- Cryptopolitan

- Posts

- 🏦 Institutions pick Ethereum as Stablecoin home

🏦 Institutions pick Ethereum as Stablecoin home

PLUS: Tron knocked to #2, Solana whales find cover, Ripple brings Wall Street bonds to XRPL, Aster rockets past Circle, and traders hedge $1B on fear.

Ethereum has overtaken Tron as the #1 USDT chain with $77B to Tron’s $76.2B, reports DeFiLlama. That’s a $17B swing since May, the last time Tron was temporarily at the top of the charts.

But here’s why this flip is significant: it is not retail that’s going and doing $10 transfers. It’s institutions.

Tron has long been a retail favorite: inexpensive fees, quick payments, particularly in emerging markets. Ethereum? More costly, and made for institutional liquidity:

DeFi depth: lending, staking and cross-chain bridges.

Integration: PayPal’s PYUSD ($1.75B supply) and more on stablecoin rails.

Settlement trust: the type of chain Wall Street feels a lot better wiring billions through.

Daily volume shows it: Ethereum processes ~400K USDT transactions from the 1.64M total number of daily transactions. Tron can still reign on raw volume, ETH is where the big money is being parked.

📚 Quick Explainer: Why Stablecoin flows are important

Stablecoins are not just for trading crypto. They are equally good for:

Paying suppliers across borders.

Parking cash between trades.

Collateral in DeFi and RWAs.

Testing institutional blockchain rails.

Liquidity follows where the stablecoins go.

Plus the chain processing these flows receives fees which inturns increase the revenue and gives optimism for long term investors.

The bigger picture

Tether is still the behemoth with a $174B mkt cap and Circle’s USDC is in second place at $74B. The GENIUS Act has put guardrails around the industry: monthly disclosures, reserve rules, and compliance. Circle was already aligned; Tether is launching a U.S.-compliant spin-off token, USAT.

Ethereum’s victory represents something larger: Institutions are selecting it as the settlement layer for stablecoins. That’s a moat others can’t bridge with low fees. (At least for now)

📊 Market Watch

Aster crashes the Party

New perp DEX, Aster has outpaced Circle has been pulling $16M+ in revenue vs Circle’s $7M baseline . Back-to-back victories placed Aster right behind Tether and light years ahead of competitors like Hyperliquid. With whales in the bank, a private order book and a CZ nod Aster is working to turn “perps war” into real market share.

Solana’s dark pool boom

First Aster, now HumidiFi. The rise of dark pool trading is shaking up Solana’s DeFi scene.

HumidiFi just hit $1.9B in daily volumes and grabbed up to 15% of all Solana on-chain trading, despite not even having a retail front-end. Its closed-pool model shields whale trades from front-running bots, a growing problem on Solana that drained $4M in 10 days.

Ripple x Ondo: When Wall Street Treasuries collide with XRPL

Ripple and Ondo Finance to Tokenize $185M in U.S. Treasuries on the XRP Ledger. Powered by BlackRock’s BUIDL fund, the OUSG token provides institutions with around-the-clock access to short-term government debt that can be minted and redeemed on-chain.

With RWA TVL 32% this year and projections in excess of $16T by 2030, this move is an attempt to establish XRPL as a core hub for institutional tokenization.

👀 Our analyst is talking about this

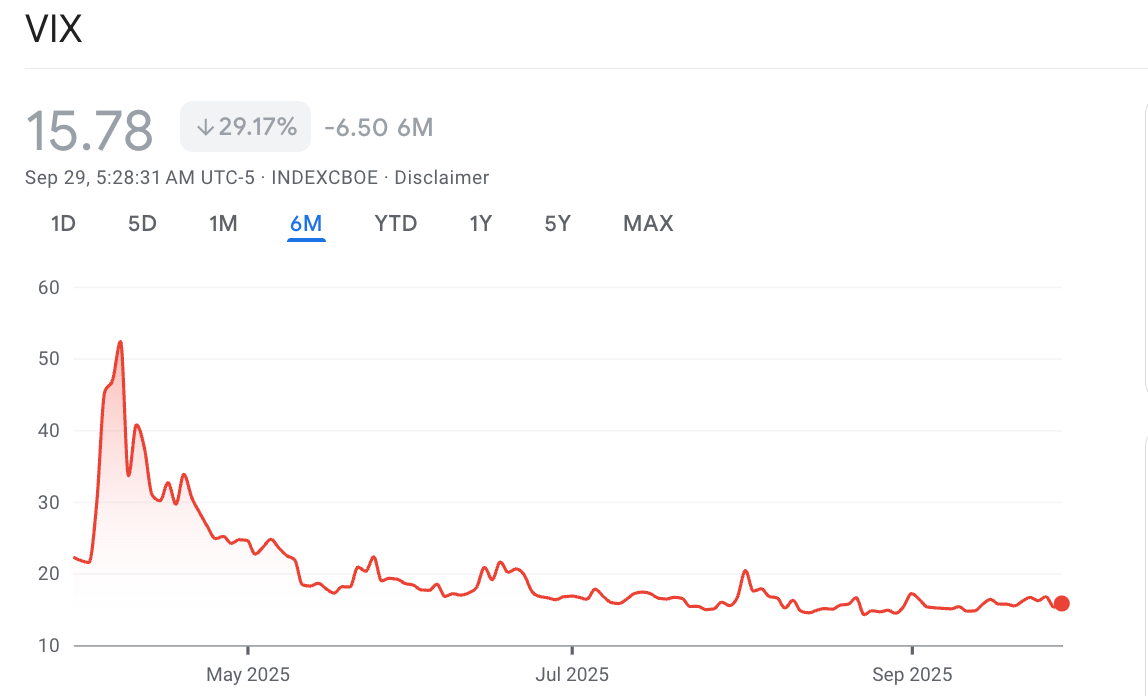

Wall Street is parking funds into VIX products aka the “Fear Gauge” of the Stock Market. They flood into these funds when markets crash… but trickle money out of them when markets are calm.

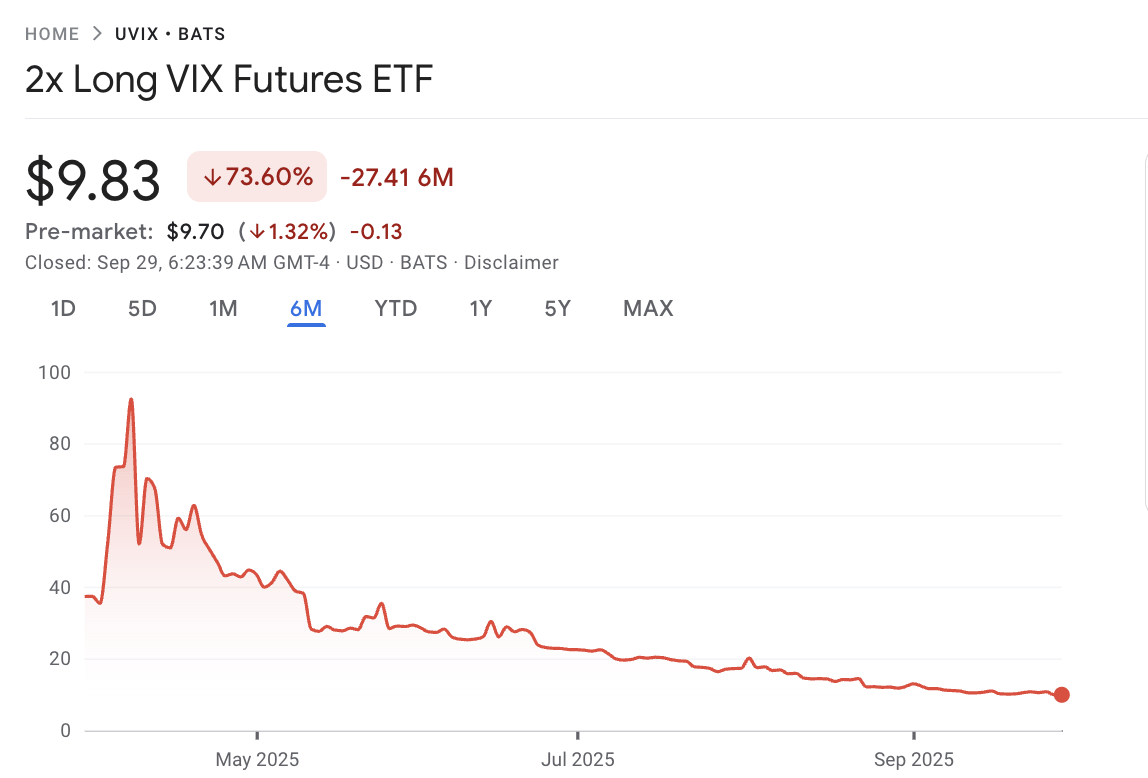

Through 2025, investors have plowed more than $1 billion into VIX funds, even though most are solidly in the red:

Translation: People are still buying insurance, and paying for it which is a sign of nerves after stock prices have hit record highs.

🧠 Quick Explainer: What Is the VIX?

The VIX is Wall Street’s “fear gauge.”

Stocks drop → VIX spikes as a rule of thumb.

If stocks rise → VIX goes down.

Investors deploy it like insurance, they pay when stocks are high and cash out in case of a market crash.

⚠️ Bottom line: $1B says traders don’t believe in this rally sticking.

🐤 Top tweets

Here are Cryptopolitan’s top picks:

Monday headline picks

🎭 Culture Corner

Donald Trump took to Truth Social with an AI-generated cartoon of him firing Federal Reserve Chair Jerome Powell complete with Powell holding a cardboard box.

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook