- Cryptopolitan

- Posts

- 💥 $3B USD1 meets its first stress test

💥 $3B USD1 meets its first stress test

PLUS: Trust wallet hack.

USD1 smashes $3B, but can it take the heat?

Trump’s preferred stablecoin just cleared a huge hurdle and smacked headfirst into a big brick wall on the same day.

The politically-focused stablecoin USD1 that was created when Trump returned to the White House has now seen its circulation rise past $3B.

The vision has caught on fast. USD1 has had the following effects since launching in April:

Hit $1B in under a month

Collaborated with Coinbase, FalconX, Bonk & Raydium

Pushed into the Solana universe

Replaced BUSD collateral on Binance via a 1:1 swap

Provided a 20% APR yield on Binance Earn

Brokered the $2B deal between MGX and Binance

WLFI co-founder Donald Trump Jr. has described it as a “stablecoin for retail users.” But it is also clearly a token with institutional brawn and political baggage.

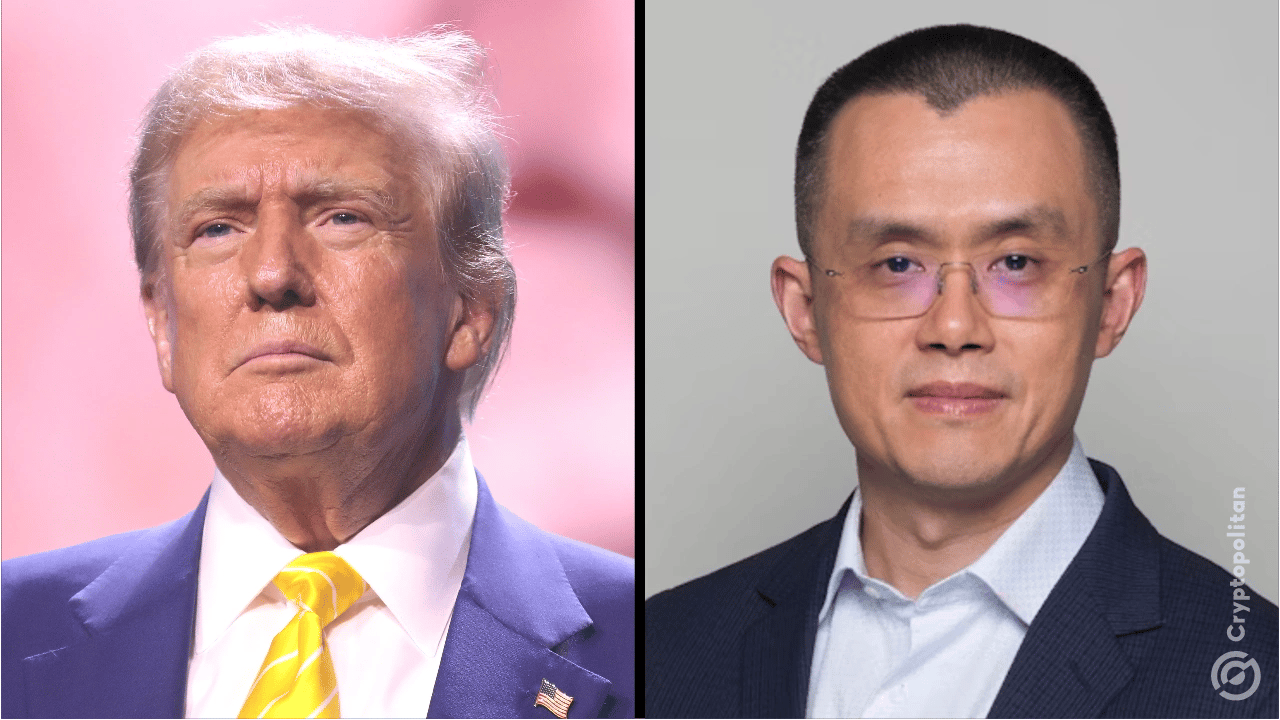

The Trump-CZ connection

Just months ago, Trump pardoned Binance CEO CZ only weeks after a huge investment deal with USD1. The move also set off alarm bells in Washington, and Senator Elizabeth Warren was already invoking it in her battle against the GENIUS Act.

WLFI denies any impropriety. Binance U.S. described its listing of USD1 as “purely business.” And yet the token’s quick rise and its connections are drawing scrutiny.

And the celebration is spoiled by a “Flash Crash”

That scrutiny was compounded this morning after the BTC/USD1 trading pair flash crashed to $24,000 on Binance then bounced back above $87,000 within seconds.

No other BTC pairs were affected.

Binance said the decline was a result of low liquidity and weak order book depth: a complaint often heard when it comes to newer pairs. But it was also a stark reminder: Size alone does not ensure stability.

USD1 might be growing rapidly, but its market structure is fragile.

Quick explainer: What’s a Flash Crash?

A flash crash occurs when there are not enough buy or sell orders at the current price in a trading pair. If one large trade lands on an empty part of the order book, prices can plummet in an instant, only to recover just as quickly after new orders are placed.

This type of volatility is typical in newer and less liquid markets, and it has resulted in sudden losses for uninitiated traders. In order to prevent these shocks, deep liquidity and strong market depth are essential.

🧠 Cryptopolitan’s take

USD1 is doing something must be rare: it’s taking cultural appeal, exchange support and political power and combining it all in one asset.

But the flash crash that took place today has served as a wake-up call. In some sense, stablecoins can “scale” in supply before they “scale” (grow) in trust & utility. And especially when they are backed by headlines, not history.

The question for the investor isn’t “If will USD1 grow?”

It’s “Will USD1 hold when it counts?”

And that's a question less of volume, and more about depth.

POLL: Would you hold USD1 in your portfolio? |

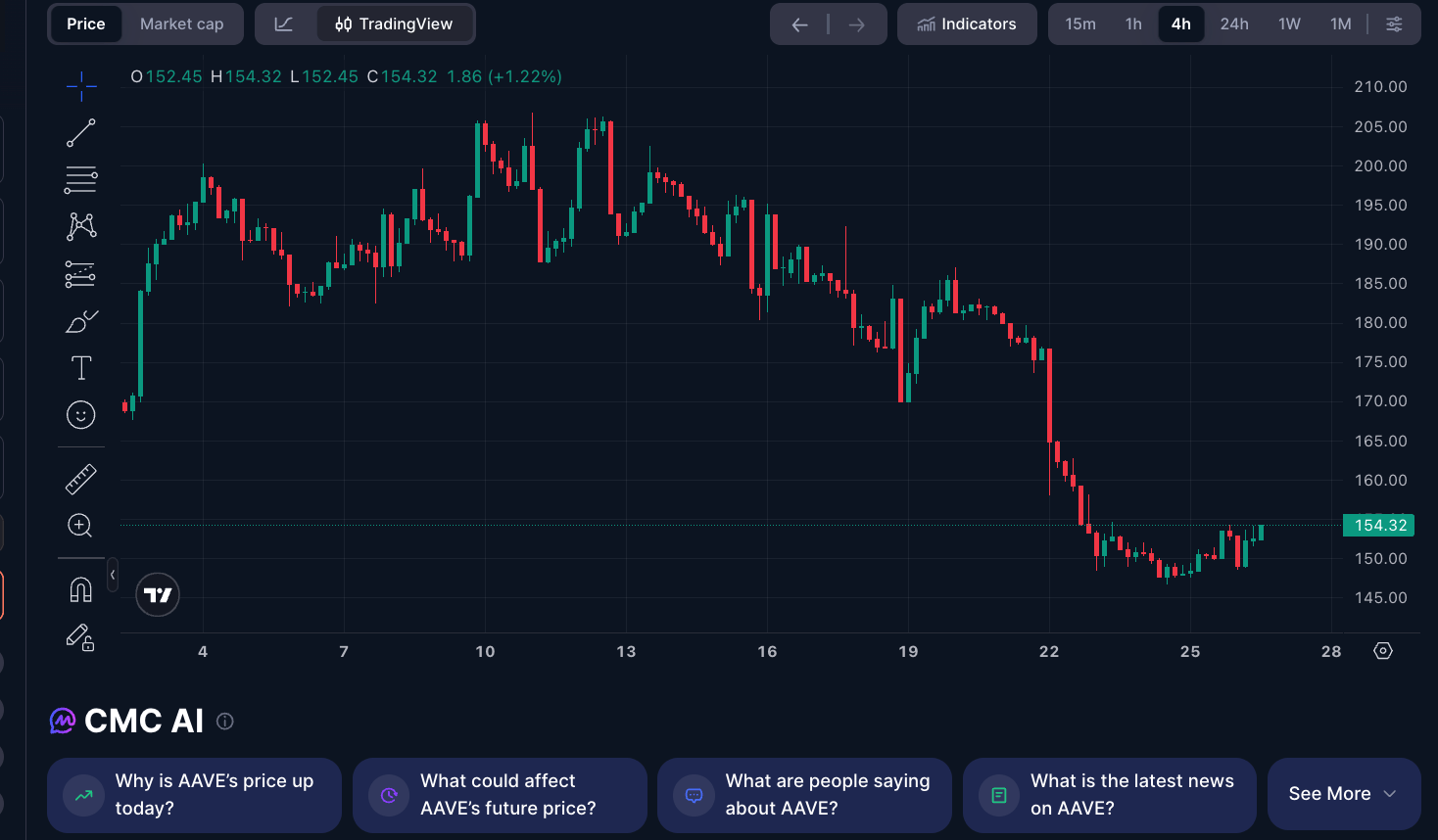

📊 Market Watch

📉 Oil tumbles, and silver rallies: Geopolitics in play again

The cost of oil plummeted worldwide after President Trump unleashed a “powerful and deadly strike” against Nigeria, further flaring tensions in Venezuela.

Markets panicked: though silver didn’t. The metal tore through $75/oz for the first time ever, by growing 158% in 2025 thanks to a combination of concerns about trade restrictions and vault inflows.

Gold is not trailing far behind, moving towards $4,525/oz, with investors piling into safe haven assets.

🔌 U.S.–Russia Bitcoin mining pact?

In a shocking turn, Putin said Russia is in discussions with the U.S. to jointly run Europe’s largest Zaporizhzhia nuclear site for Bitcoin mining, per a Russian media outlet.

He also disclosed that Ukrainian employees at the site now work under Russian authority, and that Washington had broached the discussion about a power-sharing arrangement.

It would be the most bizarre application of nuclear diplomacy in crypto history.

💰 Trump’s deregulation drives $8.6B in crypto deals

Crypto M&A is booming. At 267 transactions covering $8.6 billion, 2025 is already the largest year on record for crypto acquisitions.

Thanks to crypto-friendly policies by Trump, companies like Coinbase (Deribit: $2.9B), Ripple, Kraken and Circle led the charge

Even IPOs have returned, there was $14.6B raised across 11 offerings, including Circle, Gemini and Bullish.

👀 Are you watching this?

AAVE concludes one of the most talked about proposal - and it was rejected.

📊 Want the alpha on Perpetual DEXs?

Our latest report breaks down how on-chain derivatives are reshaping crypto trading: with transparency, self-custody, and global access at the core.

No paywall. 100% free.

👉 Read the full report

🐥 Top tweets

Here are Cryptopolitan’s top picks:

🎭 Culture Watch

Bitcoin and Ethereum just absorbed the largest options expiry in crypto history, with $28B in notional value expiring on Deribit: wrapping up monthly, quarterly, and yearly contracts in one record-breaking event.

267K BTC options expired Friday (put/call ratio: 0.35), with a max pain point at $95K

1.28M ETH options expired, worth $3.7B, with max pain at $3,100

Headline picks by our Head of HR

Meme of the day

Join the Conversation!

We'd love to hear your thoughts and comments. Join our community and stay updated with the latest trends and discussions in crypto.

Twitter | Instagram | Telegram Channel | Linkedin | Facebook