- Cryptopolitan

- Posts

- ⛓️ BlackRock: Tokenization to overtake SWIFT

⛓️ BlackRock: Tokenization to overtake SWIFT

PLUS: FDIC to drop stablecoin rules, AI agents haul $4.6M exploits, Cantor bets $1.28M on Solana ETF, Bitcoin breaks 4-year cycle, OpenAI hits code red vs. Gemini surge.

BlackRock CEO Larry Fink and COO Rob Goldstein have delivered one of the starkest institutional warnings yet for central banks, saying tokenization has the potential to overtake SWIFT and bring about a complete refresh to the “plumbing” that underpins global finance.

As per them financial systems continues to run on slow, expensive infrastructure that’s susceptible to counterparty risk which was largely built decades ago. Tokenization, they argue, fixes that.

Why BlackRock thinks tokenization wins

Three pillars:

Instant settlement

Tokenized assets clear in milliseconds, not days. No counterparty exposure that current SWIFT-era systems can’t solve in full.

Paper → Code

Ownership on digital ledgers eliminates the need for manual reconciliation, couriers and batch processing. “The shift from telephone trades to tokenized rails is the largest since SWIFT was launched in 1977,” they added.

Programmable trust

The assets on blockchain are underpinned by embedded compliance, digital ID verification, and transparent auditability.

But the pair emphasize that the technology would need regulatory guardrails: obvious buyer protections, strong frameworks for reducing counterparty risk and digital-identity security standards on par with today’s banking systems.

Where tokenization comes from & how the public missed the big picture

BlackRock traces the origins of tokenization all the way to Satoshi Nakamoto’s 2009 creation of Bitcoin, which has used “the same original rails as BTC to provide real-world ownership proofs for any asset: treasuries, credit, real estate or private funds.”

But they observe that tokenization was lost in the “crypto boom and noise,” making it difficult for mainstream finance to grasp its broader significance.

Cross-border instant settlements, something SWIFT never even get solved

In contrast, today markets settle on wildly disparate timeframes (T+1 in the U.S., T+2 or more in other regions), which leaves traders open to failure, delay and margin uncertainty.

With tokenization, a global instant-settlement standard may be established that was not achievable within SWIFT’s message-based framework.

As Goldstein put it:

Trades now execute in milliseconds. Settlement needs to catch up.

Regulatory hurdles ahead

BlackRock is being realistic: adoption won’t be linear.

Regulatory bodies need to make a bridge from TradFi to tokenized markets rather than trying from scratch.

Assets should be classified based on their economic risk, not how they are represented. “A bond is a bond, even when it resides on a blockchain,” they said.

But the momentum is obvious: markets are being rewired in real time, and tokenization is powering forward as the next layer of infrastructure for global finance.

The cautionary note

The duo compared today’s moment to the early stock-ticker breakdowns during the 1929 crash, a sign that technology can outpace safeguards.

Tokenization, if not regulated in step, could repeat history.

📌 Quick explainer: What is SWIFT?

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is the global messaging network banks use to send payment instructions to each other.

It does not move money, it only sends messages that tell banks how to settle funds.

How SWIFT works

Your bank sends a SWIFT message to another bank.

The receiving bank updates its internal ledger.

Money actually moves through correspondent banks, which adds delays, fees, and reconciliation work.

Poll: What’s the future of global settlement?Which system do you think will dominate cross-border settlement in the next decade? |

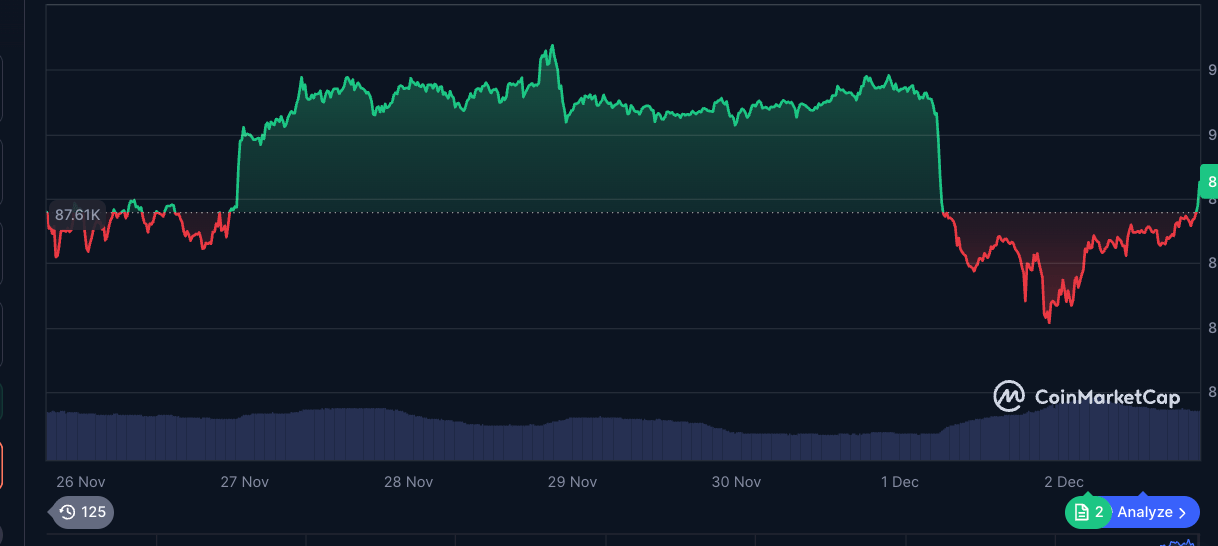

📊 Market Watch

⚖️ FDIC to eliminate first stablecoin rules this month

Before the end of the year, the FDIC will release its initial GENIUS Act rule proposals that detail what kind of licenses stablecoin issuers’ need to obtain, how they must be supervised and how much capital they need to hold.

Chairman Travis Hill said the agency is working on frameworks for applications, capital buffers, liquidity rules and reserve diversification and that more proposals are expected early in 2026.

🤖 Anthropic’s AI agents simulate $4.6M in exploit hauls

Anthropic testbed frontier AI models on 405 real attack-class smart contracts and the agents broke into 207, emulating $550M theft.

In a separate test of 2,849 live BSC contracts, GPT-5 and Sonnet 4.5 revealed new zero-day bugs that siphoned off $3.7K in simulated funds and one of the vulnerabilities was even exploited after some days.

💰 Cantor Fitzgerald reveals Solana ETF position

Cantor Fitzgerald disclosed a $1.28M holding in the Volatility Shares Solana ETF (SOLZ) - its first known investment into a Solana-linked regulated product. File notes that Cantor is cycling aggressively: launched 428 new stock buys in Q3 while cutting loose from 239 positions.

The news comes as Fidelity, Canary, VanEck and Grayscale all debut new Solana ETFs under the SEC’s expedited listing regimen.

👀 Are you watching this?

Grayscale Research predicts Bitcoin will reach new all-time highs in 2026, breaking away from the traditional four-year boom-bust cycle.

🐤 Top Tweets

Here are Cryptopolitan’s top picks:

🤖 AI Watch

OpenAI has well and truly entered “code red” concerning ChatGPT.

In a memo seen by The Wall Street Journal, Sam Altman told staff that specific way the company is pausing other projects in order to free up talent for repairing chatbot.

What triggered the panic

ChatGPT require more personalization, faster response and better reliability

Google’s Gemini is on fire, outperforming OpenAI on benchmarks, and growing 450M → 650M users in three months

Anthropic is winning enterprise clients

Investors need clarity as OpenAI spends massive capital on future data centres

📊 Poll: Who’s winning the AI race right now? |

Headline picks by our cat

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook