- Cryptopolitan

- Posts

- Crypto Lending Is Back. No Collateral. No Banks.

Crypto Lending Is Back. No Collateral. No Banks.

Biometric loans meet DeFi 2.0 — Plus: ETH staking heats up, the Fed vs. BlackRock, and Web3’s shift to modular chains.

🧠 Crypto lending is back — But this time, no collateral

Three years ago, crypto lending nearly killed the market. Celsius. Genesis. BlockFi. Billions lost. Trust shattered. Now, in 2025, it’s back and this time, there’s no collateral and no banks.

Fueled by Trump’s pro-crypto momentum, rising Bitcoin prices, and a hunger for yield, a new wave of crypto lenders is offering microloans, credit lines, and institutional facilities all without collateral. Instead, they’re betting on biometrics, smart contracts, and programmable trust.

At the center of it all: Divine Research, a San Francisco startup that’s already issued over 30,000 microloans (under $1,000) since December. Powered by Worldcoin iris scans and funded by everyday depositors, Divine offers loans with 20–30% interest despite 40% default rates on first-timers.

This is microfinance on steroids. We’re lending to everyone from fruit vendors to teachers — anyone with internet access.

And Divine isn’t alone. Here’s how the new wave of crypto lending stacks up:

🔍 The new players of crypto lending

Platform | Collateral | Trust System | Typical Loan | Status |

|---|---|---|---|---|

Divine | None | Worldcoin iris scan | Microloans < $1K | 30K+ loans issued |

3Jane | None | Bank/crypto proofs | Unsecured USDC lines | Raised $5.2M (Paradigm) |

Wildcat | Partial | On-chain reputation | Institutional/trader credit | $170M+ lent |

Clearpool | Partial | KYC’d institutions | Market maker loans | Active |

TrueFi | Light | Credit scoring & disclosures | Institutional loans | DAO-governed |

This shift isn’t just DeFi 2.0. It’s a Wall Street x AI x biometrics fusion:

Wildcat lets market makers borrow under custom terms, no hard collateral.

3Jane sells bad debt to U.S. collectors and is building AI agents to auto-enforce covenants.

Even Coinbase, with OpenAI’s help, is exploring crypto wallet–linked AI agents to manage lending autonomously.

But here’s the catch:

High rates. No collateral. Default recovery built on “trust” and code. It’s bold. It’s bleeding-edge. And it’s risky.

Celsius’s founder is still in jail. Genesis is paying a $2B settlement. The scars of 2022 haven’t healed but the cycle is turning, and lenders are back with new tech, new rules, and the same old promise: high yield in a low-trust world.

Will it work this time? Only the next default will tell.

A new research report from Cryptopolitan reveals Web3 is shifting toward modular architectures. It is moving away from monolithic blockchains such as Solana and pre-rollup Ethereum.

📈 Market Watch

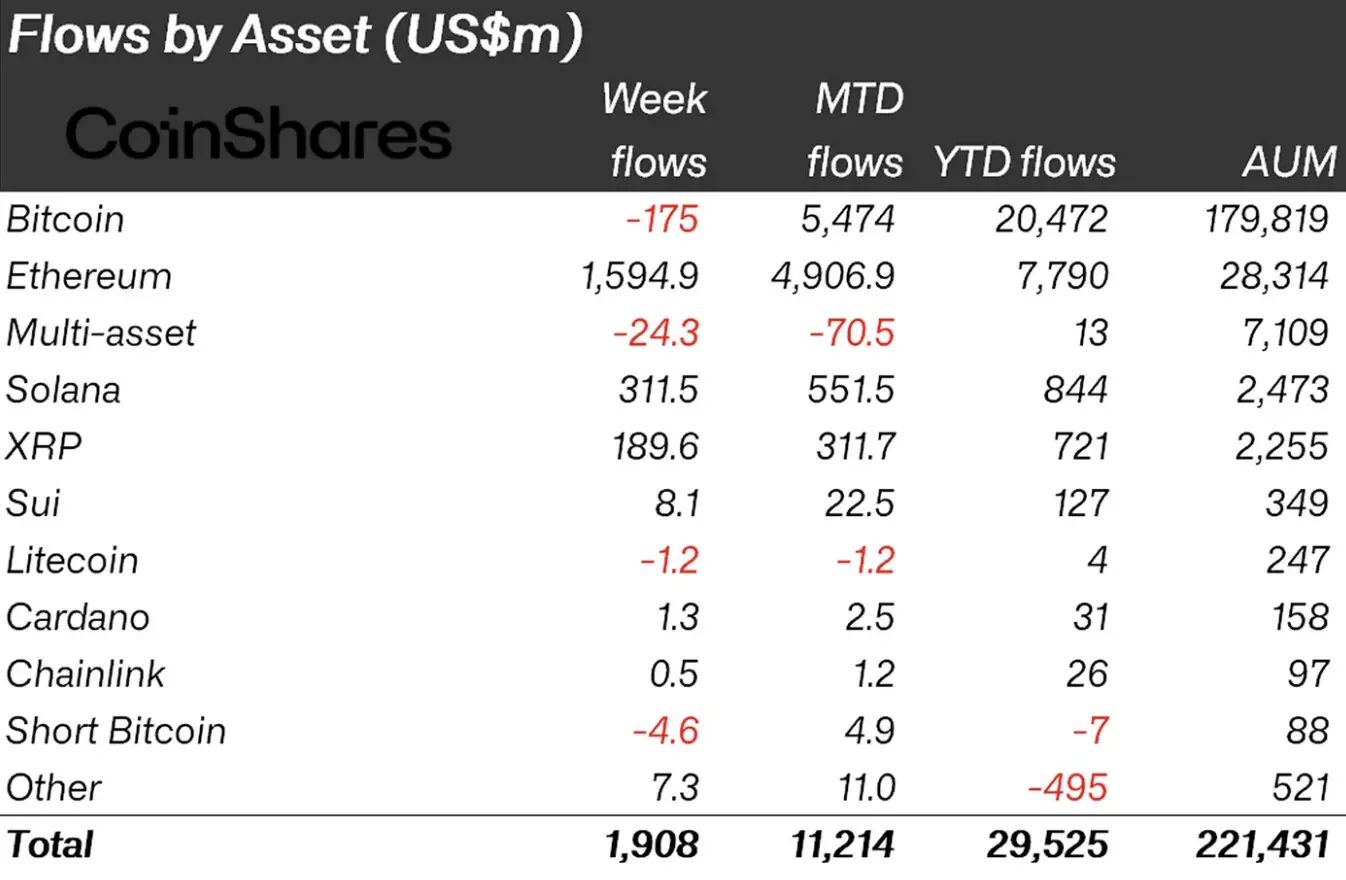

Crypto funds saw $1.9 billion in inflows last week, with Ethereum capturing a record-breaking $1.59 billion, its second-largest weekly haul ever.

But here’s what’s more important: Institutions aren’t just buying ETH. They’re staking it.

Last week, SharpLink Gaming quietly added $147 million worth of ETH to its treasury. That alone would’ve made headlines but hours later, it moved the ETH straight into staking with Figment, one of the largest institutional validators in the space.

The move pushes SharpLink’s on-chain holdings toward 438,000 ETH, rivaling BitMine’s top spot.

Between ETF demand, rising yields, and protocols like Figment offering 2.99% with insurance, Ethereum staking is becoming Wall Street’s latest yield strategy.

A bigger rotation is underway

ETH flows dominated crypto funds last week, while Bitcoin saw minor outflows.

Institutions like BlackRock’s iShares led the charge, pulling in $1.5B+.

At the same time, on-chain treasuries are ballooning with projects and companies now sitting on 2.32 million ETH, valued at over $9 billion.

What’s next?

With ETH trading back near the $3,900 mark, the line between passive holding and active yield generation is blurring fast. More companies are following SharpLink’s playbook: buy ETH, stake it, and sit on scalable returns.

If BTC was the play for treasury reserve and ETF speculation, ETH is now the asset for programmable yield and long-term capital strategies.

And last week’s flows just proved it.

Crypto funds recorded $1.9 billion in weekly inflows according to CoinShares. The flows mark the 15th consecutive week of positive investor sentiment.

⚖️ Regulation Watch

The tension is rising.

On one side: Wall Street giants like BlackRock and political heavyweights like Donald Trump, both calling for urgent interest rate cuts. On the other: The Federal Reserve, unmoved, holding firm at a 5.25–5.50% benchmark for the seventh consecutive meeting.

BlackRock’s warning: the Fed is breaking the wrong part of the economy

In a candid Bloomberg interview, Rick Rieder, BlackRock’s CIO of Global Fixed Income, didn’t mince words:

The real impact of interest rates today is about housing. And it's the lower-income borrowers who are infected by it.

Rieder argued the Fed’s playbook is outdated, designed for a goods-based economy, not the service-heavy, AI-driven, gig-powered one we have now. In his view, today’s elevated rates are:

Crushing affordable housing

Hurting low-income Americans disproportionately

And stalling productivity growth right when the economy needs it most

He believes rates could be safely cut to 3.25% without reigniting inflation — which remains tame, with break-evens around 2.5–2.75%.

If we get rates down, you build more homes, you reduce inflation. That’s how you grow your way out of debt.

He’s not just talking theory: BlackRock is already rotating capital into AI, crypto, and stablecoins, betting they’ll power the next productivity boom.

Meanwhile, Trump is turning up the heat

President Trump recently pressured Fed Chair Jerome Powell directly, demanding rate cuts and calling out the Fed’s “spending problem” even criticizing its office renovations. The optics were unmistakable: political impatience vs institutional restraint.

There’s talk in D.C. circles that Trump may try to replace Powell if reelected, despite Powell’s term running until 2026. Some economists warn that Fed independence could be at stake.

The Fed: Paralyzed by strength?

Despite this pressure, the Fed isn’t budging. Growth is holding up. Unemployment is low. Inflation is slowly improving. So why cut?

Because beneath the surface, fractures are growing:

Homebuyers are locked out of the market

DeFi borrowing is drying up

And tokenized assets, stablecoins, and staking yields are all tied to this rigid rate regime

The crypto crowd is watching because if rates don’t drop soon, capital may start flowing away from risk assets again.

Big picture:

The Fed isn’t broken. But it may be breaking the wrong things and doing too little, too late, to adapt to a transformed economy.

If Powell doesn’t move in September, the pressure will only intensify from both Wall Street and the White House.

📚 Read Also: High demand pushes OKX to launch first global regulated retail crypto derivatives from UAE

OKX, a global crypto exchange and Web3 company announced the launch of regulated retail derivative products with 5X cap, becoming the first global exchange to offer retain futures, perpetual contracts and options within Dubai, UAE.

🔵 Stories you may have missed

SuperRare NFT platform exploited for $730K in RARE tokens: The SuperRare NFT art platform was exploited through a staking smart contract.

Trump Media and Technology Group sets aside $300M for BTC options strategy: Trump Media and Technology Group (TMTG) announced it would allocate $300M to trading options for BTC-related assets.

SUI and Jupiter (JUP) lead $686 million token unlocks this week: SUI and Jupiter lead $686 million token unlocks scheduled for this week. Major cliff unlocks include SUI, JUP, ENA, OP, KMNO, SIGN, GPS, ZETA, and REZ tokens.

SharpLink Gaming pours another $147M in ETH, stakes with Figment: SharpLink Gaming extended its ETH strategy, immediately moving the new purchase into staking. SharpLink opened a new wallet to transfer $147M in ETH.

Trump, von der Leyen announce US has reached trade deal with EU: The White House confirmed Sunday that the United States has finalized a new trade deal with the European Union after direct talks between President Donald Trump and European Commission President Ursula von der Leyen in Washington.

Trump says Thailand and Cambodia ready to make peace with US backing: Thai and Cambodian prime ministers will meet in Malaysia on Monday for peace talks, hosted by Malaysia and supported by the US and China.

Did El Salvador fake Bitcoin buys to scam the IMF?: El Salvador secretly stopped buying Bitcoin in February 2025 after signing a $1.4 billion loan deal with the IMF.

28th July

🕵️ Silk Road mastermind sentenced (July 28, 2015)

On this day, Ross Ulbricht, founder of the infamous darknet marketplace Silk Road, was sentenced to two life terms without parole, marking a pivotal moment in crypto history.

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter: @CPOfficialtx

Telegram Channel: @CryptopolitanOfficial

Beehiiv: https://cryptopolitan.beehiiv.com/

Facebook: https://www.facebook.com/cryptopolitan