- Cryptopolitan

- Posts

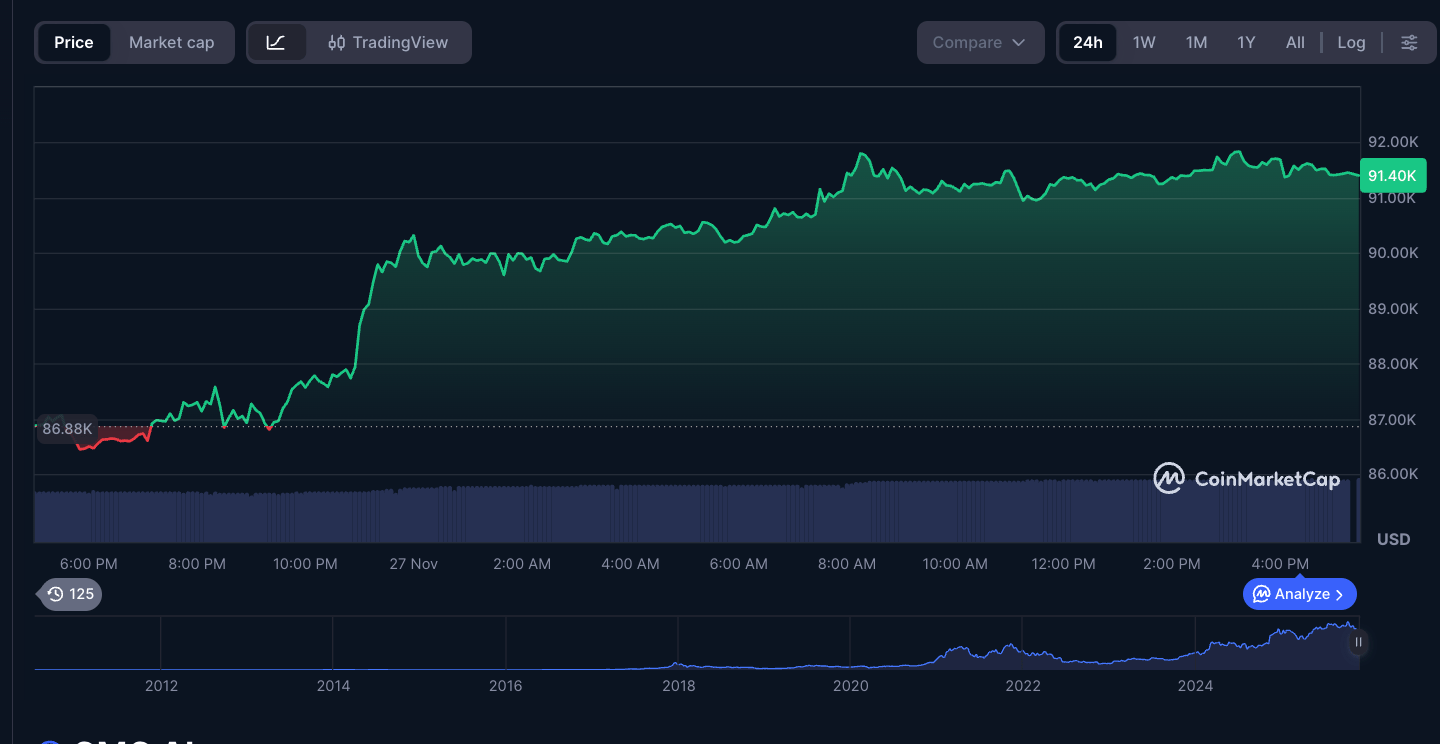

- 🚀 Bitcoin is Back Above $90K

🚀 Bitcoin is Back Above $90K

PLUS: A V-shaped rebound to $91.8K, stablecoin signals flash green, Trump tokens buy the dip, Binance targets the ultra-rich, and Tether exits Uruguay as markets reset.

Bitcoin has recovered to $91,800, a massive u-turn that set Crypto Twitter on fire as traders celebrated living what some described as “Trump’s doom week”.

After days of fear-driven liquidations, ETF outflows and macro angst spurred on by Trump’s tariff noise Bitcoin produced a V-shaped recovery – catching short sellers offside, sending sentiment spinning once again.

It wasn’t just price movement that bottomed out. It was attitude.

Memes flooded, traders returned and the “this market is dead” chatter subsided as BTC wiped away a portion of its drawdown. Funding rates reset, derivatives positioning came off the boil and spot accumulation quietly resumed, evidence that the selloff may have been exhaustion rather than crash.

But analysts caution that the bounce is not a clear BULLISH signal yet.

ETF flows are still mixed

BTC supply on exchange rose

And Trump’s tariff rhetoric keeps injecting macro volatility into crypto hours

In that case however, BTC reclaiming the $90K handle has restored something we needed back to the market: Confidence.

If Bitcoin can maintain that level throughout the week, traders say, the next key levels are

→ $93.5K (short-term resistance)

→ $96K (trend reversal zone)

→ $100K (psychological magnet)

But for now, the community is celebrating survival.

Did Bitcoin just form a bottom — or is this a dead-cat bounce? |

📊 Market Watch

1️⃣ Bitcoin & USDT: The sign of liquidity everyone’s watching

Glassnode’s latest two-year research indicates a firm negative correlation between the price of BTC and USDT exchange flows, suggesting that BTC pumps when USDT leaves exchanges, not when it enters.

USDT outflow at $126K BTC peak reached $220M/day

Profit-taking and stablecoin off-ramps were present at each local top

Funds have pushed $3.55B out of ETFs this month

Now BTC has regained $90,970 and Fear & Greed starts rising again (15 → 18). The signal: Stablecoin flows are emerging as one of crypto’s most reliable macro signals.

2️⃣ WLFI buys its own dip — hard

Trump-linked WLFI spent $7.79M in five hours buying back 46.5M tokens as price slid nearly 50% below launch.

Token rose 13% on the buyback

There’s still over $7.5B in Treasury wallets

But 30 percent of treasury liquidity could be drained if the buybacks continue analysts warn.

Short-term boost? Yes.

Long-term sustainability? Big question mark.

3️⃣ Binance goes after the ultra-wealthy

Binance announced the launch of Binance Prestige, a high-touch service aimed at family offices and wealthy TradFi allocators.

No fixed minimum, but focused on $10M+ AUM clients

Focus: on-boarding, custody, structured products , fiat access

Demand is growing: institutional trades on Binance rose 32% QoQ

With 241,700 crypto millionaires worldwide, Binance is evidently positioning itself for the next surge of wealth to flow into the market.

👀 Are You Watching This?

Tether has closed its mining operations in Uruguay and laid off 30 of its 38 employees, telling the country’s energy company and government that the project was unsustainable because of costs and tariffs for electricity.

The firm plotted a sprawling $500M build-out: data centres, a 300MW renewable energy park and substantial grid improvements. Only $100M of that was ever raised before the economics collapsed.

Local regulators said escalating power-toll fees and the terms of contracts had rendered operations unviable.

The gist: Even giants like tether walk out when economics and policies are not favourable.

🐤 Top Tweets

Here are Cryptopolitan’s top picks:

📡 Just for You: Live Market Breakdown

Introducing Cryptopolitan Market Signals. Live.

We’re kicking off something new: real trading insight, explained simply and clearly, by someone who actually understands the market beyond hype.

🎙 Haris Khan (@hariskhantrader)

A trader who reads structure, not headlines. Logic, not noise.

🗓 Thu, 27 Nov | 16:00 UTC

🔗 YouTube Live: http://youtube.com/live/VuhEsDFCqks

Expect:

The signals that matter. The setups worth watching. The traps to avoid.

No jargon. No theatrics. Just real, usable market logic.

Be there. Your future self will thank you.

Headline picks by our Communications Lead

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook