- Cryptopolitan

- Posts

- 🧠 Bitcoin capitulates as the market loses its nerve

🧠 Bitcoin capitulates as the market loses its nerve

PLUS: Whales distribute, ETFs fail to stop the bleed, Glassnode flashes capitulation, Novogratz and Burry clash on the bottom, stablecoin inflows spike, and Saylor doubles down as sentiment breaks.

Something snapped this week.

Bitcoin dropped below $62,000, its lowest since Q3 2024 as Glassnode’s Capitulation Metric hit the second highest in this cycle, confirming what so many feared: forced selling has come back with fury, and it isn’t only retail.

Whales are distributing. Small holders are dumping. More than 30,000 sub-1BTC wallets now have spent all of their coins in the last 24 hours.

Even “smart money” shark wallets (100–1,000 BTC) reduced holdings, and this time around, ETF flows are no longer enough to stem the bleeding.

📉 Quick Read: What is Capitulation?

In markets, capitulation refers to a last wave of panic selling in which investors give in to fear and sell off their assets at a loss, convinced that prices will collapse further. It’s typically driven by liquidations, emotional panic and a loss of hope. In crypto, capitulation has previously occurred before market bottoms, but not necessarily right away.

This capitulation event is larger than the one we had during the October 10 deleveraging

Novogratz: “Something went wrong”

Mike Novogratz, the head of Galaxy Digital, says he thinks we’re near a bottom, and even he sounded uncertain.

“Bitcoin wasn’t supposed to do this,” he said to Bloomberg, pointing to BTC dropping as gold and the Nasdaq hit new local highs while rates descended. “Something went wrong.”

He observes the market’s leverage has largely been flushed, and is of the opinion that BTC will find support between $70K–$100K.

Only God knows when BTC will touch these level because Bitcoin is already trading below, in fact far below such region ($62K) if compared to it’s ATH where we had almost 42% draw down from up to bottom of previous ATH of around $126 K back in October.

Burry: “No bottom in sight”

While Novogratz searches for help, Michael Burry has a more sinister view.

“Bitcoin is in a death spiral,” he wrote this week, suggesting that crypto miners are about to go bankrupt and that forced selling could trigger a liquidation chain reaction, including gold and silver holdings as companies try to raise cash.

He thinks that Bitcoin’s digital gold story has gone to crap and that no amount of organic demand will be enough to stop it from falling. In Burry’s eyes, BTC is pure speculation that has now been stripped from its narrative.

Deaton: “The math isn’t mathing”

Fanning the flames further was US Senate candidate and XRP proponent John Deaton, who blamed Wall Street for this crash.

In a viral X post, he alleged the banking system is running its same silver suppression game on Bitcoin, shorting paper futures to keep the price under control while simultaneously suppressing pro-crypto regulation behind closed doors.

Who’s selling?

The capitulation is widespread:

Whales this month have dumped more than 43,000+ BTC

100K+ BTC sold in January by sharks

There was a torrent of outflows from Retail wallets <1BTC in 24hrs

Even ETF buyers aren’t stemming the slide

Shark wallets are still the biggest holders, but they aren’t piling up aggressively anymore. And yet, what we see in the numbers is a slow bleed, not a sudden panic, one that takes momentum away over weeks.

So… bottom or breakdown?

122 days since the $126K top, and most on–chain cohorts are in net distribution now. Analysts are watching $50K as the next solid support, with very much worse case scenarios back at $30K if another liquidation cascade is triggered.

Capitulation isn’t just about price. It’s about sentiment. And at this certain moment, the market does seem broken. The ETF honeymoon is over. The macro tailwinds aren’t helping. The hodlers are blinking.

But here’s the thing: capitulation is a necessary condition of bottoms. It never feels rational. It just feels bad.

📊 Poll: Which voice do you trust right now? |

📊 Market Watch

📉 Bitcoin chart chatter, per Wall Street

Bitcoin is down $13,000 in 6 days, trading near $63K. Traders aren’t looking up, they’re looking down.

So what does the history of cycles tell us about bear markets, and how far do they tend to drop? If this one plays out, BTC may end up back around $35K.

For some $150,000 is still in the horizon.

It’s the $60K line in the sand now, and it’s breaking.

💸 BlackRock’s ETF hits $10B day, then drops 13%

IBIT just posted its biggest single-day volume… and its second-worst loss.

Since October, the ETF has halved: from $70 to $36. Strategy posted a $12.4B Q4 loss. Retail is underwater. ETF inflows are drying up.

Peter Brandt: “Sustained selling, limited support. The pain’s not over.”

🔐 Saylor launches Bitcoin quantum defense squad

Strategy will lead a global effort to address quantum threats to BTC.

Saylor: “Quantum computing won’t break Bitcoin , it’ll harden it.”

Still, Chaincode Labs says up to 50% of BTC could be vulnerable. The arms race has begun. Consensus will decide how and when Bitcoin upgrades.

🐥 Top tweets

Here are Cryptopolitan’s top picks:

👀 Are you watching

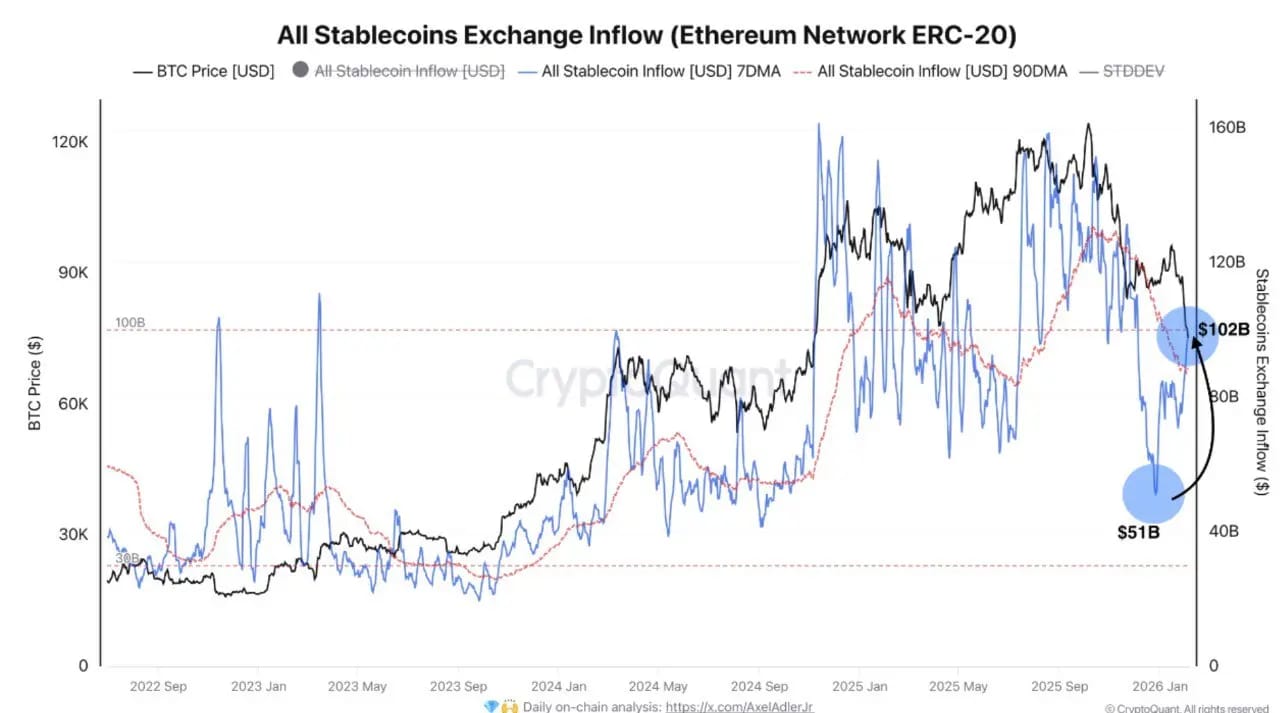

Stablecoin inflows into exchanges have surged by more than 100% amid the prevailing crypto market sell-off.

🎭 Culture Watch

Michael Saylor says if everyone “knew what I knew,” Bitcoin would hit $10 million tomorrow. But not everyone’s buying it, literally or figuratively.

Saylor’s pitch? Volatility is a gift. Crashes shake off “tourists,” and low prices are stacking opportunities. But critics called him delusional, mocking the $10M claim as cult logic.

One viral post read:

“If everyone believed what I believe about my bags, I’d be worth $10 trillion.”

🗳️ Poll: Saylor’s latest take is… |

Friday headline picks

🔥 Trending

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook