- Cryptopolitan

- Posts

- Retail vs Institutions: Ethereum’s Tightrope

Retail vs Institutions: Ethereum’s Tightrope

PLUS: ETH flinches, whales buy, Solana flexes 100K TPS, and $411M in token unlocks test the market’s nerves.

Welcome back, friends —

Crypto feels split right now.

Retail is spooked after Ethereum’s pullback, but whales and funds are quietly accumulating.

Solana just hit a record-breaking 100K TPS though real-world stress still lags.

And with $411M in token unlocks landing this week, supply pressure is testing conviction.

Let’s break it down.

🧠 Behind Ethereum’s pullback: Retail panics, institutions position, Vitalik builds

Ethereum touched greatness and blinked.

Just shy of its 2021 all-time high of $4,878, ETH hit the brakes, slipping back to the $4,400 zone. On-chain chatter turned anxious. Retail sold. Socials spun. The market dipped.

But behind the red candles, the story is more layered and more bullish.

As ETH corrected, big money was buying.

Bitmine, one of the largest corporate treasuries in crypto, added over 106,000 ETH to its balance sheet. Another shadowy whale pulled 92,000+ ETH off Kraken. Longling Capital rotated 7,000 ETH out, but still holds a $350M+ position. Meanwhile, a 2015 ICO wallet that once bought ETH for $104 finally moved now worth over $1.4 million.

Even hackers made their move. The Radiant Capital exploiter linked to North Korea offloaded $44 million in ETH, flipping profits into stablecoins. The Infini and THORChain attackers followed a similar playbook.

So, what’s really happening?

ETH isn’t just pulling back, it’s transferring hands. From panic sellers and opportunistic exits to strategic buyers who’ve seen this game before.

We’ve been here.

Back in 2021, when ETH last touched its ATH, it sparked euphoria… then destruction. The LUNA collapse. Celsius. FTX. A crypto civil war. Retail got wrecked. ETH fell under $1,000. But in the background, the Merge happened. Fees dropped. Infrastructure matured. And now, institutions are circling back not because ETH is hot, but because it’s necessary.

That’s the difference. The hype cycle might look similar, but the players and the vision have changed.

Vitalik’s quiet revolution

While traders watch charts, Vitalik is watching systems.

His recent talks have centered on one thing: making Ethereum disappear. Not literally but in the way great tech becomes invisible. Like TCP/IP. Like GPS. Like email protocols. It just works.

He’s pushing for:

Mobile-friendly nodes through EIP-4444 and light clients.

Default privacy via stealth addresses and zero-knowledge proofs.

DApp resilience, where apps survive without founders or servers.

Rollup dominance, modular execution, and protocol neutrality.

It’s not sexy but it’s the kind of infrastructure that attracts serious capital. It’s also why institutions are now treating dips like discounted future infrastructure plays.

Ethereum doesn’t need retail to believe again. It needs time to be undeniable.

TL;DR:

Ethereum pulled back from ATH, but whales and funds are buying heavily.

Retail sentiment flipped, but early believers and hackers are cashing out.

Vitalik isn’t focused on hype he’s quietly turning Ethereum into a backbone of the future web.

This isn’t 2021. It’s quieter, smarter, and way more strategic.

⚙️ Protocol Watch: Solana achieved 100k TPS

Solana just did 107,540 TPS on mainnet

yes, you read that correctly

over 100k TPS, on mainnet

good luck bears

— mert | helius.dev (@0xMert_)

11:46 AM • Aug 17, 2025

Solana Hits 100K+ TPS in stress test — But can it deliver in the real world?

Solana just flexed some serious performance muscle.

In a recent stress test, it hit 107,540 transactions per second (TPS) becoming the first major blockchain to do so on mainnet. That’s not marketing spin. It happened in a live block.

But here’s the catch:

Those transactions weren’t real. They were noop calls “no operation” commands that don’t execute logic but still fill blockspace. Think of it as revving an engine in neutral. Loud, impressive, but not going anywhere.

Why it matters:

The test shows what Solana could handle — up to 80K–100K TPS for actual use cases like oracles, transfers, and more, according to Helius co-founder Mert Mumtaz.

It sets the stage for Firedancer, a Jump Crypto-backed validator client that has hit 1.2M TPS on testnet but is still awaiting mainnet debut.

Solana’s actual TPS right now? About 3,700, mostly from validator vote messages. So yes, there’s a gap between theory and practice.

But that gap may be shrinking...

Enter: Alpenglow

While TPS headlines dominated Twitter, Solana devs quietly pushed forward on a major upgrade proposal: SIMD-0326 (aka “Alpenglow”).

What it is:

A proposal to replace TowerBFT with a faster, lower-latency consensus using Rotor, a new block propagation method.

Could reduce finality lag by up to 150ms, boosting UX in DeFi, gaming, and payments.

Introduces VATs (Validator Admission Tickets) validators pay 1.6 SOL per epoch, which is burned, not redistributed. Designed to maintain economic discipline.

The proposal is currently under validator vote and could shape how Solana evolves in high-frequency use cases.

TL;DR

Solana broke 100K+ TPS using noop calls, impressive, but not real-world volume.

Firedancer is coming, but not live yet.

Alpenglow upgrade may reduce latency, improve throughput, and reshape how consensus works.

Core challenge: Can Solana translate theoretical throughput into stable, usable infrastructure?

Protocol Signal: Solana is inching closer to becoming the go-to chain for high-frequency applications, but the gap between lab benchmarks and production use remains real.

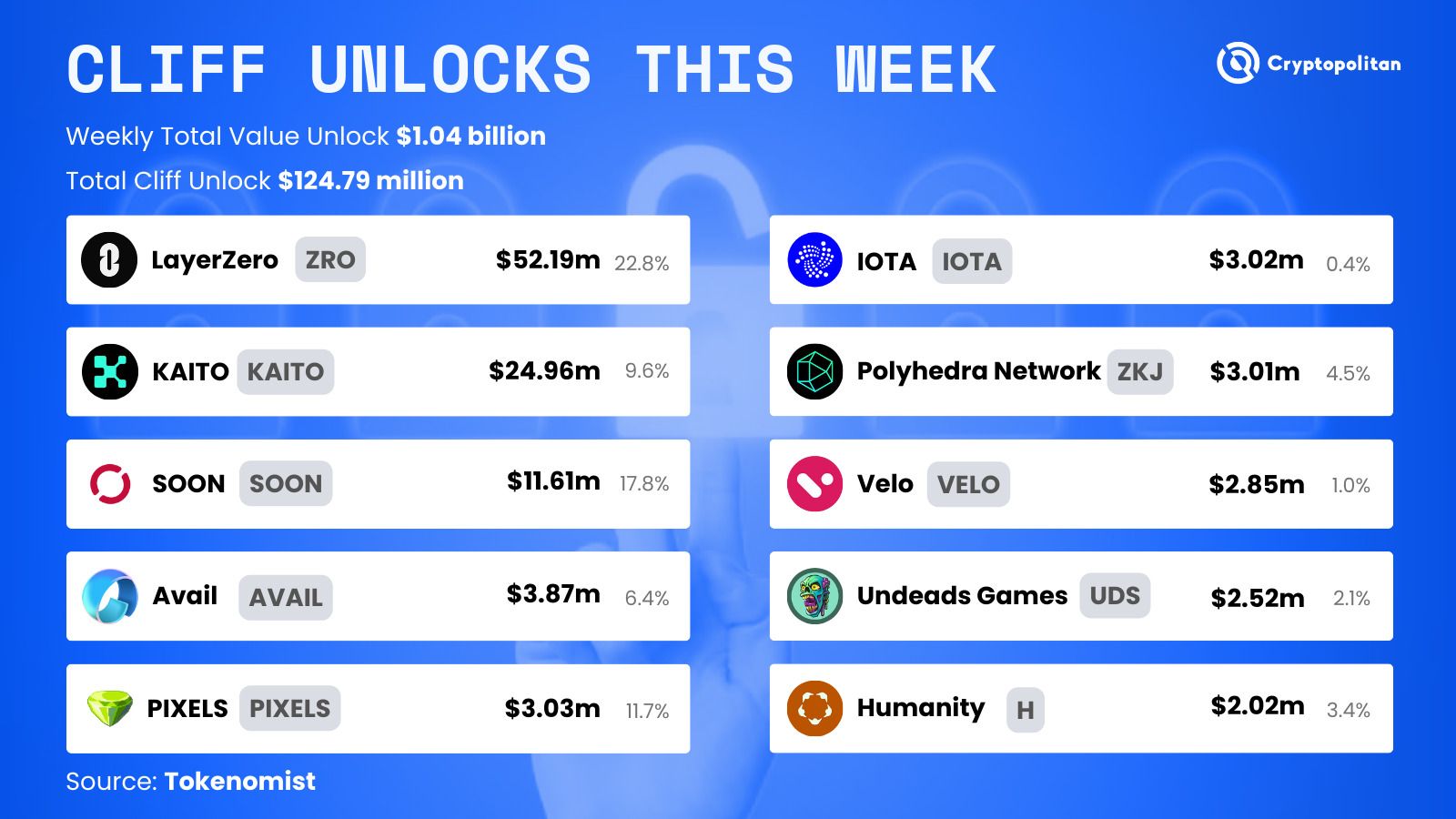

Unlock Season: LayerZero & KAITO lead the $411M supply surge

Every unlock is a story. This week, it's about $411 million in tokens hitting the open market with some big names leading the charge.

But don’t just watch the dollar value. Watch who is unlocking… and why now?

LayerZero (ZRO) is unlocking over $52M, a hefty 9.3% of supply.

→ Early investors? Protocol incentives? Either way, it’s a pressure point.KAITO is following closely, releasing $25M in tokens.

→ The AI narrative meets tokenomics but will it hold up?

These concentrated unlocks aren’t just numbers. They often trigger volatility, reshuffle token ownership, and give early players an exit.

Wait, what are unlocks?

Single unlocks = A lump sum drops at once. Usually team or VC cliffs.

Linear unlocks = Drip-feed daily emissions, often inflationary over time.

Both impact price but in different ways. One’s a shock, the other’s erosion.

Continuous pressure

Outside the headline tokens, major protocols like Solana, Worldcoin, and Dogecoin are releasing millions in linear unlocks this week. Most won’t crash the charts but they quietly reshape supply dynamics.

Top Web3 VCs and narrative-based Investors to follow on X

Here are Cryptopolitan’s top picks:

@cdixon – Thesis king at a16z. Champion of “the next internet” vision for Web3. When he writes, entire sectors get funded.

@ljxie – Focuses on modular infra, chain abstraction, and dev UX. Tweets signal where a16z might deploy capital next.

@santiagoroel – Operator turned angel turned LP. Knows how narrative meets capital. One of the most plugged-in dealmakers in crypto Twitter.

@0xJim – Tokenomics, venture design, and founder-market fit in sharp, no-fluff threads. Was early on restaking and modular plays.

@SpartanBlack_1 – Deep conviction investor at Spartan Group. Tracks Asia narratives and tweets early on big themes like restaking and socialfi.

@iamDCinvestor – ETH maxi with strong views on value accrual and governance. Often breaks down long-term narratives before they go mainstream.

Intern picks : Your Monday boost

Join the Conversation!

We track every big move on our X. You’ll love it. Go follow.

Early Ethereum investor awakens $1.5M wallet after a decade.

$104 turned into 334.7 ETH worth $1.5M,

a 14,269x return since the 2014 ICO.On-chain shows a test transaction before moving the 334.7 $ETH to a new wallet.

— Cryptopolitan (@CPOfficialtx)

1:15 PM • Aug 17, 2025

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook