- Cryptopolitan

- Posts

- 🏅 Tether is quietly becoming a gold superpower

🏅 Tether is quietly becoming a gold superpower

2 tons a week. PLUS: tokenized gold dominance, $23B in reserves, XAU₮ whales, USA₮ launch, and why Tether now looks like a private central bank.

🏦 Tether’s gold play isn’t just big. It’s reshaping the market

Inside a Cold War-era nuclear bunker in the Swiss Alps, Tether is trying to do what even central banks have struggled to: hoard gold and quickly.

The stablecoin company is now buying as much as 2 tons of gold a week, quietly building what some are calling the largest private bullion reserve in the world, at over 140 tons. The vast majority of it supports XAU₮, Tether’s gold-pegged stablecoin. The rest is kept as corporate reserves.

We are soon becoming basically one of the biggest gold central banks in the world

Outpacing everyone but Poland

In 2025, Tether purchased over 70 tons of gold, more than all but a few central banks except Poland (which announced buying 102 tons), and more than net purchases from most gold ETFs that are typically driven by tens of thousands of small investors.

The World Gold Council stated that 2025 was the second biggest year for central bank gold buying on record, another indication of Tether outpacing a plethora of sovereigns.

The firm’s total stash now stands at over $23 billion, making it the largest publicly known gold holding outside of ETFs, banks and governments.

And it’s not slowing down. Tether plans to keep the buying pace at the current rate or higher “for the next few months at least,” and reassess every quarter, according to Ardoino.

XAU₮ dominating in the tokenized gold space

Tether’s gold strategy isn’t just vault-based: it is on-chain. With XAU₮, the firm has a 60%+ of the $4B tokenized gold market as per Cryptopolitan and CoinGecko.

Every XAU₮ is backed by 1 troy ounce of physical gold, stored in Swiss vaults under military protection. There were in circulation 409,217 XAU₮ as of Q4 2025, with 110,871 XAU₮ available for purchase.

The vast majority: 27 metric tons were picked up for the S.F.S.U. reserves in just the fourth quarter alone.

The demand is real. On-chain data has revealed whales converting USDT into XAU₮, such as a $4.17M purchase identified by Lookonchain in January.

The timing could not be better

Sentiment is so bullish that gold has reached $5,100/oz and ETF holdings grew by 397 tonnes in H1 2025. Geopolitical fracturing, de-dollarization themes and central bank buying have pushed us back into a gold world.

The explosion of tokenization: BlackRock and others are embracing RWA (Real World Asset) token approaches, but Tether is already at scale.

The gold reserves serve two purposes, backing XAU₮ and hedging corporate risk, Ardoino explains, noting that institutional buyers now hold the on-chain assets to as high a standard as sovereign reserve holdings.

🇺🇸 USA₮ enters the chat

Tether, in addition to that, launched USA₮ last week which is a new dollar-pegged stablecoin for the U.S. market. Released as a part of the GENIUS Act, it’s Tether’s strongest indication yet that it aims to be compliant rather than just big.

USA₮ reinforces the strength of the U.S. dollar at a moment when countries are competing to shape the future of money.

Between USDT ($186B), XAU₮ ($2.26B), and now USA₮, Tether is asserting a vision for itself that’s not just stablecoin issuer but multi-asset reserve system.

🧠 Cryptopolitan’s Take:

Whether critics argue over transparency, the numbers reveal a company filling a void created by traditional finance, and turning tokenization into actual monetary power.

The world’s most controversial issuer of a popular stablecoin is turning into one of the world’s most powerful financial entities, all without ever receiving a banking license.

Want us to send you the best remote crypto jobs every week? |

📊 Market Watch

📈 Risk appetite reaches 5-year high

Investors are going full degen, and Wall Street is getting behind it.

Goldman Sachs’ risk appetite index has just reached 1.09, its highest since 2021 and in the 98th percentile from when records began in 1991. That means nearly every signal Goldman follows, ones from small caps to emerging markets, is flashing “risk-on.”

The Russell 2000 has jumped 7.5% YTD, outpacing the S&P 500 by a mile, well, if you are tracking these two broader market indices against one another. Small cap are riding the rate-cut narrative hard, with projected earnings growth of 30–35% vs big tech’s 22%.

🏦 ECB says: Be prepared for anything

The European Central Bank is in “sliding optional mode.”

In the face of what Austrian central bank chief Martin Kocher describes as “very high uncertainty,” the ECB is declining to commit itself to lowering or raising rates. Inflation is easing toward the 2% target, but core services inflation is sticky and Trump’s tariff threats aren’t helping.

Fiscal stimulus is holding the Eurozone together, bolstered by a surprisingly robust private sector in Germany. It is forecasted that growth will bottom out at 1%+ in 2026, supported by military spending and household savings.

But the ECB needs to stay nimble, Kocher says. If inflation or the strength of the euro begins to run away from them, expect the doves and hawks to change positions quickly.

💥 1inch token tanks 16% after team dumps

1INCH is back in the news for all the wrong reasons.

14M tokens went out of an investor or team-related wallet in one move, slashing the price by 16% in a period of just 24 hours. That’s in addition to a long history: the team’s wallets have dumped tens of millions’ worth of 1INCH in the past year.

The selloff sent 1INCH to its all-time low of $0.1134, a 98.5% plunge from the coin’s early-2021 peak of $7.87.

Yes, the protocol has made solid moves: gasless swaps, AI fraud detection, deep integrations. But the market is not buying it. Sentiment is trapped in the red, as long as transparency remains elusive.

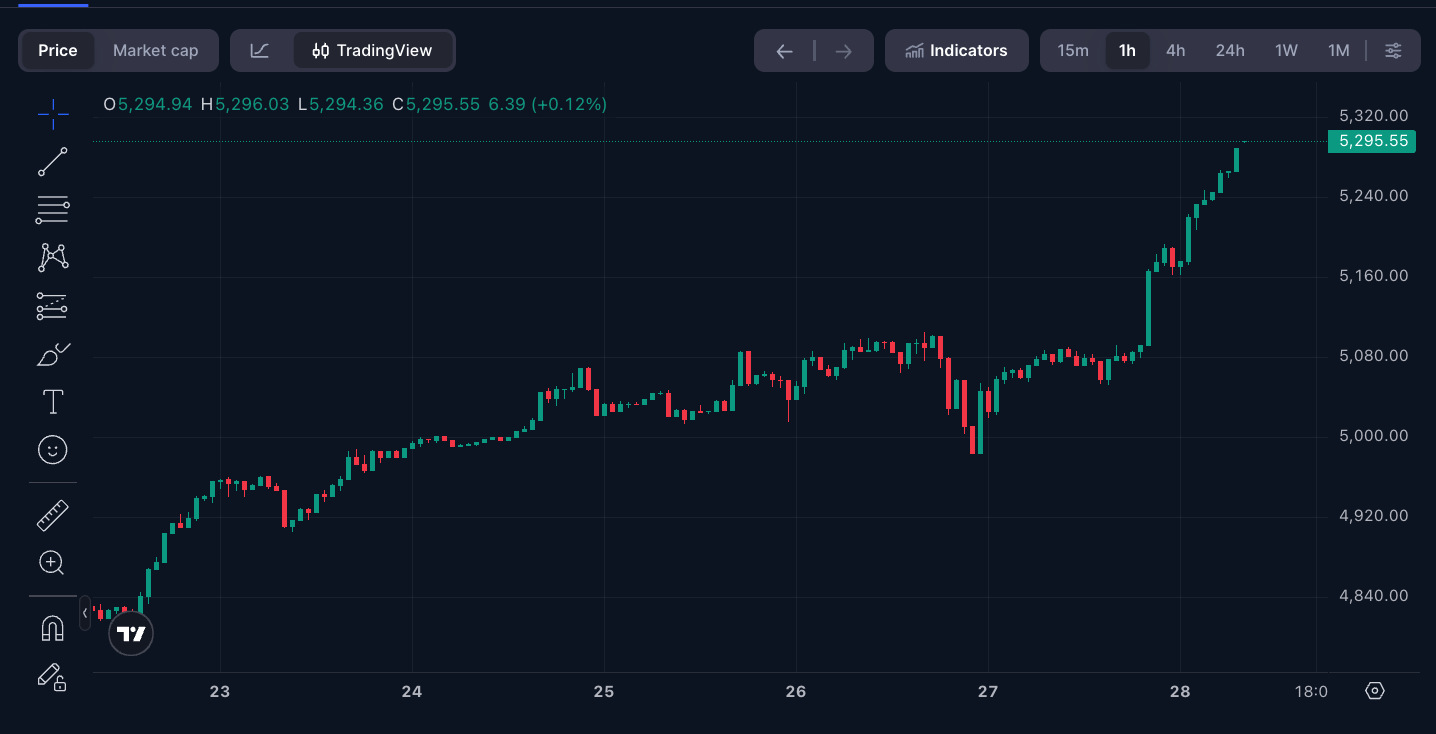

👀 Chart our Analyst is watching

HYPE pumps as metals go DeFi

HYPE is back. And the token spiked 27% to $27.61 as marketplaces for Hyperliquid’s HIP-3 token experienced a surge of whale action: not crypto whales, but silver ones.

Silver now leads HIP-3 with over $165M+ in open interest, exceeding even ETH.

There is $7.2B in open interest and there has been $18.6B in volume this month, Hyperliquid is turning out to be a macro play here. Crypto-native traders are surfing the metal wave, for now.

The question: will this rotation hold, or snap back to altcoins?

🐥 Top tweets

Here are Cryptopolitan’s top picks:

🤖 New tool in town

Moltbot: The viral AI assistant that kicked off a trademark spat

Moltbot (formerly Clawdbot) is the fastest-growing open source project of 2026-an AI assistant that runs on your infrastructure with full system access and supports integrations for WhatsApp, Telegram, Discord, and Slack.

In the first 72 hours of existence, the project racked up more than 60,000 GitHub stars, one of the most ever for a developer tool in recent memory.

But behind the hype hid a legal knot:

The original name, Clawdbot, came under fire from Anthropic, the company behind Claude AI. Founder Peter Steinberger explained that he had the app renamed due to trademark disputes, even though Clawdbot was a personal side project not affiliated with Anthropic.

Headline picks by our Finance Head

Meme of the day

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook