- Cryptopolitan

- Posts

- 😬 Bitcoin’s Back Under $100K

😬 Bitcoin’s Back Under $100K

PLUS: The Fed jitters hit hard: traders panic-sell, ETH whales exit, gold shines, XRP ETFs boom, and tokenized stocks hit $10B.

SACHI is a free-to-play, immersive gaming universe that combines next-gen gameplay with real social connection and rewarding experiences. Step into living worlds where players compete, create, and connect - shaping a new era of entertainment built around community, play, and real rewards.

On Friday, Bitcoin sank to its lowest level since March after dropping more than 6% to $95,910 as traders rapidly unravelled their bets on a December Fed interest rate cut. The action wiped billions off of crypto markets in minutes and sent a wave of fear through high-beta assets.

The total crypto market lost 7.4% to reach $3.26T, and even as Bitcoin’s market cap tumbled to $1.94T, trading volumes shot up by a robust 50%, printing $111B, a classic panic-sell signature.

Ethereum, touched $3,220 after a 9 percent decline, on the other hand is another story once you look at what’s happening on-chain. According to on-chain data source Glassnode, selling by those holding between three-to-ten years gained momentum recently, finding holders dumping more than 45,000 ETH daily, a level that has in the past been associated with local tops.

Options markets agree. The 25-delta skew, a gauge of the downside hedging demand, increased quite reasonably mirroring the stress seen during prior local bottoms. Fear is once again present in the order books.

The fire gets some fuel from global markets

The drop in crypto prices coincided with a broad risk asset sell off globally:

Europe started uncertain, pulled down by AI bubble nerves and cooling rate cut hopes.

FTSE futures: –0.5%

CAC 40: –0.4%

SMI: –0.8%

DAX: +0.2% (the lone standout)

For its part, UBS told clients not to get caught up in the mess now and instead look out toward “Europe’s next era” that kicks off in 2026, with the bank pushing its long-term wins via the “GOTCHA” stock basket — ASML, Santander, Solaria.

Asia was hit even harder.

SoftBank crumbled 8%, for the third day in a row, since it revealed it had fully sold out of its $5.8B stake in Nvidia.

Japan’s Nikkei was down 1.85%, Korea’s Kospi 2.29% and Hong Kong’s Hang Seng 0.88%.

There was nowhere to run if you were a chipmaker: TSMC, SK Hynix, Samsung, Tencent and JD were all squashed, all posting steep losses.

Dollar wobbles, Gold glows

Gold traded just below $4,183/oz, a 4.6% gain on the week, as traders rethink the path of central banking now that U.S. data is coming back on and the government shutdown is ending.

Bank of America has a warning: FX volatility set to spike as new U.S. data drops after weeks of shutdown

The Bloomberg Dollar Spot Index has already fallen in six of the past seven sessions.

Bottom Line

Risk appetite is fast disappearing throughout the world’s markets. Rate-cut hopes are fading. Crypto is recoiling. And the first real test of mood comes next week, when U.S. economic data makes its long-awaited return.

For the moment, Bitcoin is trading south of $100K as ETH holders panic sell and traders ponder if this is a mere shakeout, or the beginning of a more profound reset.

POLL: Has Bitcoin’s drop below $100K created a buying opportunity? |

📊 Market Watch

1️⃣ XRP’s debut spot ETF crushes expectations

The launch of XRPC was just went parabolic: in 30 minutes $26M volume, almost double the $17M projection.

Futures positioning from whales began even before the ETF was public, suggesting that insiders were already filling up. Day one closed at $58M, the biggest ETF launch of 2025, outpacing BSOL.

2️⃣ TEL jumps 109% after gaining U.S. digital bank charter

TEL gained over 100% intraday when Nebraska based the U.S. digital asset bank of Telcoin.

Trading volume surged 2,700%, and TEL took down key technical levels before cooling off a bit. The bank is going to issue its own USD backed stablecoin eUSD, 100% backed by the Treasuries.

3️⃣ Grayscale files for IPO, discloses $318.7M Loss, 20% drop in revenue

Challenging year on Grayscale’s SEC IPO filing: revenue dropped to $318M and net losses reached $689 million.

GBTC is continuing to bleed outflows: more than $24B since 2024 and pushing Grayscale toward newer, cheaper ETFs.

The IPO (ticker: GRAY) would arrive as Trump-era crypto momentum returns, however Grayscale comes with particular heavy baggage to public markets.

👀 Are You Watching?

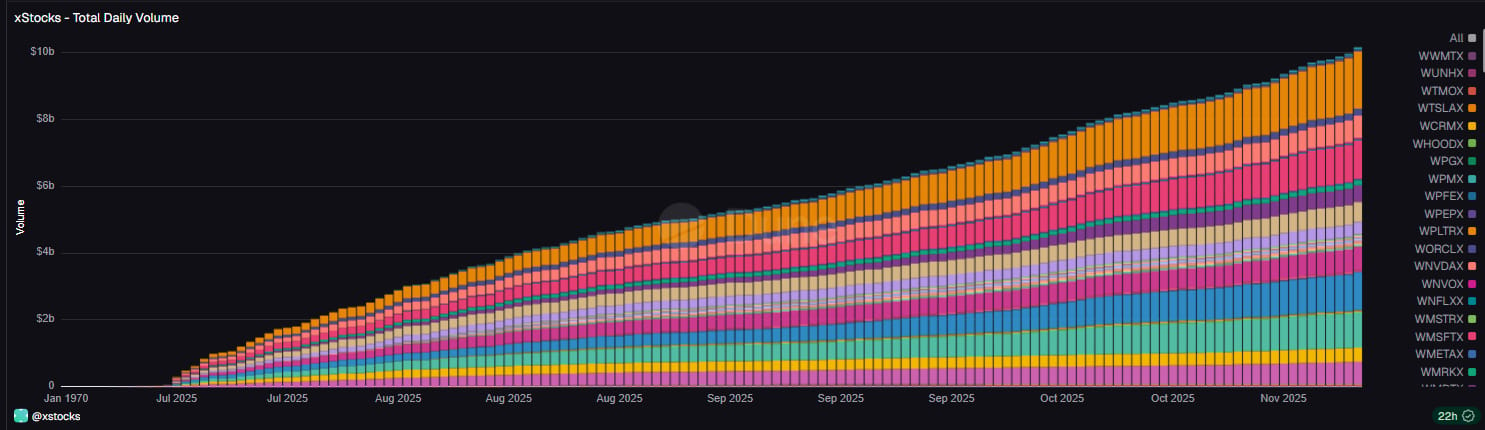

XStocks, the new unified standard for tokenized equities, has exploded in activity, fueled by inflows from Kraken and Hyperliquid. Daily volumes just broke above $10B, while DEX activity, though smaller is accelerating from a $341M base.

But the real story?

Solana now mints over 90% of all tokenized equities and handles 77% of transfer activity, making it the unexpected home of RWAs.

🐤 Top Tweets

Here are Cryptopolitan’s top picks:

Headline picks by our Cat

🎭 Check out our Intern’s art

What do you think?(Our intern would love some feedback) |

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook