- Cryptopolitan

- Posts

- 🔥 It’s official: BlackRock wants staked ETH

🔥 It’s official: BlackRock wants staked ETH

PLUS: ETHB filing lands, ETH sees its biggest Binance inflow in years, XRP ETFs dominate, and Vitalik jumps into the Musk–EU fight.

BlackRock has filed for an staked Ethereum exchange-traded fund, a product that would allow traditional investors to gain exposure to ETH while earning some yield on their position via staking through a regulated vehicle: something no US issuer has been able to offer so far.

The fund, known as the iShares Staked Ethereum Trust (ETHB), was teased in November after BlackRock quietly registered a new entity in Delaware.

That filing became official on Friday, when the company filed its S-1 with the SEC to start a review process. A second 19b-4 filing from Nasdaq is still necessary before the SEC’s approval clock starts.

That simple structure: no leverage, no derivatives

ETHB is purpose built as a simple product making best efforts to track the spot price of Ethereum (adjusted for fees) and receiving staking rewards on ETH deposits from approved validators per this SC according to the filing.

Key details:

No leverage, derivatives, or lending

Coinbase Custody as primary custodian

Anchorage Digital as Substitute Custodian

Shares to trade on Nasdaq under symbol ETHB

Only authorized participants will be able to mint/redeem shares, as is the case with spot Bitcoin and Ethereum ETFs today.

A regulatory climate shift: A golden window

Under the previous SEC regime, staking-related ETF applications were denied.

The agency suggested, for example, that centralized services offering staking, such as those provided by Kraken or Coinbase: might be unregistered securities offerings.

Now with Paul Atkins leading a crypto-friendly SEC, issuers are resubmitting staking proposals at breakneck speed. VanEck etc are changing their Ethereum products; BlackRock decided to launch a new fund instead of adding staking onto ETHA.

ETHA remains distinct and suffered the week’s biggest losses

BlackRock’s current iShares Ethereum Trust (ETHA), which has a ~$11B position of ETH, will run separately from the new staked fund. ETHA also faced basically all of the $75M outflow from US ETH ETFs last week, which came after weeks of steady accumulation.

There was more resilience for Bitcoin ETFs, which had $54.7M in net inflows, mainly from Ark/21Shares and Fidelity.

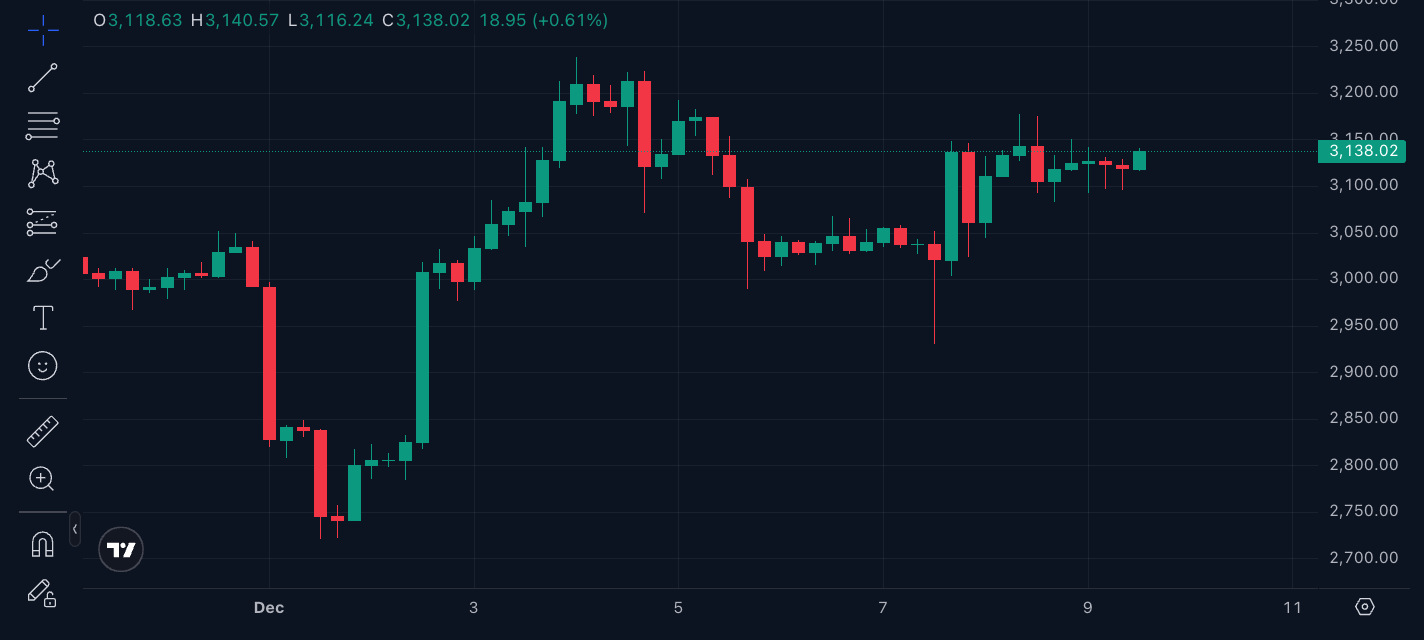

ETH price is up 13% but still trading in a range

Ethereum is up ~13.7% over the last week:

Resistance levels: $3,165–$3,550

Support: $2,745–$2,917

Key breakout level: $3,169

And, if Bitcoin taught us anything in 2025: Liquidity follows BlackRock.

Explain to a friend: How staking-enabled Ethereum ETFs work

The fund purchases and holds actual Ethereum (ETH) in a similar manner to a spot ETF. It then give this ETH to institutional validators (ie Coinbase Custody) who can stake them and earn dividends.

The staked rewards (which is typically a 2.5% –4% yield) do not get paid out as a taxable dividend. Rather, the funds are automatically re-invested in the fund itself, thus growing the incremental amount of ETH held by the ETF over time.

As the value of the underlying companies continues to grow over time, the NAV (Net Asset Value) of the ETF grows silently. That is to say, the traded price of the staked ETF will slowly outperform a non-staked spot ETH ETF by the sum of net yield.

Investors simply buy and sell shares on an exchange, with no technical overhead to worry about of staking (slashing risk, lockups or on chain withdrawal queues). The fund takes care of operational complexity.

Spot ETH ETF vs. Staked ETH ETF (Quick comparison)

Feature | Spot ETH ETF | Staked ETH ETF |

|---|---|---|

What it holds | ETH only | ETH + staking rewards |

Yield | None | Yes, auto-compounds into NAV |

Risk | Pure price risk | Price risk + staking risk (mitigated via institutional validators) |

Tracking | Mirrors ETH price | Outperforms spot over time due to yield |

Best for | Traders, macro exposure | Long-term institutions seeking income |

Complexity | Simple custody | Custody + staking operations |

Liquidity | High | High, small lag possible from staking withdrawals |

Narrative | Digital commodity | Digital commodity + yield product |

Cryptopolitan’s take

Institutions have always loved Ethereum’s yield mechanics.

If accepted, ETHB may usher in an era where yield is the main influencer of ETF flows: not just price exposure. We could even see staked ETH ETFs outpace non-staking ones regarding net inflows.

📊 Market Watch

1️⃣ ETH hits biggest Binance inflow since 2023

Here’s a little throwback to April 2023 because Binance is back again, broadcasting the most amount of ETH net inflows it has seen. Whale deposits are on the rise while exchange reserves are at or near record lows, suggesting either derivatives positioning, liquidity rotation or reserve accumulation.

Open interest returned to $17.6B, 70% long. ETH is sitting between crucial levels ($3,000–$3,169), and traders are awaiting the breakout.

2️⃣ Fake BlackRock ‘ASTER ETF’ filing dupes KOLs

A Photoshopped S-1 for a “BlackRock Staked ASTER ETF” spread across X before CZ confirmed: “Fake.” It’s the second phony ETF rumor that ASTER has had to fend off, following an October fake Grayscale filing.

That rumour temporarily sent ASTER 15% higher. Another reminder for DYOR.

3️⃣ XRP ETFs close in on $1B with zero redemptions

US spot XRP ETFs have seen inflows for the past 15 consecutive days $897M in total, which makes it one of the most most successful altcoin ETF launch.

Analysts anticipate inflows to top $1B by year end. Institutions are buying due to Regulatory clarity + Liquidity even while we saw November outflows on BTC and ETH ETFs.

Ripple’s $500M share sale attracted Citadel, Fortress, Galaxy, and Pantera, but XRP remains 34% off recent highs.

👀 On our feed

A chart that shows 100% hit rate?

Also some top tweets

🎭 Culture Watch

The EU fined X $140M for violating the Digital Services Act: citing misleading blue checks, lack of ad transparency, and blocking researchers from public data.

Musk called the ruling “bullshit,” then doubled down, saying the EU should be dissolved and accusing regulators of targeting U.S. companies.

Then came the criticism from Vitalik Buterin.

📊 Poll — Whose stance do you align with?Which side feels closer to your view on the EU vs. Musk showdown? |

Headline picks by our Cat

Convertible notes scare investors as CoreWeave stock crashes 7% on $2B offering

Zcash publishes a fee plan to ensure traders won’t be priced out

Tim Cook’s slow‑mo AI play with Apple wins praise as investors tire of tech spending spree

Dollar weakness gathers pace as ECB hawkishness and Fed uncertainty collide

Want in on our live sessions and courses?

Cryptopolitan Academy is where we run live sessions like Market Intelligence Live, plus courses and other learning for readers who want to go deeper.

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook