- Cryptopolitan

- Posts

- 🌊 CEXs Froze. DeFi Floated.

🌊 CEXs Froze. DeFi Floated.

PLUS: Centralized exchanges faltered, but DeFi protocols thrived as the market’s backbone. While XRP bounced 66%, CME expanded crypto options, and BlackRock’s IBIT stayed green, altcoins continued to bleed. Amid chaos, DeFi quietly proved it’s the most resilient part of crypto’s new market cycle.

When the crypto market experienced $20 billion in liquidations between October 10–11, it wasn’t centralized exchanges that showed resilience, it was DeFi.

The lending, trading and perpetual DEX protocols survived what some analysts are already calling the largest liquidation event post-FTX, only to emerge stronger. Fees exploded, systems held and liquidations were kept in check.

DeFi passes the stress test

Unlike 2022, the foundation of DeFi remained unshaken this go-round. Collateral structures were more conservative, stablecoins were better backed, and liquidatable ETH positions remained minimal: under $1 billion, starting only at $1,548, far below market prices.

Tokenized T-bills, advancements in collateral management, and resilient oracle designs saw DeFi absorb shock that burnt the hands of centralized projects.

Perp DEXs see 50% drawdown recovery

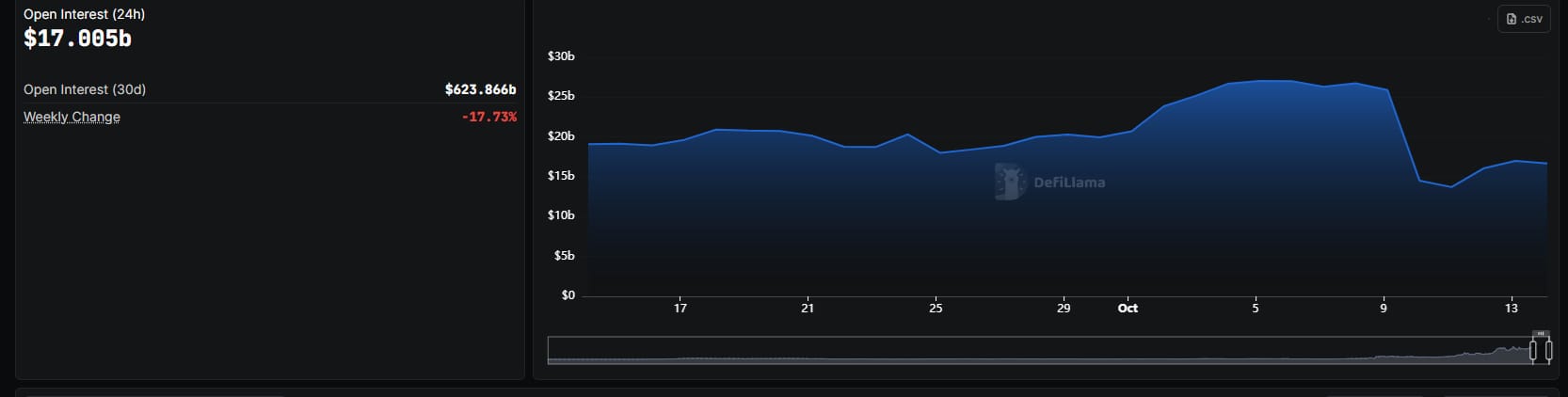

Perpetual DEXs took the early losses, dumping more than 50% of open interest dropping from $25.7B to $13.7B, per DeFiLlama.

Recovery, however, was swift, with open interest bouncing to $17B in a matter of days including Hyperliquid which reclaimed that and more, having $8.2B at their disposal.

Volumes were also at an all-time high, with $264B traded via on-chain derivatives October 6–12 trading volumes highest they’ve ever been. Yet some pain was still there — top perp tokens purged 16%–45% as their over-leveraged retail traders were liquidated.

Fees rise, lending cools

The volatility charged DEX fees through the roof, and Uniswap and PancakeSwap set a record of $177B in spot volumes that week and no downtime, liquidation or contagion.

In lending, however, we saw users retreat: total borrowed value retreated below $50B even as Aave and Lido remained stable with more moderate yields.

Lido’s stETH yield temporarily spiked to 7.05% before settling back, a reaction to the storm of validator rewards during the crisis.

The bigger picture

Instead of amplifying chaos, defi served as a shock absorber, a proof that its infrastructure is at last mature enough to withstand macro stress without collapsing under its own leverage.

While giants like Binance glitched and faced criticism, DeFi stood strong. Can this be a sign? Well, we are still on the outlook for any significant migration of people from CEXs, while the sentiment on X has indeed shifted.

If 2022 was the year DeFi disillusionment arrived, 2025 may well go down in history as the year DeFi proved itself more credible.

📊 Market Watch

1️⃣ XRP recovers 66%

XRP has recovered quickly since Friday’s bottom at $1.58, jumping 66% to about $2.60, regaining its 200-day SMA, and more than the previous day’s market cap of $75 billion plus.

Data from Santiment shows significant capitulation, including $1.5 billion worth of sales last month, followed by a mix of buying which saw daily trading volumes surpassing $10 billion.

2️⃣ CME widens regulated access to crypto

The CME Group has introduced options for Solana and XRP. This is the first such CFTC-regulated contracts to be offered, which already includes BTC and ETH.

Institutional open interest in crypto derivatives now approaches the $4 billion level after last week’s $20 billion liquidation storm, indicating resilient interest.

3️⃣ BlackRock’s IBIT outshines rivals

BlackRock’s iShares Bitcoin Trust (IBIT) reported $60.4 million in inflows Monday — the only big BTC ETF to remain in positive territory – as Fidelity, Bitwise and Ark registered $230 million-plus in outflows.

📉 Chart our analyst is watching

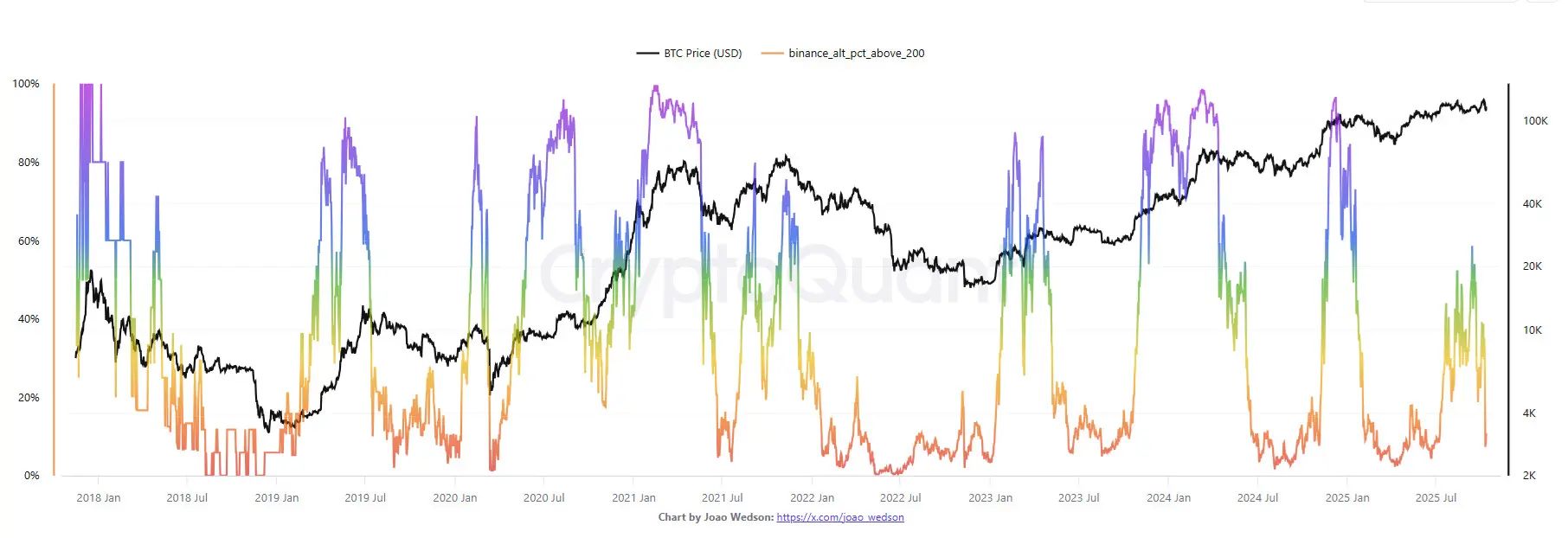

Roughly 90% of altcoins are now trading below their long-term trendline, a level historically linked to late-cycle capitulation phases.

October’s plunge eliminated almost three years of aggregate momentum, sending most altcoins back to bear-market territory. Just 10% of tokens have stayed above their directional baseline.

The Altcoin Season Index has dropped to 36, indicating that the growth period since Q2 is finally over. While ETH ($3,900) and BNB ($1,350) continue to exhibit relative resilience, small cap liquidity has become extremely thin.

Even blue chips - SOL, XRP, ADA are feeling the pinch, as there is still no movement on the 16 ETF applications which continue to stagnate thanks to the U.S. government’s shutdown extension and renewed calls for an October approval.

🐤 Top Tweets

Here are Cryptopolitan’s top picks:

Headline picks by our Social Media Lead

Stop guessing. Start trading smart.

✅ Live trades you can follow in real time

✅ A trading school with battle-tested strategies

✅ Direct support when you need it most

No Credit Card Required. Get 14 days of full access, on the house.

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook