- Cryptopolitan

- Posts

- 🏦 Ethereum just became Wall Street’s favorite blockchain

🏦 Ethereum just became Wall Street’s favorite blockchain

JPMorgan, Bitmine, and ConsenSys are all in — DATs are rising, gold nears $4K, and BNB smashes a new ATH as crypto’s market cap hits $4.35T.

Ethereum is slowly running through the institutional playbook. Once dismissed as “just another blockchain,” it’s garnering investment from the likes of JPMorgan Chase and having its reputation change to Wall Street’s preferred chain: the neutral, programmable foundation for a new era of financial services.

The best analysts are making the call.

Fundstrat’s Co-founder and Chariman of Bitmine, Tom Lee says Ethereum’s architecture “appeals to how Wall Street operates: being agnostic, decentralized and designed for excellence in processing value transfers.”

In the meantime, ConsenSys founder Joseph Lubin expects a 100x ETH surge and says Ethereum is destined to be the “settlement layer for the planet’s global capital market.”

Wall Street’s neutral chain

Bitcoin may be likened to digital gold, but Ethereum is becoming the digital infrastructure.

Speaking at Korea Blockchain Week, Lee observed that the Trump administration’s crypto policy, notably with bills such as the CLARITY Act and GENIUS Act has tilted in Ethereum’s favor already. Those frameworks enable everything from decentralized payments to proof-of-human-identity.

Wall Street will build only on neutral chains, and Ethereum is as neutral as you can get.

That neutrality along with the security, composability and existing DeFi user base of Ethereum positions it as the leading candidate for tokenized assets, corporate treasuries and AI-powered economic agents.

DATs: The next on-chain balance sheets

Now Ether is having its moment and at scale, previously Bitcoin-dominated Digital Asset Treasuries (DATs) are embracing it.

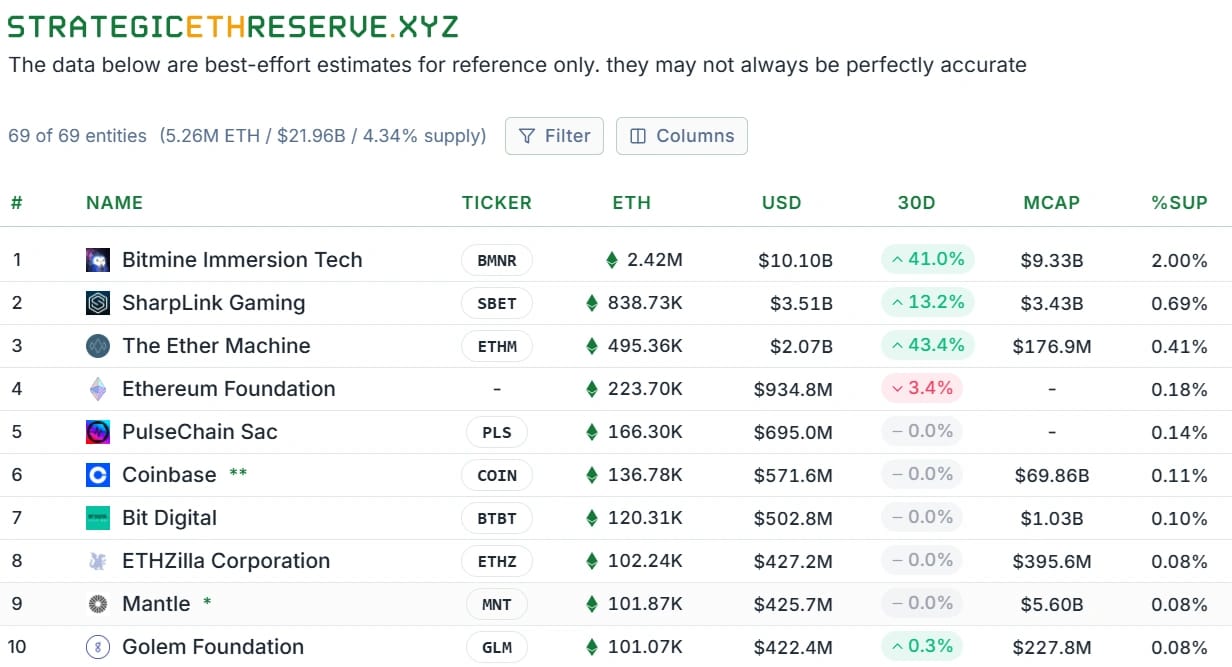

Now, again according to Bitwise research, Ether-denominated treasuries are a structural pillar of crypto’s capital markets. The Strategic ETH Reserve data reports dozens of corporates, DAOs and funds altogether holding billions in ETH, an amount that is growing more quickly than new supply.

🧠 Quick Explainer — What are DATs?

DATs (Digital Asset Treasuries) are blockchain based reserves held by corporations or protocols, think of it like a balance sheet in code. They are used to hold, stake or deploy crypto assets for growth, liquidity management or token backing.

This shift is structural, not cyclical, says analyst Max Shannon. “ETH treasuries are no longer a side story. “Now they’re the base layer for on-chain corporate finance.”

ETH’s real yield from transaction fees and MEV extraction adds another layer, turning Ether into a productive asset rather than just a speculative store of value.

From Speculative to Structural

The trend we are on is to merge traditional finance and decentralized infrastructure with Ethereum as the bridge.

Bitwise believes we’ll soon see a consolidation, where “mega-whale” and “whale” DATs dominate flows, mirroring how sovereign funds and corporate giants hold gold today.

With Wall Street, the White House and corporate balance sheets all driving toward economies based on tokenized assets, Ethereum feels like it could end up as the chain where a generation’s financial system is constructed.

📊 Market Watch

BNB Season Returns

BNB surged past $1,219, marking fresh all-time highs as the “CZ effect” kicks in. Open interest hit a 3-year peak at $1.7B, driven by short squeezes and meme-fueled demand. Binance now commands 59.5% of spot and 56.3% of derivatives volume, while BNB Smart Chain memes like Four (4) and PUP lead October’s retail wave.

ASTER’s Binance listing triggers volatility

ASTER began trading on Binance under a seed tag, opening in USDT, USDC, and TRY pairs. Prices climbed briefly above $2, but fears about inflated volumes on Aster DEX kept pressure on. The team is launching a $300K monthly reward pool and VIP trading levels to rebuild trust and liquidity as it shoots for a recovery back to $4.

Crypto market cap hits $4.35T record

Overall cryptocurrency market cap reached $4.35T, pushed up by BTC spiking to $125K and ETH surging toward $4,500. Together, they now account for 65 percent of the world’s crypto value. ‘Uptober’ momentum gets a booster shot as institutional dominance flows in over $70B in ETF inflows this year. Now analysts eye $160K BTC by year-end as crypto comes of age in mainstream finance

📉 Chart our analyst is watching

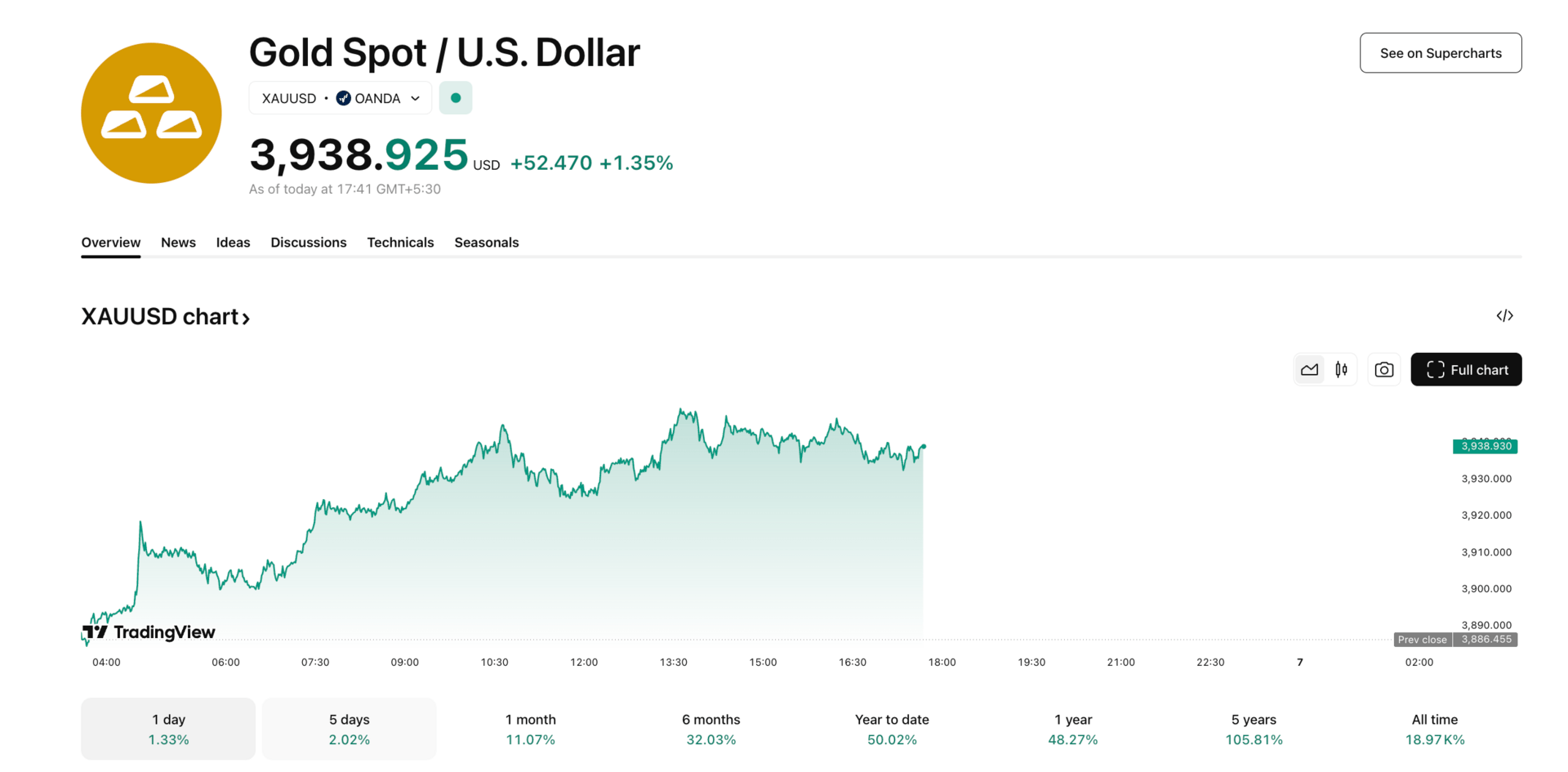

Gold this week nearly cracked $4,000 an ounce, a level never seen in human history.

The rally occurred as traders ran for cover in the U.S. government shutdown, wagering that the next move by the Federal Reserve will be to cut rates, not raise them.

Spot gold touched $3,992, now up ~50% this year on central bank hoarding, ETF inflows, and a weaker dollar, indicators that big money is positioning for long-term angst.

🪙 Quick Explainer:

The price of gold frequently jumps when investors believe in rate cuts, because lower bond yields make non interest-bearing assets like gold more attractive.

🐤 Top Tweets

Here are Cryptopolitan’s top picks:

Monday headline picks

Stop guessing. Start trading smart.

✅ Live trades you can follow in real time

✅ A trading school with battle-tested strategies

✅ Direct support when you need it most

1,000 free seats just opened. Get 30 days of full access, on the house.

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook