- Cryptopolitan

- Posts

- MetaMask wants to be your bank. And your Dollar.

MetaMask wants to be your bank. And your Dollar.

PLUS: ETH ETFs flip the flow • SEC softens on staking • TROLL takes over Pump.fun

Welcome back, friends —

MetaMask is cooking more than swaps. A Stripe-backed stablecoin might just make it the Venmo of crypto.

ETH is flipping BTC in inflows. The SEC dropped a Latin-laced staking plot twist. And Pump.fun is betting big on TROLLs.

Feels like wallets, not protocols, are leading this cycle. Let’s unpack the shift.

Let’s break it down.

🧠 The wallet power play: Metamask eyes the $250B stablecoin market

A new governance proposal suggests that Metamask is preparing to launch its own stablecoin, MetaMask USD (mmUSD), in partnership with Stripe, the fintech juggernaut. The stablecoin will be issued via the “M^0” protocol enabling onchain issuance and seamless settlement and will be natively integrated into the Metamask ecosystem.

This isn’t a branding gimmick. It’s a bid to become the base currency of Web3.

Why this matters:

The move follows Metamask’s Mastercard-powered crypto card launch — a play to blur lines between crypto and real-world payments.

Now, with a stablecoin in the works, Metamask is positioning itself as a self-custody neobank.

Stripe’s role adds TradFi-grade trust to the equation, something DeFi desperately needs for mainstream adoption.

We’re building systems that let users spend crypto directly from their self-custody wallet — without handing control to banks.

Stablecoins are having their moment

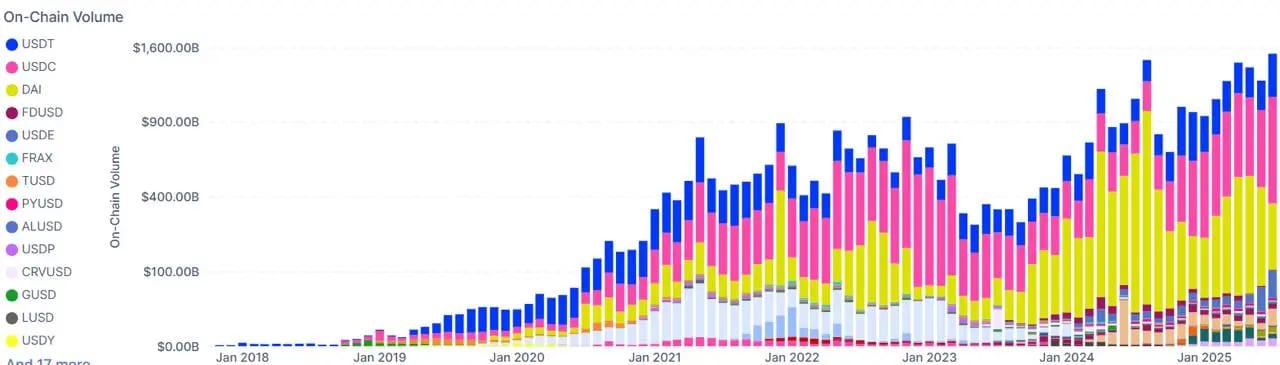

Metamask’s rumored mmUSD launch isn’t happening in a vacuum. July just became the biggest month ever for stablecoins on public blockchains:

$1.5 trillion in stablecoin settlement volume in July

Already $200B+ settled in the first 5 days of August

DeFi TVL hits $179B, a 3-year high

SEC says fully-backed stablecoins can count as cash equivalents (yes, that’s huge)

USDC is leading the charge on-chain, accounting for 40–48% of DeFi stablecoin volume in 2025. USDT, though still #1 by supply ($164.7B), is playing catch-up on actual usage.

Stablecoins monthly on-chain volume

Even Ethena’s USDe, which just became the third-largest stablecoin, is gaining ground fast, adding $4.2B in July alone.

The bigger picture: Wallets = Banks, Stablecoins = Railroads

This isn’t just another “new coin” story.

Metamask is signaling what the next crypto super-apps will look like:

Wallet + Payments + Stablecoin + DeFi access

All under one non-custodial roof

Powered by fintech giants, but still retaining Web3 ideals

Stablecoins are now extending dollar dominance, not replacing it. Even the Fed had to admit it.

If Metamask pulls this off, mmUSD could join the holy trio of on-chain currencies: USDC, USDT, and DAI. But with native wallet distribution, it could do what none of them could: become default money for DeFi users by design.

🧊 Ethereum gains, Bitcoin slips: Are ETFs signaling a sentiment shift?

After riding high on ETF inflows for weeks, Bitcoin is finally hitting a cold front. On August 5, spot Bitcoin ETFs bled nearly $196 million, marking the fourth consecutive day of outflows. Meanwhile, Ethereum ETFs bucked the trend, pulling in $73.2 million in net inflows, led by BlackRock’s ETHA which absorbed nearly $89 million on its own.

It’s not just a number story. It's a sentiment shift.

For the past month, Ethereum has outperformed Bitcoin by a wide margin, rallying over 40% compared to BTC’s modest 4% gain. The ETF flows are starting to reflect this divergence. Institutional investors seem to be rebalancing, shifting capital from the flagship asset into what they perceive as higher upside plays.

The reasons? A mix of macro fears and protocol-specific momentum.

Why is Bitcoin bleeding?

Two words: stagflation concerns. The latest ISM services data showed signs of a slowing economy with sticky inflation: a combo that’s bad news for risk assets. Traders fear that rising tariffs and weakening employment data could choke economic growth without cooling prices, prompting some institutional BTC holders to take profits and reduce exposure.

Outflows from Fidelity’s FBTC topped $100 million, while BlackRock’s IBIT saw another $77 million exit. Even Grayscale’s GBTC posted $19.6 million in redemptions. In just one week, BTC ETFs have shed over $640 million — a sharp reversal from the bullish July flows that helped push Bitcoin past $115K.

Why is Ethereum gaining?

ETH, on the other hand, is riding the wave of renewed DeFi activity, liquid staking demand, and optimism around regulatory clarity. Ethereum ETFs netted $5.43 billion in July, a record month, and August is starting strong. ETH’s deep integration across stablecoins, rollups, and staking protocols has turned it into more than just a digital asset. It’s infrastructure.

While Grayscale’s ETHE did see a small outflow, the broader ETH ETF segment printed green across BlackRock, VanEck, and 21Shares. Ethereum is holding strong at around $3,614, bolstered by strong on-chain momentum and ecosystem-wide confidence.

Beyond the U.S. — Japan joins the ETF game

In a sign of global ETF adoption, Japan’s SBI Holdings just filed for the country’s first crypto-linked ETFs. One fund will hold Bitcoin and XRP, while the second, dubbed the “Digital Gold Crypto ETF” blends gold-backed assets with digital currencies. If approved, these will be Japan’s first public crypto ETFs, potentially setting a regulatory precedent across Asia.

TL;DR: What’s happening with the ETFs

Bitcoin ETFs saw $196M in outflows in a single day, extending a 4-day bleed.

Ethereum ETFs brought in $73.2M, led by BlackRock’s ETHA.

BTC ETF outflows are tied to stagflation fears and profit-taking post-ATH.

ETH is benefitting from DeFi momentum, staking growth, and stronger fundamentals.

Japan’s SBI is pushing for the first Asian crypto ETFs, including BTC, XRP, and a “Digital Gold” blend.

🧠 Signal vs Noise

“Caveat liquid staker.”

Yes, that’s how SEC Commissioner Crenshaw signed off her dissent — in Latin. For real.

🧾 Here’s what just happened:

→ SEC’s Corporation Finance division said liquid staking ≠ securities offering

→ Platforms may not need to register liquid staking products

→ Could be a greenlight for innovation across ETH staking protocols

💬 TL;DR from SEC:

As long as it’s protocol staking, and users keep control, you’re (probably) not breaking securities laws.

So, what’s the catch?

🚨 Not official SEC policy

Crenshaw says this isn’t a Commission-wide position. It’s just the staff’s view.

📜 No legal protection

She warns this guidance is “wobbly,” legally unsupported, and doesn’t protect anyone from enforcement.

🔍 Doesn’t reflect real-world staking

Crenshaw claims the assumptions are too narrow — any deviation, and you might still get sued.

🎯 Signal:

The SEC staff’s note is the most constructive take on liquid staking we’ve seen yet. It opens doors.

🫥 Noise:

Assuming this means “all clear” is risky. Crenshaw’s fierce pushback shows how unstable that doorframe really is.

Top airdrop hunters to follow on X

Here are Cryptopolitan’s top picks:

@its_airdrop – One of the best curated airdrop hunters. Breaks down step-by-step guides, shows historical earnings, and updates eligibility lists in real time.

@defi_mochi – High-signal, low-noise airdrop alpha. Known for spotting new chains and protocols that reward loyalty over hype.

@TokemakXYZ – Tracks TVL and wallet activity with a focus on incentive-heavy protocols. Excellent for spotting new farming trends.

@CC2Ventures – VC account that often drops early-stage protocol farming frameworks and incentive guides for upcoming ecosystems.

Memecoin our finance team is watching:

Pump.fun just gave birth to its latest superstar.

TROLL a meme token that had been quietly building since May exploded this week after being granted CTO status (Community Takeover) by Pump.fun. That label now acts like a badge of honor, boosting visibility, community energy, and price action.

💥 From $0.02 to $0.17.

But this wasn’t just another random pump. It was a coordinated push. Pump.fun featured TROLL on its banner of top memes, gave it revenue-sharing privileges, and highlighted it as a model of sustainable community-led growth. Smart money noticed.

TROLL is now:

The #3 biggest meme in the Pump.fun ecosystem

Listed on KuCoin, with the top trader making $1.3M

Still showing signs of accumulation, not exit liquidity

Meanwhile, Pump.fun is staging its own comeback.

sitting in a coin that the dev abandoned? feel like there’s someone more deserving of the creator fees?

fret no longer - Creator Fees for Community Takeovers is finally here 🔥🔥🔥

how to claim Creator Fees as a CTO 👇

— pump.fun (@pumpdotfun)

7:25 PM • Jul 18, 2025

After falling behind in token creation, it’s burned $23M worth of PUMP, reclaimed its top spot with 15,000+ token launches in a day, and is now betting big on a “CTO-first” strategy to create the next wave of viral, community-owned tokens.

Marketing team picks: Read these to make us happy

Join the Conversation!

We track all the major token unlocks on our X, so that you don’t have to. Go follow us.

Over $2.8B in tokens unlock this August, with $535M this week.

Cliff unlocks, unlocked immediately after a set period, $154M this week:

• $ENA $107M

• $IMX $12M

• $MOVE $6M

• $BB $4M

• $AGI $3MLinear unlocks, slow release over time: $SOL, $WLD, $TRUMP, $DOGE, $TAO

— Cryptopolitan (@CPOfficialtx)

5:16 PM • Aug 4, 2025

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook