- Cryptopolitan

- Posts

- 🧱 Ethereum Scales. Ripple Raises. The Plot Thickens.

🧱 Ethereum Scales. Ripple Raises. The Plot Thickens.

ETH L2 breakthroughs to Ripple’s $40B valuation, ZEC’s revival, and banks clashing over crypto charters

Ethereum scales up. Ripple grows out. Crypto’s two giants signaled their future.

It’s a new chapter, and Ethereum’s scaling narrative, Ripple’s institutional pivot and other quiet plays are helping shape the kind of on-chain stories that will define what comes after bitcoin FOMO, one block at a time, one balance sheet at a time.

The Ethereum Layer-2 (L2) space is growing at an unprecedented rate.

The Ethereum Mainnet should be able to handle 10,000 transactions per second (TPS) by 2031 from the current rate of 18.6 TPS according to analytics platform GrowThePie.

It’s a 537× throughput leap, a path spurred by the lightning growth of L2s such as Arbitrum, Optimism, and ZKsync that currently handle six times more transactions than Ethereum’s base layer.

Arbitrum itself locked up $16.3B TVL, processed 3.5M txs and had over >240K active addresses from May to November. Follow by optimism was steady adoption, and upcoming Atlas upgrade on ZKsync will introduce 1-second finality and 15K TPS, which might remove any sort of latency between L2s and the mainnet.

Ethereum’s strength is not its price, it’s the silent but compounding progress today on scaling,

This means the cost per transfer on Ethereum network has fallen from $0.70 on mainnet to $0.003 on L2s, cementing Ethereum’s position as the settlement layer for DeFi, RWAs and tokenized money markets.

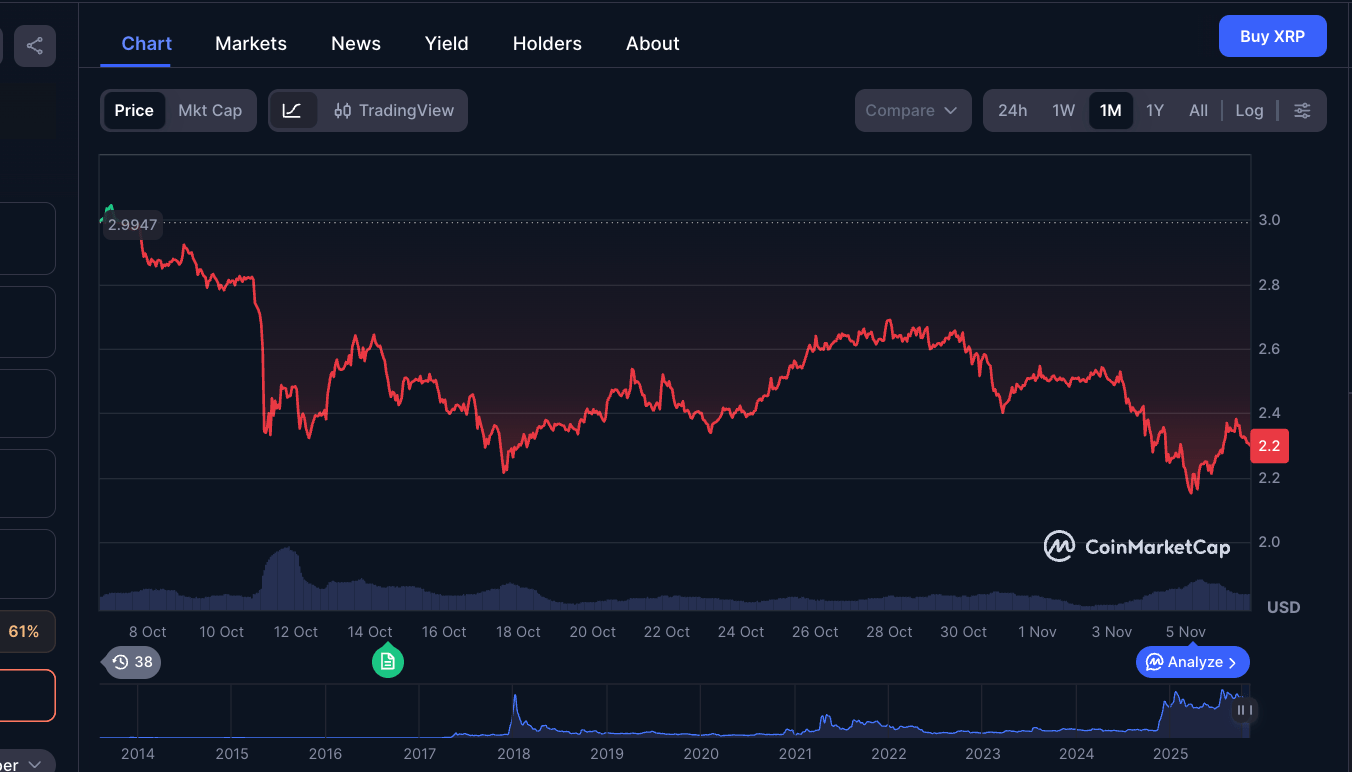

Ripple, meanwhile, just made another jump of its own.

The company raised $500M at a $40B valuation, and was up more than a 3x for its last round.

The raise, which was led by Fortress Investment Group and Citadel Securities, is one of the biggest this cycle for crypto funding deals.

Ripple’s new capital will fuel its expansion into stablecoins, custody, prime brokerage, and treasury solutions, extending its footprint far beyond payments. Its RLUSD stablecoin has already climbed to a $1B+ market cap, now ranked among the top 10 U.S. stablecoins.

It’s also collaborating with Mastercard, WebBank and Gemini to experiment with settlement of credit card transactions in RLUSD, connecting fiat rails to blockchain settlement for the first time at scale.

This investment demonstrates confidence in our business model and the broader market opportunity for blockchain based finance.

🗳️ Poll: Who wins this round? |

📊 Market Watch

1️⃣ Grayscale waives fees for Solana ETF

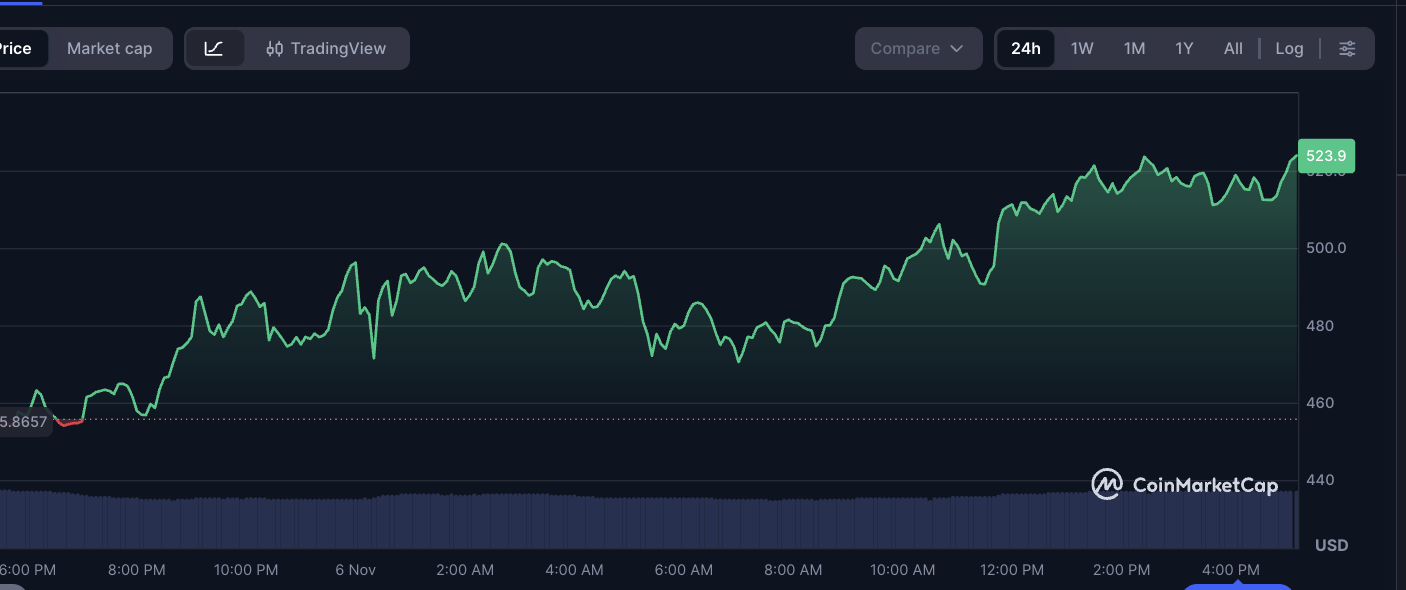

Grayscale just waived management and staking fees for its Solana Trust (GSOL) for as many as three months or until AUM reaches $1 billion. It is staking 100% of SOL holdings at a reward rate of 7.23%.

The shift follows $12B in outflows from GBTC and competition from low-fee adversaries, such as BlackRock and Fidelity.

2️⃣ Prediction markets have a new player

Opinion Labs (rumored to be backed by Binance’s Yzi Labs) just joined the big leagues with a jaw-dropping $748M in weekly volume, trailing only Kalshi ($1.26B) and Polymarket ($1.11B).

→ The recent arrival didn’t open to the public until early November.

→ Messari dubs it a “potentially major” player.

With Kalshi and Polymarket securing NHL licensing deals, prediction markets are going mainstream, and the competition is heating up quickly.

3️⃣ U.S. banks resist crypto charters

Old-school banks are livid at the likes of cryptocurrency companies like Coinbase, Ripple and Circle for seeking national trust charters, which they see as a regulatory backdoor into U.S. finance.

→ Trade groups called on the OCC to block new crypto trust bids.

→ Jonathan Gould, the comptroller says oversight is better inside than outside the system.

Stablecoins like USDC provide Wall Street 3.85% yields, but banks call “deposit flight” and expect the GEINUS Act to make sure no bank can ever offer that again.

🤯 What Just Happened

ZCash: 4× since our first call, still defying gravity

📊 Key Data Points

→ Open Interest: $674M, a record high

→ Funding Rates: Deeply negative as short sellers pay to stay in

→ Tokenized ZEC: Now active on Solana and BNB Chain, held by 16K+ wallets

→ Shielded Supply: 4.96M ZEC stored in anonymous pools

🐤 Top Tweets

Here are Cryptopolitan’s top picks:

Short-Term Holders just sent 45,700 BTC to exchanges at a loss

New York mayor-elect Zohran Mamdani once backed a crypto bill protecting investors.

OpenAI has now signed $816 BILLION worth of AI deals this year alone.

The Fed just injected $29.4B into the banking system via overnight repo, the biggest since 2020.

Headline picks by our Communications Lead

⚡️ Covering live: Elon Musk’s $1 Trillion Tesla payout faces shareholder vote today

Investors are deciding whether to hand Elon Musk a jaw-dropping $1 trillion payday, tied to a moonshot vision of Tesla’s future. He’d earn 425 million shares, but only if he hits some insane goals, like driving Tesla’s market cap to $8.5 trillion and pushing annual EBITDA past $400 billion.

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook