- Cryptopolitan

- Posts

- 🧠 Not Ethereum vs Solana anymore

🧠 Not Ethereum vs Solana anymore

Stablecoins define use-cases PLUS: AAVE dips, Bitcoin's quantum problem and Uniswap's UNIfication

Where do Crypto’s dollars actually live?

For years, it was framed as the Ethereum vs Solana debate.

But now the data paints a more complex picture: The on-chain dollars have divided duties.

Onchain Foundation’s Leon Waidmann says that Ethereum mainnet processes $90–$100 billion in stablecoin transfers daily. Which makes it very much the global settlement layer of crypto.

October 2025 made it impossible to overlook that dominance. Ethereum handled $2.82 trillion in stablecoin volume: the highest amount ever recorded in a single month. November came in at $1.94T, and December has already surpassed $1.6T.

More than half of that volume is pushed by Tether’s USDT which continues to favor Ethereum when it comes to size, security and finality.

As Waidmann put it:

When serious money moves, it still settles on Ethereum mainnet. Not because it’s the fastest. Because it’s the most trusted.

But while Ethereum dominates settlement, something else is happening in parallel.

The trading layer is shifting

On the other end of the liquidity stack: Solana.

Artemis data shows for three months in a row, the on-chain SOL-USD spot volume was larger than Binance and Bybit combined. That’s not a meme-driven anomaly. You’ve got real time liquidity cycling on-chain.

Solana’s edge is structural:

Ultra-low fees

High throughput

Quicker feedback loops from traders and apps

The stablecoin favored by the protocol is Circle’s USDC, which represents more than 68% of all Solana stablecoin activity. Total supply of stablecoins on Solana now exceeds $15 billion, according to figures provided by the ecosystem: a new record for the network.

As Artemis researcher Kaviish Sethi explained:

Solana is not just a memecoin chain. It is emerging as the liquidity layer of crypto.

🧠 Different chains. Different jobs.

This is when the story changes.

Ethereum is where big, institutional, high-trust dollar ends up settling.

Solana is where the liquidity moves, trades and gets reused at speed.

They are no longer competing for the same job.

And Ethereum and Solana aren’t the only ones. Overall, Tron remains the very leader on high-frequency USDT transfers around the world, particularly in emerging markets. Different rails, different use cases, same underlying trend: The real product is stablecoins.

As regulation firms up in the U.S. and elsewhere, stablecoins are turning blockchains from speculative networks into financial infrastructure.

Waidmann framed it simply:

Stablecoins made blockchains useful. Ethereum made them reliable.

Solana is now proving that trustworthy doesn’t have to mean slow and safe. Sometimes it has to be fast, cheap and always moving.

The takeaway for markets?

This is about liquidity not wanting to pick a single chain. It’s about choosing the right layer for the job.

🧠 Cryptopolitan’s take

When you're choosing a chain to build on, transact through, or even a token to invest in: understanding how it's perceived in global markets is crucial.

Ethereum is the story of trust, security and institutional settlement. The Solana story is speed, usability and trading liquidity.

Both are winning, just in different lanes.

So the more appropriate question isn’t which chain is better, but this one:

“Which future are you betting on?”

If you think the future is all about high-stakes tokenized finance, maybe Ethereum’s the place for you. Solana might be your winner if you buy in to the idea of hyperactive on-chain economies.

Either way, follow the dollars and how they move. That’s where the next opportunity usually shows up first.

POLL: Where would you park your stablecoins? |

📊 Market Watch

💡 Uniswap flips the switch

Uniswap’s UNIfication upgrade is set to go live post 62M votes. It turns on protocol fees, burns 100M UNI from the treasury and addresses LP incentives. UNI surged 25% as market participants priced in real token utility and future cash flows.

🧠 Bitcoin’s quantum problem could be a timing thing

It could be 5–10 years before Bitcoin moves towards quantum-safe security, developers say. It’s a threat that isn’t there now but one that is difficult to coordinate across the network. Markets could begin pricing in risk long before there is any actual quantum leap.

🪙 Pumpfun lawsuit escalates

A U.S. judge approved new class action against Pump exhibited. fun and Solana, based on chat logs from a whistleblower. Plaintiffs claim insiders manipulated token launches through validator infrastructure. The memecoin lawsuit now risks being its own DeFi fairness reckoning.

👀 Chart our analyst is watching

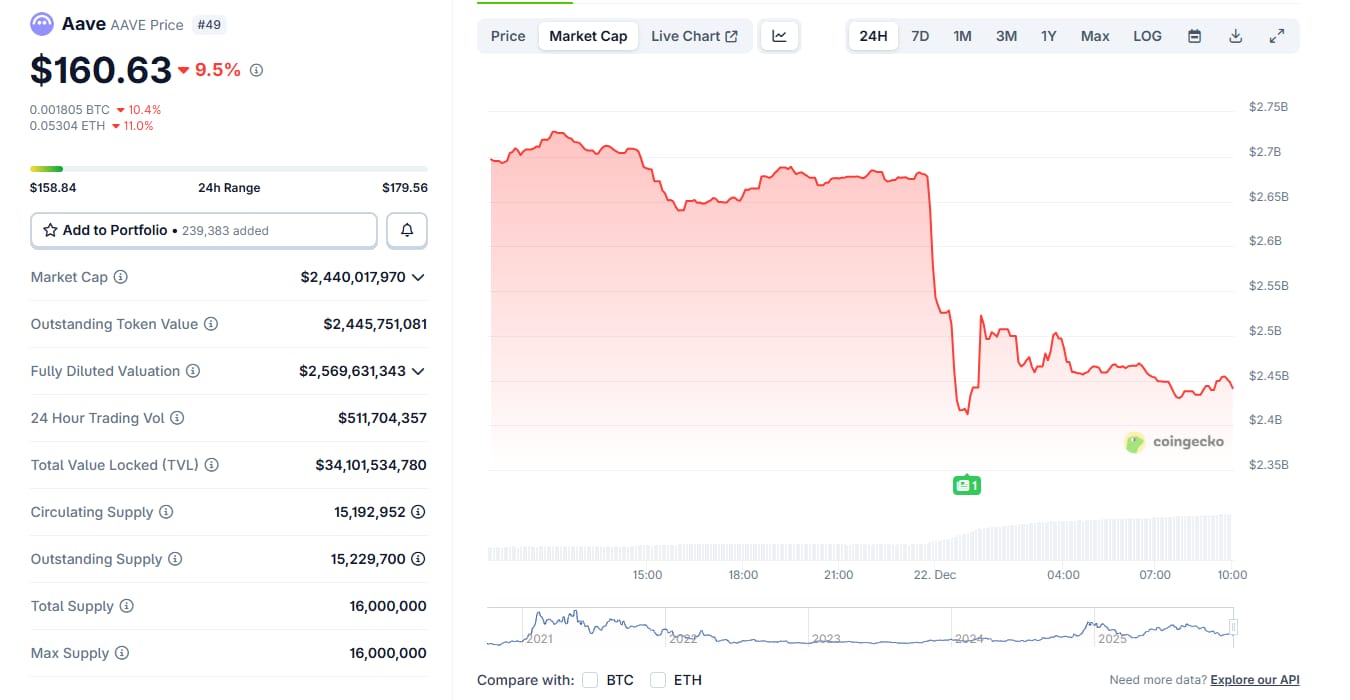

AAVE slumped to $160 after an unexpected DAO proposal led to a community backlash. The proposal: intended to yank brand ownership totally under control of the Aave DAO, was pushed to a snapshot vote without unanimous support, including from its author.

The drop in the token’s value indicates that investors have fears about rushed governance changes especially in a market still dealing with low volumes and end-of-year exhaustion. Aave is still a DeFi behemoth with $33B in TVL and collecting $726M in fees annually, but this price action illustrates that not even the top-tier protocols are immune from bad optics around governance.

🐥 Top tweets

Here are Cryptopolitan’s top picks:

🚀 Calls of the future

Galaxy believes BTC will hit $250K by the end of 2027, though 2026 is “too chaotic to predict.” The options market sees equal chances of either $50K or $250K at year-end. For now, BTC has to reclaim $100K+ to see upside confidence.

Stablecoins > ACH?

Galaxy says stablecoins will process more volume than the U.S. Automated Clearing House (ACH) system by 2026, thanks to explosive growth in payments and GENIUS Act driven regulatory clarity

DEXs on the rise

Decentralized exchanges may stake their claim to 25% of global spot volume by end-2026, against 15-17% currently. Big driver: trader preference for on-chain settlement as well as self-custody.

Which 2026 prediction feels most real to you? |

Headline picks by our Cat

Tweet of the day

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook