- Cryptopolitan

- Posts

- 🚀 IPO season is the new alt season

🚀 IPO season is the new alt season

Inside: Figure boosts its raise, Gemini bags Nasdaq, SOL whales smell ETF money, and Robinhood tries to turn trading into social media.

📈 Alt season may be delayed, but IPO season is definitely in.

Coinbase walked. Circle and Bullish jogged. Now Figure and Gemini are sprinting straight onto Wall Street.

Figure Technologies just supersized its IPO. The stablecoin and lending firm boosted its price range to $20–22, increased the share count, and is now eyeing a $4.6B valuation. That’s nearly $700M raised when trading kicks off Thursday under FIGR. Not bad for a company that flipped from losses last year to a $29M profit in 2025.

Gemini is lining up right behind. The Winklevoss twins convinced Nasdaq itself to invest $50M in their Friday debut under GEMI. It’s not just a capital raise, it’s a statement: crypto and Wall Street aren’t shaking hands, they’re locking arms.

So why are IPOs suddenly back in style?

Regulatory vibes are warmer. Trump’s pro-crypto stance + the GENIUS Act gave companies a green light they didn’t have a year ago.

Investors are hungry. Circle and Bullish IPOs demonstrated the potential of Crypto IPOs and now we have Wall Street’s attention.

Wall Street wants more skin in the game. Nasdaq buying into Gemini isn’t just about money, it’s about making sure they don’t miss the crypto-infrastructure wave.

👉 Coinbase isn’t the poster child anymore. Crypto IPOs seem to line up, but who is to blame? Everyone now wants a piece of the pie: the company, Wall Street, and even retail. We expect to see more “bullish“ crypto IPOs in this cycle, which is the first of its kind. While the market waits for Alt season, IPO season is definitely here.

📈 Market Watch

Solana just pulled an Ethereum move.

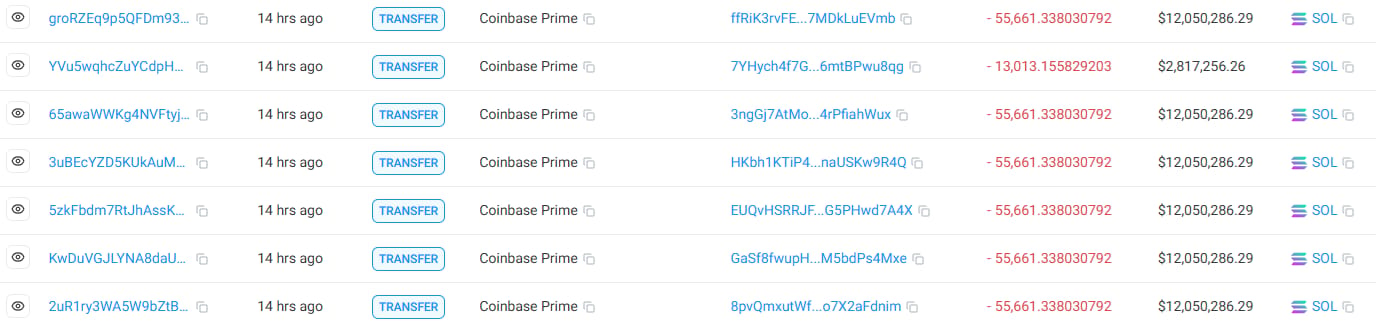

With the SEC’s October 10 deadline for a spot SOL ETF looming (and approval odds sitting at a juicy 95%), whales have started loading the boat. Coinbase Prime wallets have been bleeding SOL into a handful of fresh addresses, likely one giant buyer in accumulation mode. Even Galaxy Digital parked $40M worth of SOL in custody last week.

The timing isn’t random. Ethereum saw the same behavior before its ETF approval. Treasuries and funds want reserves ready to go, and Solana is being lined up as the next institutional play.

Traders felt the wake immediately. SOL ripped above $220 for the first time in seven months, nuking shorts left and right. Depending on whose numbers you trust, anywhere between $7M and $17M in short positions got liquidated in a single day. Open interest is still near all-time highs, and nearly 40% of positions are betting against the rally, which is fuel for more squeezes if SOL keeps pushing.

From here, the chart points to $250+ price discovery in the short term. Long term? SOL believers are whispering about an ETH-like run.

🤯 This blew our mind

Think you missed a memecoin that just went vertical?

Guess again. It was Oracle.

The stock jumped 27% in a single day, adding $100+ in five sessions, after the company reported a ridiculous 359% surge in its cloud backlog to $455B.

And here’s the kicker: they missed on earnings.

Didn’t matter. Investors saw the monster deals piling in and ape’d straight into ORCL.

What happened:

Oracle signed four multi-billion-dollar contracts with three customers in Q1.

Cloud revenue is on fire: $7.2B this quarter (+28%), with forecasts that could take it to $144B in five years.

Multicloud database sales through Amazon, Google, and Microsoft grew 1,529% in Q1.

Coming soon: an “Oracle AI Database” that lets you plug ChatGPT, Gemini, or Grok directly into your existing Oracle data.

The Signal: This isn’t just a tech earnings beat, it’s Wall Street’s version of a parabolic meme chart. Only difference? The fuel here is AI + cloud contracts, not Pepe or Doge.

🐦 Top tweets to check out

Here are Cryptopolitan’s top picks:

Headline picks: Curated by our Intern

🎭 Culture Corner

Robinhood is taking a page out of Reddit and X, but with a twist.

Next year, the brokerage will launch Robinhood Social, a built-in network where every post has to be tied to a real trade. Prices update in real time, gains and losses are transparent, and conversations happen around positions that actually exist.

That means no more doctored screenshots or wild claims. It’s basically a live trading feed where users can track not just retail traders but also public figures like Nancy Pelosi or Bill Ackman through their required disclosures.

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook