- Cryptopolitan

- Posts

- 🤨 Everyone’s invited to this rally. Except crypto stocks.

🤨 Everyone’s invited to this rally. Except crypto stocks.

Silver and crypto surge together. PLUS: crypto equities shed $20B, lawmakers yank a market-structure bill, and policy uncertainty punishes infrastructure plays.

Retail is chasing silver. Institutions are chasing crypto. But crypto stocks? They’re getting wrecked.

New rally’s in town, not that everyone is welcome.

In a mere 30 days, retail traders have funneled over $920M into silver ETFs, a record-breaking clip. SLV has now seen net inflows in 169 straight days, and analysts are calling it the most aggressive retail positioning as far back as memory serves.

Silver was even hotter than gold last year, driven by industrial demand, Chinese speculation and fears of new U.S. tariffs on essential minerals.

But when Trump backed off from tariffs on critical minerals Wednesday night, silver corrected 7% and that’s when the real mayhem started.

This, as Bitcoin broke through $97K, Ethereum exploded higher and commodities lit up.

Crypto stocks tanked.

Circle dropped 9.67%.

Robinhood sank 7.78%.

Coinbase fell 6.49%.

Strategy tumbled 4.68%.

More than $20 billion in market cap evaporated, just as crypto was pumping.

So what broke the momentum?

The missing piece: A bill that died before it lived

Everything seemed to favor a bullish week:

ETFs get $1.7B inflows in 3 days

Inflation cooled

Short positions exceeded $700M in liquidations

But then there was the Capitol rug pull.

Lawmakers in both chambers and on both sides of the aisle worked across party lines, but a Senate bill weeks in the making was yanked from floor consideration after Coinbase CEO Brian Armstrong’s public opposition. His warning?

The response was swift:

The Senate pulled the bill. The rally stalled. And crypto equities bled.

🧠 Quick explainer:

Why do crypto stocks plunge when bills go bust?

This is because these companies like Coinbase, Circle, etc. are betting their future on regulatory clarity.

No rules = no stable market = no green light for institutional capital.

So even if BTC the asset continues to run, BTC the infrastructure a.k.a these companies, will languish under uncertainty.

🪙 Cryptopolitan’s take

This moment reveals a deeper market divide.

Because retail needs universes they can grasp: silver as an inflation hedge, AI as the future, BTC as digital gold.

Institutions are increasingly wading into crypto markets, with JPMorgan predicting another record year of inflows.

But crypto equities?

They are Washington captives, battered by both innovation and regulation.

The rally is real. The opportunity is here.

But policy and product have to be in harmony, or crypto companies may fall ever more short of the ecosystem they helped bring into existence.

🗳️ Where’s your money going right now? |

📊 Market Watch

🟢 Jobless claims just blew Wall Street away.

U.S. jobless claims printed 198K, and this isn’t a release we talk much about simply because of its sparseness in scheduled frequency. It’s the most recent signal that the labor market is not cracking, even as months of rate hikes and talk of recession hang over everything.

Fewer layoffs, faster re-hiring and a housing market that’s heating up on tumbling mortgage rates? The old “soft landing” crowd must be feeling like it just suddenly got a shot in the arm.

🟡 The new boss of the CFTC wades into crypto madness.

The man perched atop the CFTC’s chair, Michael Selig, stands astride a complex regulatory minefield: sports bets, prediction markets and token oversight, and ever shrinking staff.

States want in, Congress… is still arguing about whether it wants in. His first big test? What to do with Polymarket and Kalshi as $1 billion a year pours in.

🟣 State Street just got upgraded.

The biggest custodian in TradFi stealth-launched a full-throated digital asset platform. I mean tokenized funds, stablecoins, on-chain wallets and Solana-powered redemptions.

With Galaxy and Chainlink on board this isn’t just another blockchain initiative. This is a real step towards the vision of crypto-native financial, not just money, management.

👀 Are you watching this?

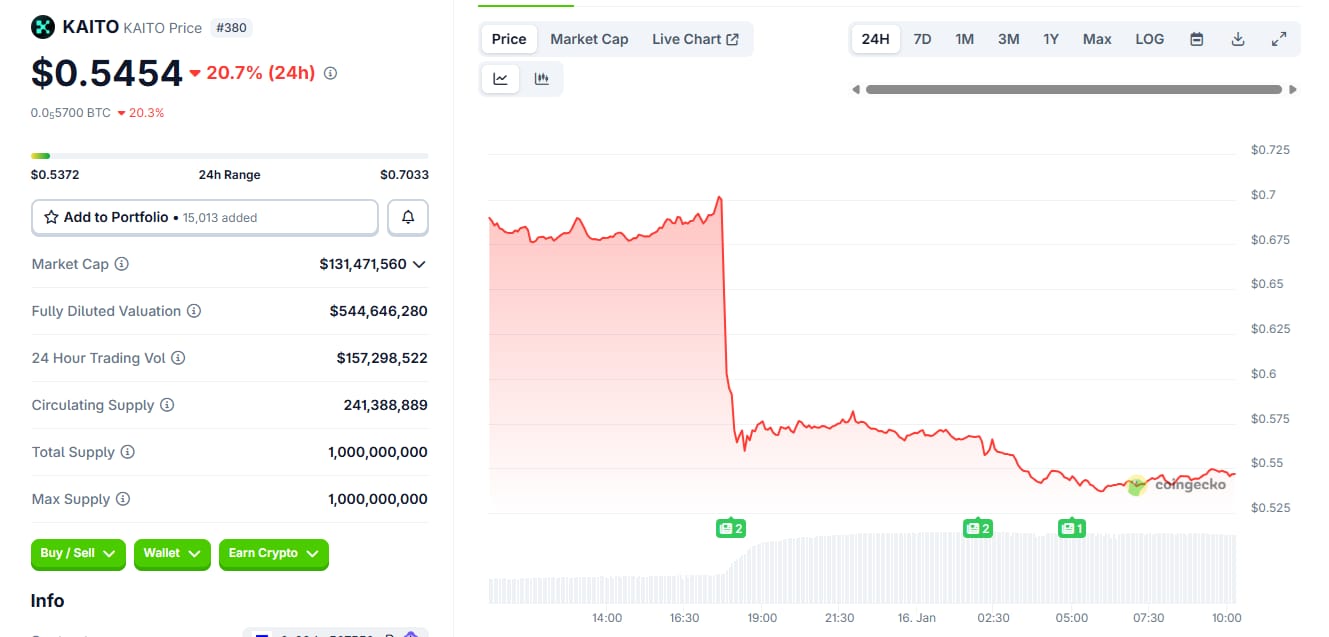

Kaito is shutting down its Yaps product.

Once a leading player in the InfoFi wave, Kaito built influence leaderboards and rewarded users for posting. But after X pulled API access and clamped down on spammy crypto content, the writing was on the wall. KAITO’s token is now flirting with all-time lows, and other InfoFi projects are also reeling.

Kaito says it’s pivoting toward a more curated, cross-platform model focused on “high-quality creators” over open incentives. But the broader takeaway?

The days of gamifying attention with airdrops and point-farming may be fading, and crypto marketing will have to grow up fast.

📌 Got a hot take on InfoFi’s future? Hit reply. We’re listening.

🐥 Top tweets

Here are Cryptopolitan’s top picks:

Meme of the day

Headline picks by our Head of Ops

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook