- Cryptopolitan

- Posts

- 🌏 From AI to Greenland: How Davos went off the rails

🌏 From AI to Greenland: How Davos went off the rails

Trump steals the spotlight. PLUS: EU trade talks freeze, gold and silver spike on safe-haven flows, markets rally on a last-minute climbdown, and trust erodes further.

Greenland, gold & global drama: Trump at Davos

This year’s Davos summit was supposed to cover AI, global risks, and economic recovery. Instead, it devolved into a geopolitical spectacle featuring Donald Trump, the island of Greenland and a threat to slap tariffs on Denmark that shook Europe and the transatlantic alliance.

The speech that's making rounds

At the World Economic Forum on Jan 21, U.S. President Donald Trump opted not to focus on AI or climate in his time on stage, but dusted off an old obsession: that of obtaining Greenland.

He charged Denmark with being too weak to defend it, and he demanded “immediate negotiations,” referring to the island as “our territory” that was vital to America’s security. Although he said he would not use force, he also cautioned:

You can say yes, and we will appreciate it. Or you can say no and we will remember.’

Trump also:

Mocked NATO as a money sink

Labeled green energy as “loser tech.”

Said he could negotiate peace in Ukraine

Applauded post-coup Venezuela for making deals with the U.S.

EU hit pause

The response was swift. Less than 24 hours later, on January 22, the European Parliament paused the ratification of the $400 billion EU-US trade pact because:

Trump’s new tariffs (10%-25%)) and his territorial pressure over Greenland

Bernd Lange, the EU trade chair, accused Trump of economic blackmail and reneging on an agreement over Turnberry signed last year and suggested there could be retaliation under the Anti-Coercion Instrument (ACI), a potent new trade weapon that has yet to be used but one that would limit American companies’ access to the EU market.

Gold and Silver liked the drama

Gold reached a high for the session at $4,878

Silver edged as close to all-time highs, hitting $95.89

From fire to freeze

By the evening of Jan. 22, Trump was retreating.

In a Truth Social post, he announced to have clinched the “framework of a future deal” on Greenland after talks with NATO chief Mark Rutte

He also had wiped the threat of tariffs as of Feb 1, saying it would be a boon for NATO and US security, and appointed VP JD Vance and Secretary Marco Rubio as principal negotiators.

Stocks rose, the S&P 500 gained 1.2 percent, and the Nasdaq was up 1.3 percent, even though skepticism lingers.

Also, Gold & Silver finally cooled down:

🪙 Cryptopolitan’s take

There have been no specifics about what the Greenland framework looks like. Both Denmark and Greenland have publicly denied any involvement. The bloc’s position is unchanged: If the threats of tariffs are not lifted and if there is still pressure on territorial issues, the trade deal remains frozen.

Greenland was the bait, the EU finally took a stand, markets got spooked and in that end nothing actually happened except rocking gold and silver prices.

Quick Poll 🗳️ What do you think Trump’s Greenland move was really about? |

📩 Reply to this email with your hot take, you might get featured in our next issue.

PS, for Crypto Twitter, this was the highlight of the whole Davos event:

📊 Market Watch

The AI boom is building more than just software

At Davos, Huang went on stage with BlackRock’s Larry Fink and made it clear: AI’s expansion isn’t just code, it is concrete.

Data centers are cropping up all over, and in an odd twist of 21st-century irony, skilled trade workers have become the modern equivalent of the backbone of the boom. PhDs are forgotten, it’s the guys with tool belts who are getting raises.

Meanwhile, junior software jobs? Under threat.

XRP is going full Wall Street

Evernorth, which already owns almost half a billion XRP, just announced that it is raising $1B to create the biggest institutional XRP treasury in the world.

But this is not static holding, It’s DeFi yield strategy with automated AI agents. Lending, liquidity, basis trades, all on autopilot. They’re even preparing for a debut on Nasdaq.

Bottom line: This is what it means to manage a crypto treasury in 2026.

Banks and crypto could come closer

The White House’s crypto czar, David Sacks, believes TradFi and Bitcoin are about to seem like one and the same. Once the CLARITY Act is signed into law, banks are going to be coming at crypto full force, not just partnerships but fully integrated in.

That is, if they can stop bickering over who gets to offer yield first.

Banks are currently attempting to prevent stablecoins from paying interest. Crypto firms are pushing back. Regulation is the battleground, and the endgame may be a single digital asset industry.

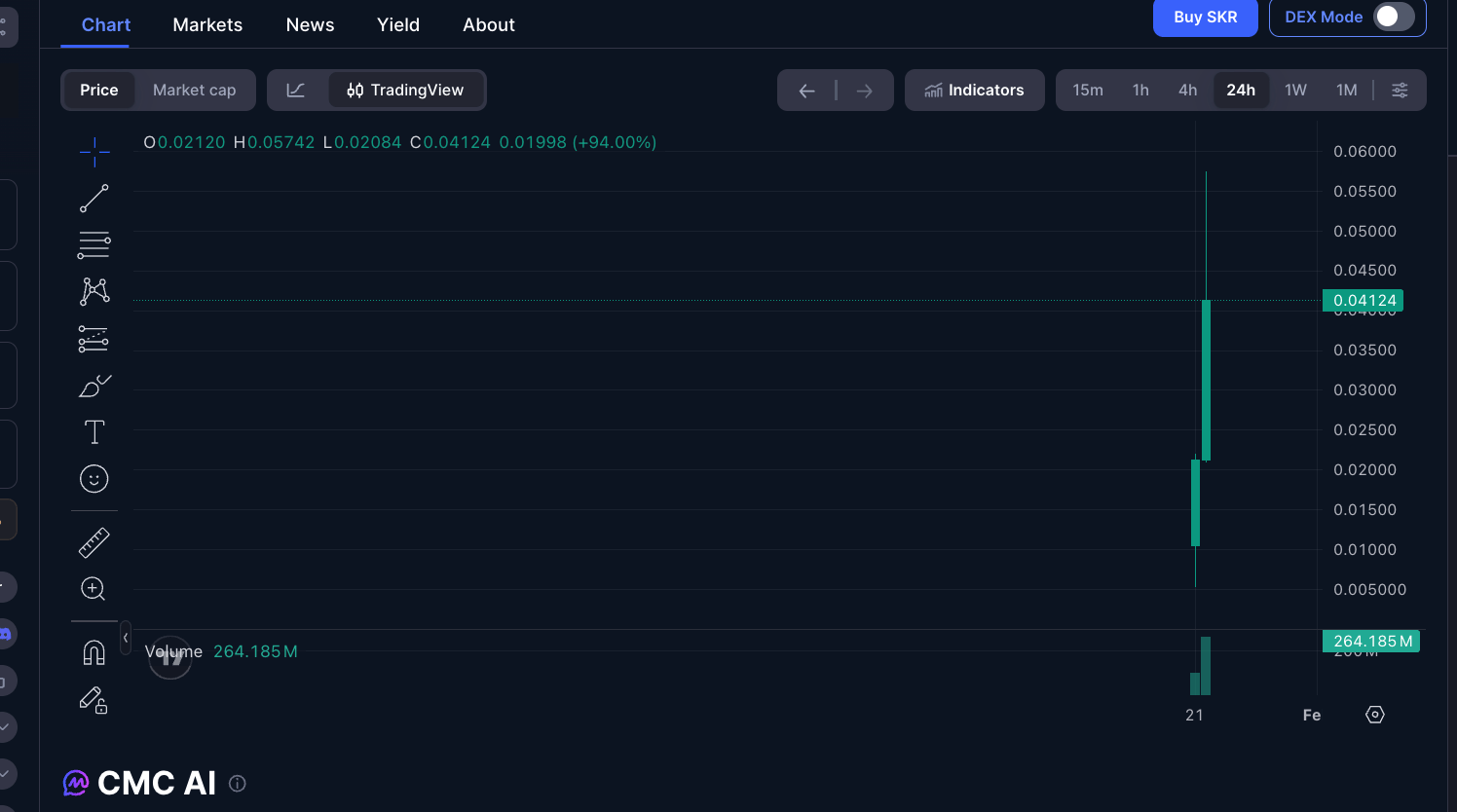

👀 Chart our analyst is watching

While the rest of the crypto market wilted this week, a new kind of token was waxing.

SOL (Solana Mobile token) already more than 5x after its initial launch on Jan 21 with a short peak at $400M FDV and over $230M in 24h volume, and that was on a down day for Bitcoin.

Why the rally?

Massive 2B Token Airdrop to 100K+ seeker phone holders and early devs

A seamless staking experience in App that locked 44% of claim tokens

Real product usage: SKR powers governance, rewards and app discovery on Solana’s crypto-native phone

But be sure to read the fine print:

SKR is still play for price discovery, its extremely volatile and low float risk perception is real. Seeker phone traction and real user retention is the long term value.

🐥 Top tweets

Here are Cryptopolitan’s top picks:

🔐 Protecting your crypto in 2026: What goes, and doesn’t, Work?

If you had sleepless nights over the FTX crash, or last year’s Bybit hack. Well, you’re not alone.

Custody remains crypto’s Achilles heel. And in 2026, it’s not just a matter of “not your keys, not your crypto.’

It’s all about the custody model that accurately reflects how you use you coins.

It doesn’t matter if you’re a HODLER, a trader or a treasury manager for a DAO, your setup will differ.

Cold wallets we huddle to, MPC setups for teams, non-custodial solutions for moving fast – i.e., today's smartest users are not deploying any one tool but layering them as a security stack.

But that is not the kind of ranking this guide does. It’s not a strict science, but it is about getting you the actual options based on what type of problem are you trying to solve:

Pick what works. Mix and match. But don’t sleep on this.

It doesn’t matter what you have in crypto if you can’t access that thing when it matters most.

📌 READ THE FULL GUIDE

Headline picks by our Editor in Chief

Vibe coding on Solana: platforms launch a new type of asset with risk warnings

US crypto market bill hits a delay as Senate shifts focus to Trump’s housing push

Strategy’s preferred equity surpasses the company’s convertible debt

Amazon bulls say AWS cloud momentum could finally reboot stock sentiment

Ripple CEO Brad Garlinghouse predicts 2026 will be crypto’s best performing year ever

Tweet of the day

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook