberg’s Eric Balchunas says approval could come as soon as next week. If cleared, it would mark the first U.S. ETF tied directly to DOGE, an asset born as a meme in 2013 and now one of crypto’s most recognizable tokens.

How it works:

At least 80% of the fund’s assets will be in DOGE or instruments that mirror its price (futures, swaps, direct holdings).

The rest may sit in Treasuries or cash for operations.

Distribution will be handled by Foreside Fund Services.

The filing takes an unusual route: Rex is using the Investment Company Act of 1940 (“40 Act”) instead of the slower S-1/19b-4 process. ETF Store president Nate Geraci calls it a “regulatory end-around” that could help Rex beat rivals like 21Shares, Grayscale, and Bitwise whose DOGE ETF proposals remain in limbo.

Rex and Osprey aren’t stopping with Dogecoin. They’ve also applied for ETFs tied to TRUMP, XRP, and Bonk, hinting at a new wave of politically and culturally flavored crypto products hitting mainstream markets.

💡 If $DOJE gets the green light, it will be more than a meme milestone, it will show how creative structuring can fast-track crypto ETFs past the SEC’s usual gridlock.

📊 Chart our analyst is watching

Solana’s August data is here, and it looks promising for the network and $SOL holders.

August on Solana, by the numbers:

➔ $148 million in app revenue, up 92% from 2024 and surpassing all other networks

➔ All-time high perps volume of $43.8 billion

➔ 2.9 billion transactions, up 46% y/y and more than 4x all other networks combined

➔ $144 billion in DEX

— Solana (@solana)

3:00 PM • Sep 4, 2025

App Revenues: Solana apps generated $148M in August, with ~$85M from DEX activity. That’s higher than its base fees for the 8th month in a row.

Active Users: Daily active wallets stayed above 3.3M, keeping Solana at the top end of user activity across chains.

Liquidity & TVL: Total value locked rose from $8.5B to $11.5B, supported by $12.2B in stablecoin inflows.

Perpetual Futures: Volumes hit $43.8B, largely from Drift Protocol, alongside SOL open interest climbing above $6B.

Token Launches: 1.34M new tokens deployed in August, a 30% increase from July. Most were meme-linked, with Pump.fun continuing to dominate issuance.

Context: Growth is being driven by liquid staking tokens (notably Marinade), tokenized equities moving on-chain ($500M+ now on Solana), and wrapped BTC inflows ($300M+ via Kamino).

Takeaway: August data shows Solana expanding on multiple fronts: fees, users, liquidity, and issuance. The question is whether these numbers reflect sustainable adoption or a market-driven peak.

Top AI projects to follow on X

Here are the top picks:

Anthropic (@AnthropicAI)

Building Claude, one of the leading large language models. Posts frequent updates on AI safety, scaling laws, and enterprise adoption.xAI (@xai)

Elon Musk’s AI venture. Expect big-vision drops about Grok, Tesla integration, and how AI will reshape social + search.OpenAI (@OpenAI)

Still the heavyweight in the room. Their feed is where new research, GPT updates, and ecosystem tools get unveiled first.Stability AI (@StabilityAI)

Known for Stable Diffusion. Their X is full of model releases, open-source debates, and visual AI demos.Mistral AI (@MistralAI)

The fast-rising European contender. They post about open-weight models and partnerships that compete head-on with U.S. players.Perplexity (@perplexity_ai)

They’re rethinking how AI search and knowledge work. Strong updates on product direction and integrations.Hugging Face (@huggingface)

The GitHub of AI. Follow for community-driven model releases, open datasets, and developer-first tools.

Friday picks: Have a great weekend :D

🎭 Culture corner:

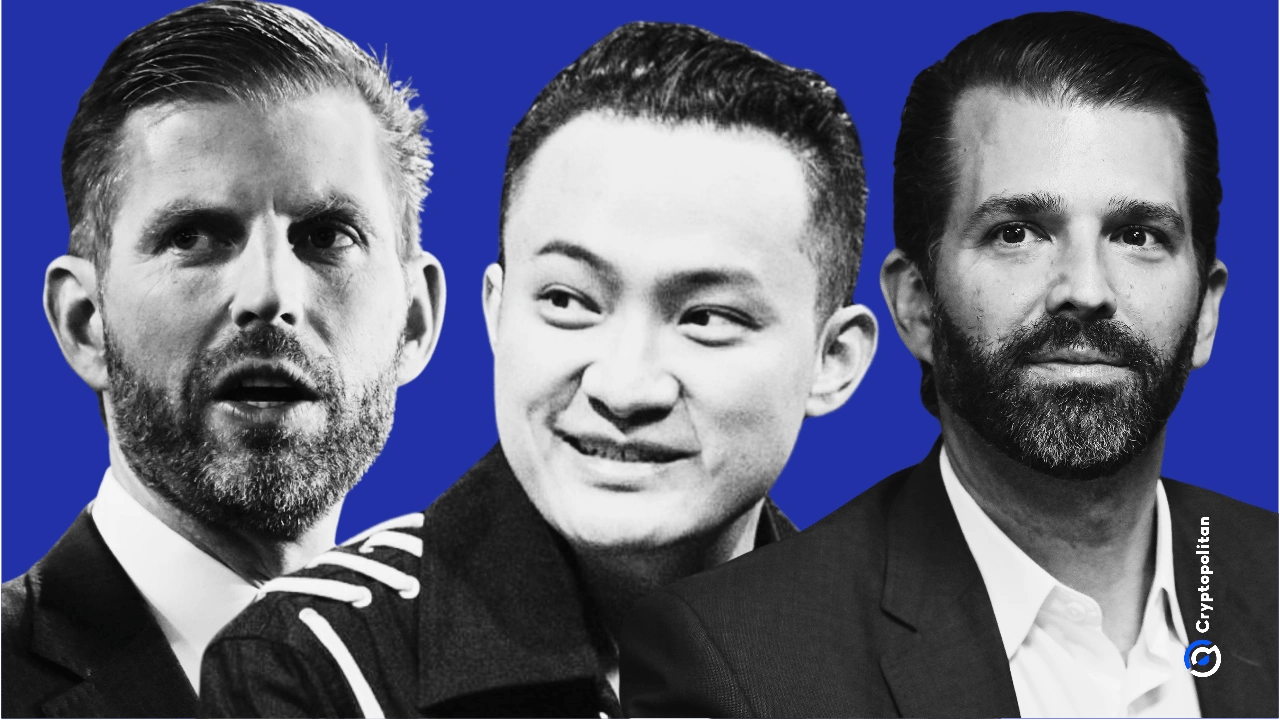

Justin Sun is in the spotlight (again). This time, it’s over claims that $500M worth of his WLFI tokens were “unfairly” frozen.

What happened: On-chain sleuths spotted two wallets tied to Sun blacklisted by World Liberty Fi. The freeze came after he moved ~9M WLFI to HTX, the exchange he controls. Speculation immediately swirled that he was prepping to dump.

Sun’s response: He fired back on X, insisting the transfers were “tests,” not sales, and argued that tokens are “sacred and inviolable.” He called on WLFI’s team to respect DeFi principles and unlock his stash.

Community reaction: Critics weren’t buying it. SwanDesk’s Jacob King even joked that Sun needed ChatGPT to write his apology.

Meanwhile, WLFI has slid to $0.18 from its $0.46 launch peak, with nearly a third of holders already exiting. The team hasn’t budged on the freeze.

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook